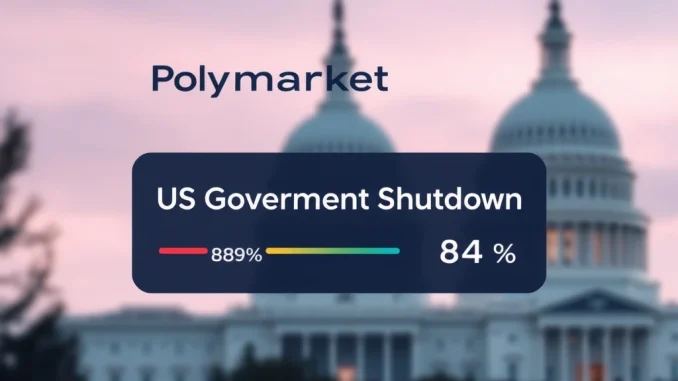

The world of cryptocurrency often intersects with real-world events. Today, data from **Polymarket** draws significant attention. This decentralized prediction market now shows an 84% probability of the **US government shutdown** ending this week. This figure offers a compelling glimpse into collective market sentiment. It provides crucial insights for those following both politics and **crypto prediction** trends.

Polymarket’s Role in Gauging US Government Shutdown Odds

Polymarket operates as a **prediction market**. It allows users to bet on the outcomes of future events. These events range from political elections to economic indicators. Currently, the market for the **US government shutdown** resolution is active. Participants buy and sell shares representing specific outcomes. The price of these shares directly reflects the perceived probability. Therefore, an 84% chance indicates strong market confidence. This confidence suggests a resolution is highly likely before the week concludes.

Furthermore, Polymarket provides a unique lens. It offers a real-time, market-driven forecast. This contrasts with traditional polling methods. Traditional polls often rely on surveys and public opinion. However, prediction markets incentivize accurate forecasting. Users stake actual capital. They profit when their predictions prove correct. Consequently, this financial incentive encourages participants to seek out and integrate all available information. This mechanism makes the **government shutdown odds** on Polymarket particularly insightful.

Understanding Prediction Markets and Crypto Prediction

A **prediction market** is an exchange-traded market. Its purpose is to trade contracts whose payoffs depend on the outcome of unknown future events. These markets harness the ‘wisdom of the crowd.’ They aggregate diverse information. This aggregation happens through the collective actions of many participants. Many of these platforms, including **Polymarket**, operate on blockchain technology. This ensures transparency and immutability. All transactions and outcomes are recorded on a public ledger. Thus, it builds trust and reduces manipulation risks.

For individuals interested in **crypto prediction**, these platforms offer more than just entertainment. They represent a practical application of decentralized finance (DeFi). Participants use cryptocurrencies to engage. They stake digital assets like USDC. When their forecast is accurate, they receive a payout. Conversely, incorrect predictions result in a loss of staked funds. This system creates a powerful incentive. It pushes users towards informed decision-making. Therefore, the market’s efficiency increases significantly.

Why the 84% Figure for the Government Shutdown Odds?

The 84% probability for the **US government shutdown** ending reflects complex market dynamics. Several factors contribute to this high figure. Firstly, political negotiations often intensify as deadlines approach. Lawmakers face increasing pressure. They must avoid negative public perception. Secondly, historical precedent often plays a role. Past shutdowns have typically found resolutions. These resolutions often occur under similar political conditions. Thirdly, recent statements or actions from key political figures can shift market sentiment. Participants constantly analyze these developments.

Moreover, the market absorbs a wide range of information. This includes news reports, expert analyses, and even social media chatter. Each piece of data influences trading behavior. Traders adjust their positions. This continuous adjustment refines the probability. Consequently, the 84% figure is not a static prediction. It is a live, evolving consensus. It represents the market’s current best estimate. This estimate considers all available information about the **government shutdown odds**.

How Polymarket Offers Unique Insights into Government Shutdowns

Traditional media often reports on the *sentiment* surrounding a shutdown. However, **Polymarket** quantifies this sentiment. It transforms it into a measurable probability. This distinction is crucial. When individuals place money on an outcome, they demonstrate a stronger conviction. This conviction often surpasses mere opinion. It reflects a deeper analysis of the situation. Therefore, the odds generated by Polymarket can be more predictive than traditional polls. They are less susceptible to social desirability bias. This bias can skew survey results.

For instance, a poll might ask if people *believe* the shutdown will end. Polymarket asks users to *bet* on it. This difference is fundamental. It shifts the incentive structure. Participants are rewarded for accuracy, not for expressing a popular view. As a result, the platform aggregates a more objective assessment. This assessment helps stakeholders understand the true likelihood of a resolution. It provides a unique, financially weighted perspective on the **US government shutdown**.

The Broader Implications for Prediction Markets and Policy

The increasing accuracy and adoption of platforms like **Polymarket** have broader implications. They extend beyond just **crypto prediction**. Governments and corporations could potentially leverage these markets. They might use them to forecast various events. These events include public health crises, economic recessions, or even technological advancements. The collective intelligence gathered can offer valuable foresight. This foresight could inform policy decisions. It could also help in strategic planning.

Furthermore, the transparency of blockchain-based prediction markets builds trust. It ensures that no single entity controls the market. All rules are encoded. Outcomes are verifiable. This decentralized nature is a core tenet of the crypto space. It offers a powerful alternative to centralized data collection methods. Ultimately, the success of the **US government shutdown** market on Polymarket highlights this potential. It showcases the growing utility of decentralized tools in analyzing real-world events. This evolution continues to shape the future of information aggregation.

The Future of Crypto Prediction and Decentralized Forecasting

The trajectory for **prediction markets** points towards significant growth. As blockchain technology matures, these platforms will become more accessible. They will also become more robust. New features and functionalities will emerge. These innovations will enhance user experience. They will also improve forecasting accuracy. For the **crypto prediction** community, this means more opportunities. They can engage with diverse topics. They can also contribute to collective intelligence.

The application of these markets will also expand. We may see more granular predictions. These could cover specific legislative outcomes or court decisions. The ability to predict such complex events with accuracy is invaluable. It empowers individuals with better information. It also provides a novel tool for analysis. Therefore, the 84% **government shutdown odds** on Polymarket are not just a data point. They represent a milestone. They show the increasing power of decentralized forecasting in the digital age.

In conclusion, the 84% probability on **Polymarket** for the **US government shutdown** ending this week is a significant indicator. It underscores the power of **prediction markets** in providing timely, financially incentivized insights. This event highlights the growing intersection of real-world politics and **crypto prediction**. As decentralized platforms continue to mature, their role in informing public discourse and decision-making will only expand. The market’s confidence signals an imminent resolution, offering a compelling example of collective intelligence at work.

Frequently Asked Questions (FAQs)

What is Polymarket?

Polymarket is a decentralized prediction market platform. It allows users to bet on the outcomes of future real-world events. These events can include politics, finance, or current affairs. It operates on blockchain technology.

How do prediction markets like Polymarket work?

Users buy shares in specific outcomes using cryptocurrency. The price of these shares fluctuates based on supply and demand. This price reflects the market’s perceived probability of that outcome occurring. If your prediction is correct, you earn a payout.

Why are Polymarket’s odds considered reliable for events like the US government shutdown?

Polymarket’s odds are often considered reliable because participants stake real money. This financial incentive encourages thorough research and accurate forecasting. It often leads to more objective probabilities than traditional polling methods.

What does a ‘US government shutdown’ mean?

A US government shutdown occurs when Congress fails to pass appropriation bills. These bills fund government operations. Essential services continue, but many non-essential government functions cease. Employees may be furloughed without pay.

Can anyone participate in Polymarket?

Participation in Polymarket is generally open to anyone. However, local regulations regarding online betting and cryptocurrency can vary. Users should check their local laws before participating. The platform uses stablecoins for transactions.