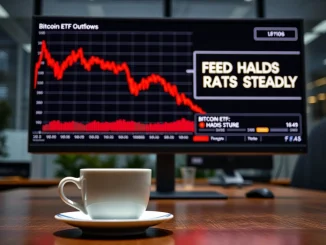

Bitcoin Traders Analyze Trump’s ‘Gone Soon’ Powell Remark for Crucial Monetary Policy Signals

Washington, D.C., April 2025: A recent public statement by former President Donald Trump, suggesting Federal Reserve Chair Jerome Powell would be “gone soon,” has sent ripples through global financial markets. Bitcoin traders and cryptocurrency analysts are now scrutinizing this political commentary for potential signals about future U.S. monetary policy, interest rates, and dollar strength, factors […]