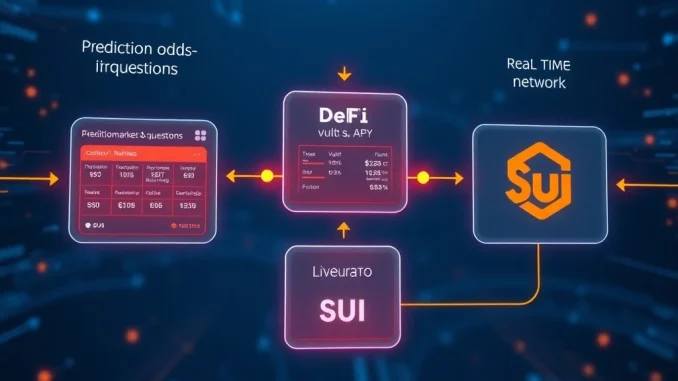

In a significant development for decentralized finance, the Sui blockchain ecosystem has witnessed the launch of a novel financial instrument that directly bridges speculative data with automated capital allocation. Announced on March 21, 2025, the collaboration between Ember Protocol and Bluefin introduces a data-driven vault that utilizes real-time information from the prediction market platform Polymarket. This product represents a tangible step toward a more interconnected and intelligent DeFi landscape, where on-chain data from one sector can directly power sophisticated strategies in another.

Ember Protocol and Bluefin Vault Merges Prediction Markets with DeFi

The newly launched vault operates on a foundational principle of data utility. Essentially, it employs information derived from Polymarket’s prediction markets to inform and adjust its automated investment strategies. For instance, market sentiment and probability data surrounding real-world events—such as election outcomes, regulatory decisions, or macroeconomic indicators—can serve as input signals. Consequently, the vault’s underlying algorithms, developed by Bluefin, can dynamically allocate assets, manage risk, or hedge positions based on these probabilistic forecasts. This creates a direct feedback loop between collective intelligence gathered in prediction markets and capital deployment in decentralized finance.

This integration is not merely a technical novelty. It addresses a core challenge in DeFi: sourcing reliable, real-world data (oracles) for complex strategies. Traditionally, oracles provide price feeds. However, this vault utilizes a new category of data oracles focused on event probability and sentiment. The Sui Foundation, in its announcement, highlighted this as an example of the network’s growing capability to support high-throughput, composable applications that can share data and liquidity seamlessly.

The Technical Architecture and Sui Ecosystem Advantage

The deployment on the Sui blockchain is a critical component of this launch. Sui’s object-centric model and parallel transaction processing enable the high-frequency data updates and complex state changes required for such a product. Ember Protocol, known for its structured financial products, provides the vault’s framework and user interface. Meanwhile, Bluefin contributes its expertise in perpetual swaps and advanced trading infrastructure to manage the strategy execution. Polymarket acts as the verified data source, with its markets providing a continuous stream of information on event likelihoods.

Key technical features of the vault include:

- Data Oracle Integration: Secure, low-latency pipelines that pull resolved and unresolved market data from Polymarket onto the Sui blockchain.

- Strategy Modules: Pre-configured and audited smart contracts that translate market probabilities into specific actions, like increasing stablecoin allocations or adjusting leverage.

- Risk Parameters: Built-in safeguards that limit exposure based on data confidence intervals and market volatility.

- Transparent Reporting: All data inputs and strategy actions are recorded on-chain, allowing users to audit performance triggers.

Expert Analysis on the Convergence of Prediction and Finance

Industry analysts view this development as part of a broader trend toward ‘information-aware’ DeFi. “The true innovation here is the formalization of prediction market data as a legitimate input for automated asset management,” notes a report from Delphi Digital, a leading crypto research firm. “It moves beyond simple betting and begins to treat aggregated forecasts as a valuable risk management variable.” The success of such a product depends heavily on the accuracy and manipulation-resistance of the underlying data source, a challenge that Polymarket has been designed to address through its dispute resolution and liquidity mechanisms.

Furthermore, the launch underscores the strategic growth of the Sui ecosystem. By fostering native integrations between its leading applications, Sui is cultivating a synergistic environment. Applications are no longer isolated; they become interconnected modules. This vault demonstrates a practical use case where a prediction market (Polymarket), a derivatives exchange (Bluefin), and a structured product platform (Ember Protocol) combine to create a new financial primitive. The potential impact includes attracting a new cohort of users interested in data-driven strategies and providing existing DeFi participants with novel tools for hedging and speculation.

Potential Implications and Market Impact for 2025

The introduction of this vault could have several downstream effects on the broader cryptocurrency and DeFi market. Firstly, it may increase the utility and trading volume on Polymarket, as the data generated there now has a direct financial application beyond the markets themselves. Secondly, it sets a precedent for other DeFi protocols to explore alternative data sources, potentially leading to vaults powered by social sentiment, governance outcomes, or supply chain data.

However, experts also caution about inherent risks. The performance of these strategies is intrinsically linked to the efficiency of prediction markets. If those markets are slow to reflect information or suffer from low liquidity, the vault’s strategies could be based on noisy or outdated signals. Additionally, smart contract risk is compounded across three major protocols, necessitating rigorous security audits. Regulatory scrutiny may also increase, as the product blurs the lines between prediction markets and investment funds.

| Feature | Traditional Yield Vault | Ember/Bluefin Polymarket Vault |

|---|---|---|

| Primary Input | Asset prices, liquidity pool APY | Prediction market probability data |

| Strategy Basis | Yield optimization, liquidity provision | Event-driven hedging and allocation |

| Data Source | Price feed oracles (e.g., Chainlink) | Event oracles (Polymarket) |

| Risk Profile | Market volatility, impermanent loss | Data accuracy, event outcome risk |

| Innovation | Automating existing farming strategies | Creating new strategies from novel data |

Conclusion

The launch of the Ember Protocol and Bluefin vault utilizing Polymarket data marks a pioneering moment for decentralized finance. By successfully connecting prediction market intelligence with automated investment strategies on the Sui blockchain, the collaboration demonstrates a tangible path toward more adaptive and information-sensitive financial products. This vault is more than a new yield opportunity; it is a proof-of-concept for a future where diverse on-chain data streams seamlessly power a complex array of financial engines. Its evolution will be closely watched as a benchmark for the maturity and interoperability of the broader DeFi ecosystem in 2025 and beyond.

FAQs

Q1: What exactly does the new Ember Protocol and Bluefin vault do?

The vault uses real-time data from Polymarket prediction markets to automatically adjust its DeFi investment strategies. For example, if prediction data suggests a high probability of a certain economic event, the vault’s algorithms might shift asset allocations to hedge against that outcome.

Q2: Why is the Sui blockchain important for this product?

Sui’s high throughput and unique object-oriented architecture allow for the fast and efficient processing of frequent data updates from Polymarket and the complex state changes required for the vault’s automated strategies, enabling a seamless user experience.

Q3: What are the main risks associated with this data-driven vault?

Key risks include reliance on the accuracy and timeliness of Polymarket data, smart contract vulnerabilities across the three integrated protocols (Ember, Bluefin, and the data bridge), and the novel, untested nature of event-driven automated strategies in volatile markets.

Q4: How is this different from just betting on Polymarket directly?

Direct betting involves taking a position on a single outcome. This vault uses Polymarket’s aggregated data as a signal for broader, multi-asset DeFi strategies. It’s a form of portfolio management informed by collective prediction, rather than a direct wager.

Q5: Does this mean prediction markets will become a common data source for DeFi?

This launch is a significant experiment in that direction. If successful, it could encourage other DeFi projects to use prediction markets, social sentiment, or other alternative data streams to inform lending rates, insurance parameters, or derivative pricing, expanding the oracle landscape beyond simple price feeds.