Robinhood Unlocks ENA: A Pivotal Moment for Crypto Investors

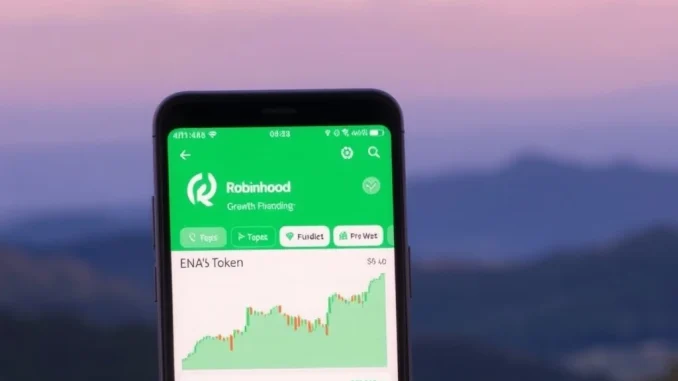

The cryptocurrency market often experiences significant shifts with new platform integrations. Recently, Robinhood, a prominent financial services company, announced the highly anticipated **Robinhood ENA listing**. This development marks a crucial step for both the Ethena project and digital asset accessibility for millions of users. Therefore, understanding its implications becomes vital for crypto enthusiasts and investors alike.

Understanding the Significance of the Robinhood ENA Listing

Robinhood’s decision to list the **ENA token** represents a major milestone. This listing provides expanded access to a project gaining considerable traction in the decentralized finance (DeFi) space. Previously, access to ENA was limited to a narrower set of exchanges. Now, however, a broader retail audience can engage with this innovative asset.

Moreover, the inclusion of ENA on Robinhood’s platform underscores a growing trend. Mainstream financial applications are increasingly embracing a wider array of digital assets. This move potentially boosts liquidity and visibility for Ethena. Consequently, it solidifies ENA’s position within the broader crypto ecosystem.

What is Ethena (ENA)? Exploring the Synthetic Dollar Protocol

To fully grasp the impact of this listing, one must understand **Ethena (ENA)** itself. Ethena Labs developed a synthetic dollar protocol, USDe. This protocol aims to provide a stable, scalable, and censorship-resistant digital asset. USDe maintains its peg to the US dollar through delta hedging staked Ethereum and Bitcoin collateral.

Ethena Labs offers a unique approach to decentralized finance. They provide a ‘internet bond’ that combines yield from staked Ethereum with a perpetual futures funding rate strategy. This innovative mechanism underpins the stability and potential returns associated with USDe. Thus, ENA serves as the governance token for the Ethena protocol, allowing holders to participate in key decisions regarding its future development and parameters.

Key aspects of Ethena:

- USDe: A synthetic dollar pegged to the USD.

- Delta Hedging: Utilizes derivatives to maintain stability.

- Internet Bond: Combines Ethereum staking yield with funding rates.

- ENA Token: Governance token for the Ethena protocol.

Robinhood Crypto’s Expanding Horizon

The **Robinhood ENA listing** also highlights Robinhood Crypto’s continued expansion strategy. The platform has steadily increased its crypto offerings since its initial foray into digital assets. This commitment reflects growing user demand for diversified investment opportunities beyond traditional stocks and ETFs. Clearly, Robinhood aims to remain competitive in the evolving financial landscape.

Robinhood Crypto has become a significant player in the retail crypto market. It provides a user-friendly interface and commission-free trading. This approach attracts new investors to the digital asset space. Listing ENA further diversifies its portfolio, catering to users interested in innovative DeFi protocols and the potential for **stablecoin yield** generation.

This expansion benefits Robinhood’s users. They gain access to a wider range of cryptocurrencies. Furthermore, it reinforces Robinhood’s position as a gateway for mainstream crypto adoption. Such strategic listings are crucial for maintaining relevance in a fast-paced industry.

Impact on the ENA Token and Market Dynamics

A listing on a platform like Robinhood typically brings several benefits for the listed asset. For the **ENA token**, increased exposure is a primary advantage. Millions of Robinhood users now have direct access to ENA, potentially leading to higher trading volumes and improved liquidity. Therefore, this wider accessibility could positively influence ENA’s market valuation.

Moreover, the listing can enhance ENA’s credibility. Being featured on a regulated and widely recognized platform like Robinhood often instills greater confidence among potential investors. This institutional validation is invaluable for emerging crypto projects. It signals a level of due diligence and acceptance within the broader financial ecosystem. As a result, new capital inflows might occur.

However, market dynamics are complex. While increased exposure is generally positive, price movements can also be volatile immediately following a major listing. Investors should always conduct thorough research. They must also understand the underlying technology and risks associated with any digital asset.

The Future of Stablecoin Yield and Ethena’s Role

Ethena’s core offering, USDe, provides a compelling alternative in the stablecoin market. Its innovative approach to generating **stablecoin yield** through delta hedging and staked assets has garnered significant attention. The **Robinhood ENA listing** brings this novel concept to a much larger audience, potentially driving further interest in USDe and its yield-bearing capabilities.

The demand for stable, yield-generating assets remains high in the crypto space. Ethena’s ‘internet bond’ mechanism seeks to provide a robust solution. It offers a transparent and on-chain alternative to traditional financial instruments. This approach could redefine how users perceive and interact with stablecoins. Consequently, Ethena could play a pivotal role in the future of decentralized finance.

As the crypto market matures, protocols that offer genuine utility and sustainable yield mechanisms will likely thrive. Ethena’s integration into a mainstream platform like Robinhood validates its potential. It also highlights the growing importance of innovative stablecoin solutions in the global financial landscape.

Navigating Opportunities and Risks with Robinhood Crypto

For individuals utilizing **Robinhood Crypto**, the **Robinhood ENA listing** presents both opportunities and considerations. On the opportunity side, users gain convenient access to a promising DeFi asset. This broadens their investment horizons. They can now easily diversify their crypto portfolios with a token linked to a unique stablecoin protocol.

However, all cryptocurrency investments carry inherent risks. The crypto market remains volatile. Prices can fluctuate dramatically. Ethena, while innovative, is still a relatively new protocol. Understanding its underlying mechanics, including potential smart contract risks and market exposure, is crucial. Therefore, investors must practice caution and only invest what they can afford to lose. Robinhood provides the platform; due diligence remains the investor’s responsibility.

In conclusion, Robinhood’s decision to list ENA is a noteworthy event. It reflects the ongoing evolution of both centralized trading platforms and decentralized finance protocols. This move undoubtedly increases ENA’s reach. It also offers Robinhood users a new avenue for engaging with innovative crypto assets and the concept of **stablecoin yield**.

Frequently Asked Questions (FAQs)

Q1: What is ENA and why is its Robinhood listing important?

ENA is the governance token for Ethena Labs, a protocol that created USDe, a synthetic dollar. The Robinhood ENA listing is important because it significantly increases the token’s accessibility and visibility to millions of retail investors, potentially boosting liquidity and market adoption.

Q2: What is USDe, and how does it relate to Ethena (ENA)?

USDe is Ethena’s synthetic dollar, designed to maintain a stable peg to the US dollar. It achieves this through delta hedging using staked Ethereum and Bitcoin collateral. ENA is the governance token, allowing holders to vote on key protocol decisions that affect USDe.

Q3: How does Ethena generate stablecoin yield?

Ethena generates stablecoin yield through its ‘internet bond’ mechanism. This combines the yield from staked Ethereum (and other assets) with funding rates from perpetual futures positions. This innovative strategy aims to provide a sustainable and decentralized yield.

Q4: What are the potential benefits of the Robinhood ENA listing for investors?

For investors, the Robinhood ENA listing offers easier access to the ENA token. This can lead to increased trading opportunities and portfolio diversification. It also brings the potential for enhanced market liquidity and greater institutional recognition for Ethena.

Q5: Are there any risks associated with investing in ENA on Robinhood Crypto?

Yes, all cryptocurrency investments carry risks. The ENA token, like other digital assets, can experience significant price volatility. Investors should research Ethena’s protocol, understand its underlying mechanics, and be aware of general market risks before investing.

Related News

- Crypto Fear & Greed Index Soars to 74: Opportunity or Warning?

- Franklin Templeton Money Market Funds Revolutionize Tokenized Finance and Stablecoin Integration for Institutional Investors

- Unleash Your Crypto Fortune with STG Energy’s Revolutionary Cloud Mining in 2025!

Related: Crucial Crypto Tax Reform: Ripple & Coinbase Champion 14-Point Plan for Congress

Related: ESG Crypto Gets Major Boost: Collably Network Joins Lovebit on BNB Chain for Transparent Impact