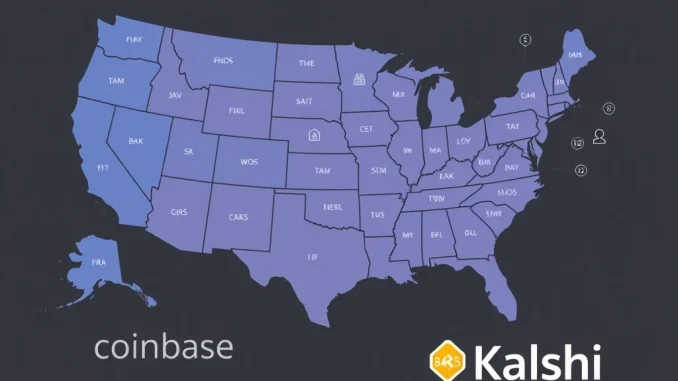

Coinbase Prediction Market Achieves Landmark Nationwide Access Across All 50 U.S. States

United States, April 2025: In a significant move for regulated financial innovation, Coinbase has achieved a landmark expansion of its prediction market service. The platform, powered by the CFTC-regulated exchange Kalshi, is now available to users in all 50 U.S. states and Washington D.C. This nationwide rollout follows a limited initial launch last month and represents a major step in bringing event-based trading to a mainstream American audience through a trusted cryptocurrency gateway.

Coinbase Prediction Market Enters a New Phase of National Availability

The expansion, first reported by The Block, removes the geographic restrictions that initially limited the service. Coinbase users across the country can now access what the industry terms “event contracts.” These financial instruments allow individuals to trade on the predicted outcomes of real-world events. The service operates within a distinct section of the Coinbase platform, with all transactions processed directly through Kalshi’s infrastructure. This structure is crucial, as Kalshi holds the regulatory designation necessary for this type of trading activity.

For context, prediction markets have existed in various forms for decades, often in academic or unregulated offshore spaces. Their core function is to aggregate crowd-sourced wisdom on future events, with market prices reflecting the collective probability of an outcome. The integration into a major, publicly-traded platform like Coinbase signals a maturation of this concept within the U.S. regulatory perimeter. It provides a familiar and compliant on-ramp for users interested in this alternative asset class.

Understanding the Kalshi Framework and CFTC Regulation

The legal foundation for this expansion rests entirely on Kalshi’s status as a Designated Contract Market (DCM) registered with the Commodity Futures Trading Commission (CFTC). This is a critical distinction from many crypto-native prediction platforms. A DCM is an exchange licensed to offer futures and options contracts for trading by retail and institutional participants. Kalshi is the first and only DCM exclusively dedicated to event contracts.

- Regulatory Oversight: As a DCM, Kalshi must adhere to strict CFTC rules regarding market surveillance, anti-manipulation, transparency, and customer protection.

- Contract Design: Each event contract is reviewed and approved by the CFTC before listing. This includes contracts on politics (e.g., election results), economic indicators (e.g., CPI inflation rates), sports championships, and entertainment awards.

- Settlement: Contracts have a fixed expiration and settle based on verifiable, objective outcomes from pre-defined authoritative sources, eliminating ambiguity.

By routing users through Kalshi, Coinbase leverages this existing regulatory framework. Users are essentially accessing a Kalshi account and trading its CFTC-reviewed products through the Coinbase interface. This model differs sharply from decentralized prediction markets on blockchains, which operate outside traditional financial regulation.

The Strategic Rationale Behind Coinbase’s Move

Analysts view this expansion as a strategic diversification play for Coinbase. The cryptocurrency exchange has consistently worked to broaden its product suite beyond simple spot trading of digital assets. This includes ventures into derivatives, staking, and now, event contracts. The prediction market offers a product with low correlation to crypto asset prices, potentially attracting a different user segment interested in geopolitics, economics, or sports.

Furthermore, it aligns with a broader industry trend of blending traditional and crypto finance, often called “TradFi” integration. By offering a regulated, non-crypto product, Coinbase strengthens its identity as a multifaceted financial platform rather than solely a crypto exchange. The timing is also notable, as it expands a novel product ahead of a U.S. presidential election cycle, a period that typically generates heightened interest in political event trading.

Implications for Users and the Broader Market Landscape

For the average Coinbase user, the expansion means access to a new form of financial engagement. An individual in Wyoming or Vermont now has the same access as someone in New York or California. Users can allocate a portion of their portfolio to express a view on, for instance, the winner of the NBA Finals or the next Federal Reserve interest rate decision, all within an account they already use.

However, this access comes with clear distinctions from cryptocurrency trading. Event contracts are finite-life derivatives; they expire worthless or at full value based on the outcome. This creates a defined risk profile different from the indefinite holding of an asset like Bitcoin. Coinbase and Kalshi provide educational resources emphasizing this point, a requirement under CFTC rules for retail-facing derivative products.

The move also applies competitive pressure to other financial platforms and fintech apps. It establishes a benchmark for how regulated prediction markets can be integrated at scale. Other brokers or trading apps may now explore similar partnerships or product developments to keep pace.

Conclusion

The nationwide expansion of Coinbase’s Kalshi-based prediction market is a pivotal development in the convergence of cryptocurrency platforms and regulated traditional finance. By achieving availability in all 50 states, Coinbase has successfully scaled a novel financial product that is distinct from its core crypto business yet complementary to its growth strategy. This move, underpinned by the robust CFTC regulatory framework governing Kalshi, provides millions of Americans with a new, compliant avenue to trade on their views of future events. It underscores the evolving role of major crypto exchanges as diversified financial hubs and marks a significant step toward the mainstream adoption of prediction markets within the United States.

FAQs

Q1: What exactly is the Coinbase prediction market?

The Coinbase prediction market is a service within the Coinbase platform that allows users to trade event contracts. These are financial contracts that settle based on the outcome of real-world events like elections, sports games, or economic data releases. All trading is processed through Kalshi, a CFTC-regulated exchange.

Q2: Is this service legal and regulated?

Yes. The service is legal because the trading occurs on Kalshi, which is a Designated Contract Market (DCM) registered with and regulated by the U.S. Commodity Futures Trading Commission (CFTC). Each event contract is approved by the CFTC before being listed for trading.

Q3: How is this different from betting or gambling?

This is a regulated financial market, not gambling. Contracts trade on a regulated exchange with strict rules against manipulation, are based on verifiable public outcomes, and are designed for price discovery and risk transfer. The CFTC classifies them as financial derivatives, not wagers.

Q4: Do I need a separate account from my main Coinbase account?

No. The service is integrated into the Coinbase platform. Users can access it through their existing Coinbase login, but their activity and funds for event contracts are managed within the Kalshi-regulated environment.

Q5: What kinds of events can I trade on?

You can trade on CFTC-approved event contracts across categories including U.S. politics, global economic indicators, major sports league outcomes, and entertainment awards. Examples include presidential election winners, inflation rate thresholds, Super Bowl champions, and Oscar winners.

Related News

- Bitcoin Price Plunge Below $69K Erases 15 Months of Gains, Sparks Investor Shift to AI Tokens

- Fomoin and YUMO Forge Transformative Partnership to Pioneer AI-Led Digital Personas in Web3

- Cardone Capital Bitcoin Purchase: Strategic $10M Investment Signals Institutional Confidence

Related: Lido V3 Integrates Kiln to Unlock Institutional Ethereum Staking with stVaults

Related: DeFi Hack: $1.78M Exploit Linked to Claude AI-Generated Smart Contract Code

Related: Revealing: BitMine's 45,759 ETH Purchase Sparks Analysis of Potential Market Bottom