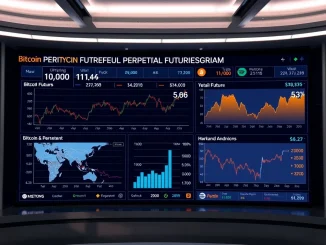

BTC Perpetual Futures: Decoding the Crucial Long/Short Ratio on Top Exchanges

Global, May 2025: The BTC perpetual futures long/short ratio serves as a critical, real-time barometer for institutional and retail trader sentiment. Over the last 24 hours, aggregated data from the world’s three largest crypto futures exchanges by open interest reveals a market leaning slightly bearish, with an overall ratio of 47.57% long positions versus 52.43% […]