Warning: Attempt to read property "post_excerpt" on null in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 392

Warning: Trying to access array offset on false in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 394

Warning: Attempt to read property "post_title" on null in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 394

[ad_1]

Key Takeaways

Solana’s price jump reflects market optimism following VanEck’s ETF filing.

VanEck’s initiative could set a precedent for future cryptocurrency ETFs in the US.

Share this article

![]()

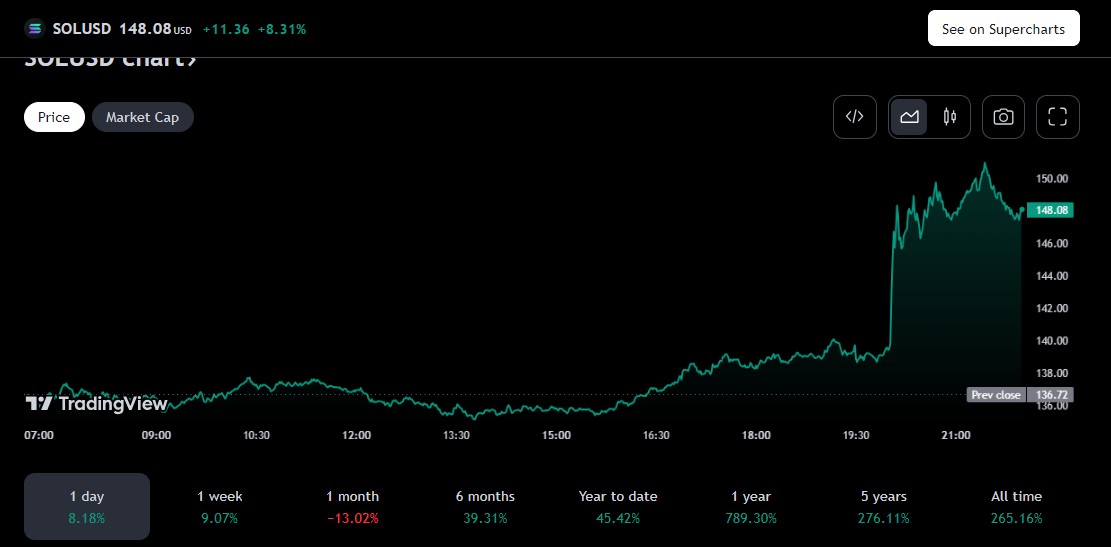

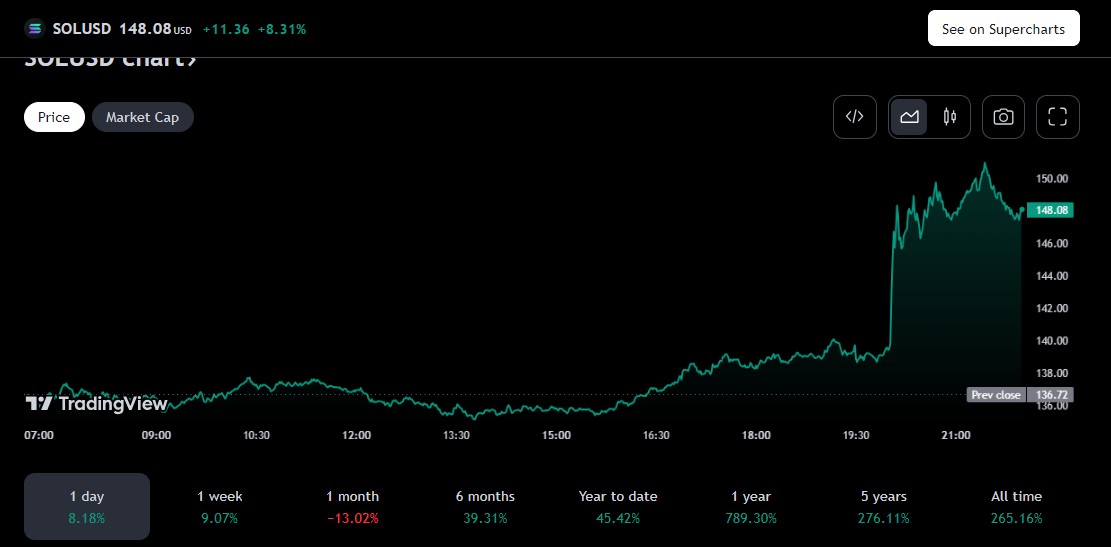

Solana’s (SOL) price surged almost 10%, from around $139 to $151, shortly after VanEck’s application for a spot Solana exchange-traded fund (ETF). According to TradingView, SOL is currently trading at around $148, up 8% in the past 24 hours.

On Thursday, VanEck, the prominent player in the ETF market, submitted an S-1 form to the US Securities and Exchange Commission (SEC) to launch the VanEck Solana Trust. VanEck’s move marks the first attempt to establish a Solana-based ETF in the US.

With the latest filing, VanEck has classified Solana as a commodity rather than a security.

In addition, Matthew Sigel, Head of Digital Assets at VanEck, said Solana stands out as a high-performance blockchain with remarkable attributes like high scalability, speed, and low transaction fees.

I am excited to announce that VanEck just filed for the FIRST Solana exchange-traded fund (ETF) in the US.

Some thoughts on why we believe SOL is a commodity are below.

Why did we file for it?A competitor to Ethereum, Solana is open-source blockchain software designed to… pic.twitter.com/XwwPy8BXV2

— matthew sigel, recovering CFA (@matthew_sigel) June 27, 2024

VanEck’s new filing comes ahead of the anticipated launch of spot Ethereum funds in the US. In May, the SEC greenlit a batch of Ethereum ETF filings, including one from VanEck. These ETFs are currently pending trading approval from the SEC.

Bloomberg ETF analyst Eric Balchunas predicts the SEC will allow Ethereum ETFs to start trading as soon as next week.

Share this article

![]()

[ad_2]

Source link