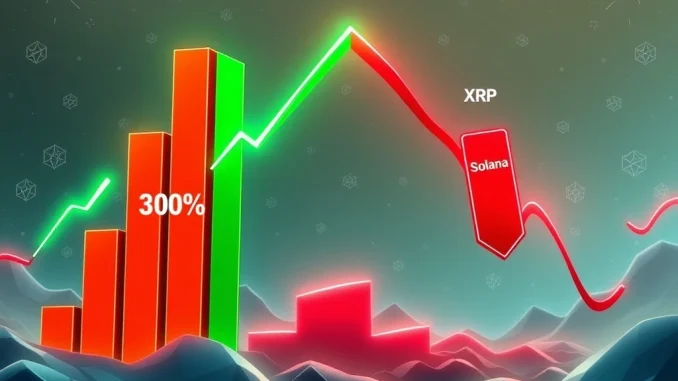

The cryptocurrency market is a dynamic landscape, constantly shifting with new innovations and evolving investor sentiment. Today, the spotlight shines on a fascinating divergence: while established giants like XRP and Solana navigate choppy waters, a new contender, the DeSoc Altcoin, is capturing attention with bold forecasts of up to 300% gains. This pivotal moment signals a potential shift in capital, as investors increasingly seek out projects offering real-world utility and groundbreaking decentralized solutions.

DeSoc Altcoin: The Next Frontier in Decentralized Social Media?

A new player has entered the arena, stirring considerable excitement among analysts and investors alike: DeSoc. Its native token, $SOCS, is positioned to revolutionize the way we interact online by building a truly decentralized social platform. Unlike traditional social media, which often grapples with issues of data privacy, censorship, and centralized control, DeSoc aims to empower users with full ownership over their content and data. This vision resonates deeply with the core principles of Web3, emphasizing autonomy and community governance.

The project integrates blockchain-based tools specifically designed for content creators and community builders. Imagine a platform where your contributions are not just seen, but directly rewarded through tokenized incentives, fostering a more equitable digital economy. DeSoc also emphasizes cross-platform content syndication, meaning your creations aren’t locked into a single ecosystem. This focus on user control, combined with features like low gas fees and scalability, differentiates $SOCS from many existing blockchain protocols that primarily focus on financial transactions.

The ambitious forecast of 300% gains for $SOCS in the coming week, while speculative, highlights the market’s hunger for innovative projects with clear utility. Analysts believe DeSoc could be a breakout altcoin in 2025, benefiting from the growing demand for platforms that address the shortcomings of Web2 and the scalability challenges of earlier blockchain iterations. However, as with all high-reward predictions, it’s crucial to acknowledge the high-risk nature. The realization of such gains would depend heavily on rapid adoption and the successful execution of DeSoc’s ambitious roadmap, which remains unproven at scale.

XRP Price Analysis: Navigating Troubled Waters

While new projects like DeSoc capture headlines with their potential, established cryptocurrencies like XRP are facing significant headwinds. Recent XRP price analysis reveals a concerning trend: the asset has slipped below the critical $3 mark, accompanied by thinning trading volumes. This performance has raised alarms among market participants who closely monitor Ripple’s native token.

Technical indicators paint a challenging picture for XRP. It has struggled to maintain momentum above its 20-day Exponential Moving Average (EMA) of $3.01. Furthermore, analysts are warning that a failure to reclaim the crucial resistance zone between $3.30 and $3.40 could trigger a deeper correction. For a long time, XRP’s value proposition has been tied to its role in facilitating fast, low-cost international payments for financial institutions. However, a perceived lack of significant innovation in Ripple’s core payment infrastructure, coupled with ongoing regulatory uncertainties, appears to be impacting investor confidence.

Most forecasts suggest that XRP could remain capped at $3.10 through Q4 2025, unless there’s a substantial acceleration in institutional adoption of its on-chain services. The path forward for XRP hinges on its ability to demonstrate renewed utility and clear regulatory certainty, which would be pivotal for attracting fresh capital and reversing its current trajectory. Investors are advised to monitor these technical levels and fundamental developments closely.

Solana Price Prediction: Beyond the Meme Coin Hype

The Solana ecosystem has been a hotbed of activity, particularly driven by the explosive growth of meme coins. Tokens like BONK and PENGU have posted impressive double-digit gains, creating significant buzz and attracting new users to the network. This vibrant meme coin culture underscores Solana’s efficiency and low transaction costs, making it an attractive platform for rapid token launches and speculative trading.

However, despite this frenetic activity, the Solana price prediction for its native token, SOL, tells a more nuanced story. SOL recently reversed from a high of $200, raising questions about whether meme coin enthusiasm can truly translate into sustained growth for the underlying asset. Analysts caution that while the emergence of spot and staking ETFs has fueled optimism for Solana’s long-term prospects, maintaining momentum above the $175–$180 range will be absolutely critical. This resistance level is seen as a key determinant for SOL to reach projected targets of $250–$300 by late 2025.

The disparity between the soaring popularity of meme coins and the mixed signals from SOL’s price performance highlights the fragmented nature of the Solana ecosystem. While a robust developer community and innovative dApps continue to build on Solana, the speculative nature of meme coins can sometimes overshadow the fundamental value and long-term potential of the network itself. For SOL to achieve its higher price targets, it needs to demonstrate broader utility and institutional interest beyond just the meme coin phenomenon.

Altcoin Market Trends: A Shifting Landscape of Opportunity and Risk

The contrasting fortunes of DeSoc, XRP, and Solana underscore broader Altcoin Market Trends. The cryptocurrency market is in a constant state of evolution, with capital frequently rotating from older, established protocols to newer projects that promise innovative use cases, superior technology, or a more compelling narrative. This dynamic creates both immense opportunities for early investors and significant risks for those holding onto assets that fail to adapt or innovate.

Investors are increasingly seeking projects that offer tangible utility, scalable solutions, and strong community governance. This shift in sentiment is putting competitive pressure on older protocols that may be struggling with scalability, high transaction fees, or regulatory uncertainties. The allure of a potential 300% gain from a project like DeSoc, while highly speculative, reflects this appetite for groundbreaking innovation and disruptive potential.

However, it’s vital to approach such speculative forecasts with a balanced perspective. The high-risk, high-reward nature of altcoin investing means that while the upside can be substantial, the downside risk is equally pronounced. Success hinges not just on a compelling vision but also on flawless execution, rapid user adoption, and the ability to navigate a highly competitive and volatile market. Diligent research and a clear understanding of risk tolerance are paramount for any investor venturing into this exciting yet unpredictable space.

Solana News Today: What It Means for Your Portfolio

In summary, the latest Solana News Today, coupled with the developments around XRP and the emergence of DeSoc, paints a clear picture of a maturing yet ever-evolving cryptocurrency market. We are witnessing a period of significant capital rotation, where narratives of decentralization, user empowerment, and real-world utility are gaining precedence. While established players like XRP and Solana face their own set of challenges, new entrants like DeSoc are pushing the boundaries of what’s possible in the Web3 space.

For investors, this means maintaining a keen eye on market dynamics, understanding the underlying technology, and critically evaluating the long-term viability of projects. Speculative forecasts, while exciting, should always be balanced with a rigorous assessment of execution risks, market conditions, and the fundamental strength of the project. The cryptocurrency market continues to be a frontier of innovation, offering unparalleled opportunities for those who navigate its complexities with caution and informed decision-making.

Frequently Asked Questions (FAQs)

1. What is DeSoc and why is it attracting attention?

DeSoc is a new decentralized social (DeSoc) platform aiming to give users control over their data and content through blockchain-based tools and tokenized incentives. It’s attracting attention due to its focus on user empowerment, scalability, low gas fees, and a forecast of potential 300% gains, positioning it as a next-gen Web3 social platform.

2. Why are XRP and Solana losing momentum?

XRP is facing challenges due to thinning trading volumes, a lack of significant innovation in Ripple’s core payment infrastructure, and struggles to maintain key support levels. Solana, despite strong meme coin activity, has seen its native token (SOL) reverse from recent highs, with analysts noting a disconnect between meme coin performance and SOL’s sustained growth, indicating a fragmented ecosystem.

3. What are the key technical levels for XRP and Solana to watch?

For XRP, failure to reclaim the $3.30–$3.40 resistance zone could lead to deeper corrections. For Solana (SOL), sustained momentum above $175–$180 is critical for it to reach projected targets of $250–$300 by late 2025.

4. Is the 300% gain forecast for DeSoc realistic?

The 300% gain forecast for DeSoc is highly speculative and reflects the high-risk, high-reward nature of altcoin investing. While proponents cite its innovative utility and market demand for decentralized social platforms, critics note that such gains would require rapid adoption and flawless execution of DeSoc’s vision, which remains unproven at scale.

5. How do current altcoin market trends affect investors?

Current altcoin market trends highlight a shift where investors are increasingly seeking projects with real-world utility, scalability, and strong community governance. This creates opportunities in newer, innovative projects like DeSoc but also puts competitive pressure on older protocols. Investors are advised to approach speculative forecasts with caution and conduct rigorous assessments of execution risks and market conditions.