The world of decentralized finance (DeFi) continues its rapid evolution, offering innovative solutions for traditional financial activities. In a significant move, Polymarket, a leading decentralized prediction market, has just unveiled a groundbreaking new section. This expansion focuses on predicting corporate earnings, a core aspect of traditional investing. This development marks a notable convergence of blockchain technology and mainstream financial analysis, creating exciting new opportunities for participants.

Polymarket Unlocks Exciting Corporate Earnings Markets

Polymarket, known for its diverse range of event-based markets, now steps into the realm of corporate finance. The platform launched a dedicated section for predicting the earnings of publicly traded companies. This initiative significantly broadens the scope of available prediction markets. Furthermore, it allows users to speculate on real-world financial outcomes with greater precision. Consequently, this integration bridges the gap between the volatile crypto space and established financial markets. The new section offers a unique way for users to engage with financial data.

This expansion leverages the core strength of Polymarket: creating liquid, transparent markets for future events. Participants can now buy and sell shares representing specific outcomes related to company earnings reports. For instance, users might predict if a company will beat, meet, or miss its estimated earnings per share (EPS). This mechanism provides a direct incentive for accurate forecasting. Moreover, it introduces a novel method for information aggregation within the financial sector.

Strategic Alliance with Stocktwits Elevates Prediction Markets

This ambitious venture is not a solo effort. Polymarket forged a key partnership with Stocktwits, a prominent social trading platform. The Block reported details of this collaboration. Stocktwits brings a vast community of retail investors and financial enthusiasts. Therefore, this partnership provides immediate access to a highly engaged audience. It also integrates real-time market sentiment directly into the prediction market framework.

The collaboration enhances the visibility and utility of these new prediction markets. Stocktwits users can now seamlessly transition to Polymarket to act on their insights. This synergy creates a powerful ecosystem where social discussion translates into actionable market positions. Moreover, the partnership lends credibility and a broader user base to Polymarket’s new offerings. This is a crucial step for mainstream adoption of decentralized finance tools.

Navigating Corporate Earnings: FedEx, Bullish, and Beyond

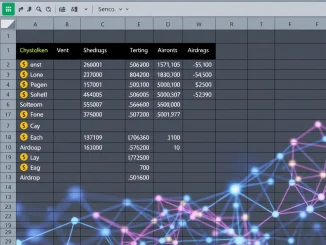

The initial launch features prediction markets for the corporate earnings of several well-known companies. These include global logistics giant FedEx and Bullish (BLSH), a cryptocurrency exchange recently listed on Nasdaq. The inclusion of both traditional and crypto-native companies highlights the diverse appeal of these new markets. It also demonstrates Polymarket’s commitment to offering relevant and timely prediction opportunities.

Participants can engage with these markets by:

- Analyzing financial data: Reviewing past performance, analyst estimates, and industry trends.

- Leveraging community sentiment: Observing discussions on Stocktwits and other platforms.

- Making informed predictions: Betting on specific earnings outcomes before official announcements.

The markets for FedEx and Bullish serve as compelling early examples. They allow users to apply their financial acumen to concrete, high-profile events. Consequently, this provides a practical application for the platform’s innovative technology. The success of these initial markets will likely pave the way for an expanded roster of companies.

The Power of Decentralized Prediction in Modern Finance

The integration of decentralized prediction markets for corporate earnings offers several advantages over traditional forecasting methods. First, these markets are permissionless. This means anyone, anywhere, can participate without intermediaries. Second, they are transparent. All transactions and market outcomes are recorded on the blockchain, ensuring auditability. Third, they aggregate information efficiently. The market price itself reflects the collective wisdom of participants, often providing more accurate forecasts than individual analysts.

Furthermore, decentralized prediction platforms resist censorship. This characteristic is particularly important in regions with restricted access to financial information. By providing an open and equitable platform, Polymarket democratizes access to financial forecasting tools. This shift empowers a broader base of individuals to participate in sophisticated financial activities. Therefore, it represents a significant step towards a more inclusive financial future.

Broader Implications for DeFi and Traditional Markets

Polymarket’s latest expansion holds significant implications for both the DeFi landscape and traditional financial markets. For DeFi, it showcases the practical utility of blockchain beyond purely crypto-native assets. It demonstrates how decentralized protocols can address real-world financial challenges. For traditional markets, it introduces a new, transparent, and globally accessible mechanism for price discovery and information aggregation. This could potentially influence how analysts and investors approach corporate earnings forecasts.

The partnership with Stocktwits is also a crucial milestone. It represents a tangible bridge between the crypto-savvy audience and mainstream investors. As more traditional financial data flows onto decentralized platforms, the lines between these two worlds will continue to blur. Ultimately, this move by Polymarket solidifies its position as a pioneer in the evolving space of information markets, driving innovation and accessibility in financial predictions.

FAQs about Polymarket’s Corporate Earnings Prediction Markets

Q1: What are Polymarket’s new corporate earnings prediction markets?

Polymarket has launched a new section allowing users to predict the financial outcomes, specifically earnings, of publicly traded companies. Users can bet on whether a company will beat, meet, or miss its projected earnings per share (EPS).

Q2: How does the partnership with Stocktwits enhance this new section?

The partnership with Stocktwits, a popular social trading platform, provides Polymarket with access to a large, engaged community of retail investors. This collaboration helps integrate real-time market sentiment and expands the reach of these new prediction markets to a broader audience.

Q3: Which companies are featured in the initial launch of corporate earnings predictions?

The initial launch includes prediction markets for companies like global logistics firm FedEx and Bullish (BLSH), a cryptocurrency exchange that recently listed on Nasdaq. This selection offers a mix of traditional and crypto-native companies.

Q4: What are the benefits of using a decentralized prediction market for corporate earnings?

Decentralized prediction markets offer transparency, censorship resistance, and global accessibility. They aggregate information efficiently through collective wisdom, often leading to more accurate forecasts, and allow anyone to participate without intermediaries.

Q5: How do users participate in these corporate earnings markets on Polymarket?

Users can participate by analyzing financial data, considering community sentiment, and then buying or selling shares representing specific earnings outcomes (e.g., ‘FedEx beats EPS’). The market resolves based on official company reports, and winning shares pay out.

Q6: What is the broader impact of Polymarket’s expansion into corporate earnings?

This expansion helps bridge decentralized finance (DeFi) with traditional financial markets, showcasing the practical utility of blockchain for real-world financial challenges. It introduces a new, transparent mechanism for price discovery and information aggregation, potentially influencing how investors approach earnings forecasts.