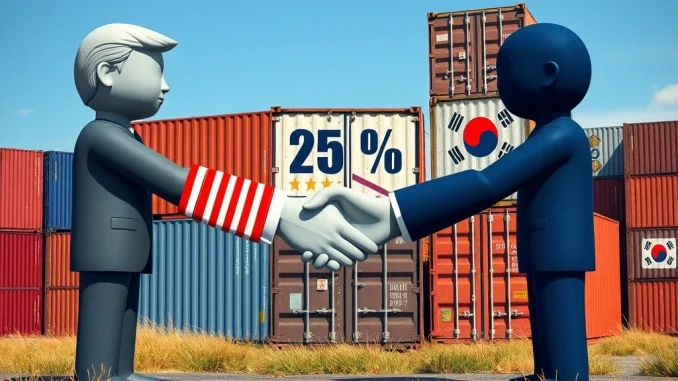

Trump Tariffs on South Korea: Stunning 25% Levy Announced Amid Trade Talks Stall

Washington D.C., March 21, 2025: In a move that sent immediate shockwaves through global financial markets, former President Donald Trump announced his intention to raise tariffs on goods imported from South Korea to 25%. The stunning declaration, framed as a response to what he termed “delays and bad faith” in ongoing trade negotiations, marks a […]