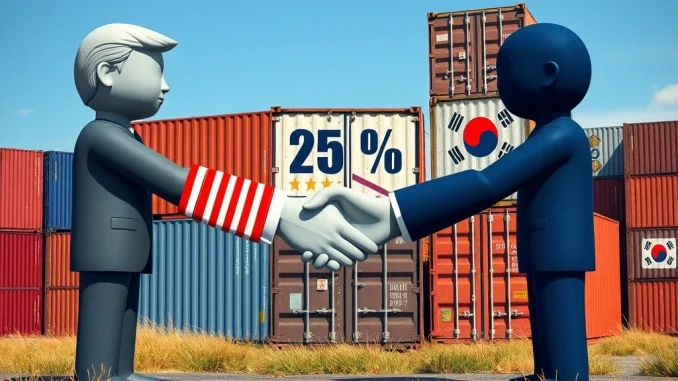

Washington D.C., March 21, 2025: In a move that sent immediate shockwaves through global financial markets, former President Donald Trump announced his intention to raise tariffs on goods imported from South Korea to 25%. The stunning declaration, framed as a response to what he termed “delays and bad faith” in ongoing trade negotiations, marks a significant escalation in U.S. trade policy and directly threatens the framework of the longstanding U.S.-Korea Free Trade Agreement (KORUS FTA). This potential tariff hike carries profound implications for bilateral relations, supply chains, and consumers in both nations.

Trump’s 25% Tariff Announcement on South Korean Goods

The announcement was made during a campaign rally in the Midwest, a region with deep historical ties to manufacturing. President Trump stated, “We have been incredibly patient, but the negotiations with South Korea have gone nowhere. They are taking advantage of our great country. Therefore, I will be raising tariffs on all South Korean goods to 25% until we get a deal that is fair for the American worker.” The statement lacked immediate specifics on an implementation timeline or whether the levy would apply to all imports or target specific sectors. However, the 25% figure represents a substantial increase from the current most-favored-nation (MFN) rates, which average around 2-3% for many industrial goods under the KORUS FTA, and is comparable to the tariff levels previously imposed on China during the 2018-2020 trade war.

Background and Context of US-South Korea Trade Relations

To understand the gravity of this announcement, one must examine the history of U.S.-South Korea trade. The KORUS FTA, which took effect in 2012, was a landmark agreement designed to eliminate roughly 95% of tariffs between the two nations within five years. It was renegotiated and amended during Trump’s first term in 2018, with modifications focused on automotive trade and extending U.S. tariffs on Korean trucks. Since then, the trade relationship has been largely stable but punctuated by U.S. concerns over its trade deficit with South Korea and market access for key American exports like automobiles and agricultural products.

- Trade Volume: South Korea is the United States’ 6th largest goods trading partner, with two-way trade totaling over $180 billion in 2024.

- Key U.S. Imports: Vehicles, automotive parts, electrical machinery, semiconductors, and refined petroleum.

- Key U.S. Exports: Machinery, aircraft, optical/medical instruments, and agricultural products like beef and corn.

The “delays” referenced by President Trump likely pertain to ongoing discussions about further amendments to KORUS, potentially including stricter rules of origin for automotive parts, digital trade provisions, and environmental standards.

Immediate Economic and Sectoral Impact Analysis

The immediate market reaction saw a drop in the shares of major South Korean exporters and their U.S.-based partners. Economists and trade analysts began modeling the potential fallout. A blanket 25% tariff would function as a significant tax on trade, with costs likely passed through supply chains.

| Sector | Primary Impact | Potential Consequence |

|---|---|---|

| Automotive | High | Increased prices for Hyundai, Kia, and Genesis vehicles in the U.S.; disruption for U.S. automakers using Korean parts. |

| Electronics & Semiconductors | Medium-High | Higher costs for consumer electronics (Samsung, LG) and potential bottlenecks for critical chip components. |

| Steel & Chemicals | High | Revival of earlier sector-specific trade tensions; increased costs for U.S. manufacturers using these inputs. |

| U.S. Agriculture | Retaliatory Risk | Potential Korean tariffs on U.S. beef, corn, and wheat, harming American farmers. |

Global Trade Implications and the Risk of Escalation

This move cannot be viewed in isolation. It signals a potential return to the unilateral, tariff-first trade policy that defined much of the previous Trump administration. Allies in Europe and Asia are watching closely, concerned about the precedent it sets for their own trade agreements with the U.S. Furthermore, it risks pushing South Korea closer to other major trading partners, notably China, as it seeks to diversify its export markets in response to U.S. pressure. The action also complicates broader U.S. strategic goals in the Indo-Pacific, where South Korea is a critical military and diplomatic ally in counterbalancing regional challenges.

Legal and Procedural Pathways for Implementation

Implementing such a tariff is not instantaneous. The President possesses broad authority to adjust tariffs under certain legal provisions, such as Section 301 of the Trade Act of 1974 (for unfair practices) or Section 232 of the Trade Expansion Act of 1962 (for national security). However, applying these authorities to a treaty ally like South Korea would be legally contentious and likely face immediate court challenges. Alternatively, the administration could initiate a formal withdrawal from the KORUS FTA, which has a six-month notice period, after which higher MFN tariffs would automatically apply. The chosen pathway will determine the speed and legal durability of the policy.

Conclusion

President Trump’s announcement of 25% tariffs on South Korean goods represents a pivotal moment in international economic policy. It is a stark instrument of leverage aimed at extracting new concessions in trade negotiations, but it carries substantial economic and diplomatic risks. The potential for increased consumer prices, supply chain disruptions, and retaliatory measures creates immediate uncertainty for businesses and markets. As the situation develops, the world will see whether this announcement forces a rapid negotiation or marks the beginning of a new, more contentious chapter in one of America’s most important Asian alliances. The outcome will serve as a critical test of how trade, geopolitics, and domestic policy intersect in the current global landscape.

FAQs

Q1: What did President Trump actually announce regarding South Korea?

A1: President Trump announced his intention to raise tariffs on goods imported from South Korea to 25%, citing delays in ongoing trade negotiations. The statement did not provide a specific start date or a detailed product list.

Q2: What are the current tariffs on South Korean goods under the KORUS FTA?

A2: The U.S.-Korea Free Trade Agreement (KORUS) eliminated tariffs on most industrial goods. Remaining tariffs are typically very low, often in the 0-3% range for covered items. A jump to 25% would be a massive increase.

Q3: Which industries would be most affected by these Trump tariffs?

A3: The automotive industry (cars and parts), electronics (including semiconductors and consumer appliances), and steel and chemical sectors would likely feel the most direct and significant impact due to the high volume of trade.

Q4: How could South Korea respond to these U.S. tariffs?

A4: South Korea could challenge the move at the World Trade Organization (WTO). It could also impose retaliatory tariffs on strategically selected U.S. exports, such as agricultural products, machinery, or energy exports, as it has done in previous trade disputes.

Q5: Does the President have the legal authority to impose these tariffs unilaterally?

A5: The President has significant, though not unlimited, authority to adjust tariffs under various trade laws (Sections 232 and 301). However, using these tools against a treaty ally like South Korea would be legally controversial and would almost certainly face immediate legal challenges in U.S. courts.