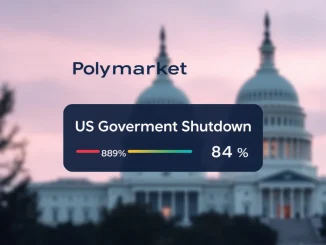

The convergence of decentralized finance and traditional sports entertainment marks a pivotal moment. Indeed, Polymarket, a leading blockchain-based prediction market, is stepping into a groundbreaking role. It will serve as the designated clearinghouse for sports betting giant DraftKings’ new prediction market venture. This development signals a significant leap for both the crypto and mainstream betting industries. It also highlights the increasing acceptance of decentralized technologies within regulated financial frameworks.

Polymarket: Pioneering the Future of Prediction Markets

Polymarket operates as a decentralized information platform. Here, users can bet on the outcomes of future events, ranging from politics to sports. Built on blockchain technology, it offers unparalleled transparency and immutability. Consequently, all market actions and outcomes are publicly verifiable. This core principle fosters trust among participants. Furthermore, Polymarket’s innovative structure minimizes counterparty risk, a common concern in traditional financial markets. Its infrastructure is designed for efficiency and fairness. Therefore, it provides a robust environment for real-time market activity.

The platform’s design leverages smart contracts. These self-executing contracts automate market operations. For example, they handle settlement processes once an event’s outcome is determined. This automation reduces the need for intermediaries. Moreover, it enhances the speed and accuracy of payouts. Polymarket’s success demonstrates the viability of decentralized prediction markets. It showcases their potential to offer more resilient and accessible alternatives to traditional forecasting methods. Its selection by DraftKings underscores its technological maturity and operational reliability.

DraftKings’ Strategic Expansion into the Prediction Market

DraftKings, a dominant force in daily fantasy sports and sports betting, consistently seeks innovative growth avenues. Their foray into prediction markets represents a strategic diversification. This move allows them to tap into a new segment of engaged users. Furthermore, it expands their product offerings beyond traditional sports wagering. The acquisition of Railbird, a designated contract market (DCM), proved crucial for this expansion. Railbird operates under the strict oversight of the U.S. Commodity Futures Trading Commission (CFTC). This acquisition provides DraftKings with a critical regulatory foundation. It ensures their new prediction market adheres to established financial guidelines.

DraftKings’ decision to partner with Polymarket as its clearinghouse is a testament to Polymarket’s robust capabilities. It also signifies DraftKings’ commitment to building a compliant and trustworthy platform. This collaboration combines DraftKings’ extensive user base and brand recognition with Polymarket’s cutting-edge blockchain technology. Ultimately, it aims to create a superior prediction market experience. The integration promises to blend the best of both worlds: mainstream accessibility with decentralized integrity.

Navigating CFTC Regulation in the Digital Age

The U.S. Commodity Futures Trading Commission (CFTC) plays a vital role in regulating derivatives markets. This includes futures, options, and swaps. Its primary mission is to foster open, transparent, competitive, and financially sound markets. When prediction markets involve financial instruments, they often fall under CFTC jurisdiction. DraftKings’ acquisition of Railbird, a CFTC-regulated DCM, highlights the importance of regulatory compliance. This step ensures that DraftKings’ prediction market operates within legal boundaries. It also provides a level of consumer protection and market integrity.

The involvement of a CFTC-regulated entity like Railbird changes the landscape for prediction markets. It transitions them from unregulated, often speculative, environments to a more structured framework. This regulatory oversight helps prevent market manipulation. It also ensures fair trading practices. For Polymarket, acting as a clearinghouse for a CFTC-regulated market is a significant validation. It demonstrates the platform’s ability to meet stringent compliance requirements. Consequently, this partnership could pave the way for broader institutional adoption of blockchain-based solutions in regulated sectors.

The Clearinghouse Role: Ensuring Trust and Efficiency

A clearinghouse performs several critical functions in financial markets. It acts as an intermediary between buyers and sellers. By doing so, it guarantees the fulfillment of contractual obligations. In the context of the DraftKings prediction market, Polymarket will assume this essential role. Specifically, it will manage the settlement of trades. It will also ensure that all parties honor their commitments. This function significantly reduces counterparty risk. Without a clearinghouse, participants would face the direct risk of a trading partner defaulting.

Polymarket’s blockchain foundation enhances its clearinghouse capabilities. Smart contracts automate the settlement process. This eliminates human error and potential delays. Furthermore, the transparent nature of blockchain technology means that all transactions are recorded on an immutable ledger. This provides an auditable trail for regulatory bodies and market participants alike. The efficiency gained through this automated, transparent system is substantial. It ensures that funds are securely held and disbursed according to market outcomes. Therefore, Polymarket’s role is pivotal for the smooth and trustworthy operation of DraftKings’ prediction market.

Impact on the Future of Crypto Betting and Beyond

This partnership between Polymarket and DraftKings holds profound implications. Firstly, it legitimizes blockchain-based prediction markets in the eyes of mainstream consumers and regulators. The association with a reputable brand like DraftKings lends credibility. This could encourage wider adoption of crypto betting platforms. Secondly, it showcases a practical application of decentralized technology in a regulated environment. This integration may inspire other traditional companies to explore similar blockchain collaborations. Ultimately, it could accelerate the convergence of traditional finance and decentralized finance (DeFi).

The collaboration also sets a precedent for how decentralized autonomous organizations (DAOs) and traditional corporations can interact. Polymarket, while a company, embodies many principles of decentralized governance and operation. This hybrid model could become a blueprint for future partnerships. Furthermore, it could open new avenues for innovation in sports betting and forecasting. The enhanced transparency and efficiency offered by Polymarket’s clearinghouse services could redefine industry standards. As a result, the entire prediction market ecosystem stands to benefit from this groundbreaking development.

Conclusion

The announcement that Polymarket will serve as the clearinghouse for DraftKings’ prediction market marks a landmark event. It signifies a powerful synergy between innovative blockchain technology and established sports entertainment. This move, bolstered by DraftKings’ acquisition of a CFTC-regulated entity, ensures compliance and fosters trust. Consequently, it sets a new standard for transparency and efficiency in prediction markets. As the lines between traditional and decentralized finance continue to blur, this partnership exemplifies the exciting future of digital betting and forecasting. It promises a more robust, fair, and accessible experience for users worldwide.

Frequently Asked Questions (FAQs)

Q1: What is Polymarket’s specific role in the DraftKings partnership?

A1: Polymarket will act as the designated clearinghouse for DraftKings’ prediction market. This means it will manage the settlement of trades, ensuring all contractual obligations are met and reducing counterparty risk through its blockchain-based system.

Q2: Why did DraftKings acquire Railbird?

A2: DraftKings acquired Railbird because it is a designated contract market (DCM) regulated by the U.S. Commodity Futures Trading Commission (CFTC). This acquisition provides DraftKings with the necessary regulatory framework to legally operate a prediction market in the U.S.

Q3: What does CFTC regulation mean for prediction markets?

A3: CFTC regulation ensures that prediction markets operate within established legal and financial guidelines. It aims to promote market integrity, prevent manipulation, and protect consumers, transitioning these markets from potentially unregulated environments to structured, compliant platforms.

Q4: How do prediction markets work?

A4: Prediction markets allow users to bet on the outcome of future events. Participants buy and sell shares corresponding to specific outcomes. The price of these shares fluctuates based on market sentiment and information. If an outcome occurs, shares for that outcome pay out at a fixed value, while others become worthless.

Q5: What are the benefits of using a blockchain-based clearinghouse like Polymarket?

A5: A blockchain-based clearinghouse offers enhanced transparency, immutability, and efficiency. Smart contracts automate settlements, reducing human error and delays. All transactions are recorded on a public, immutable ledger, providing an auditable trail and fostering greater trust among participants.

Q6: How does this partnership impact the broader crypto betting industry?

A6: This partnership legitimizes blockchain-based prediction markets by associating them with a mainstream brand like DraftKings and operating under CFTC regulation. It could encourage wider adoption of crypto betting, inspire more traditional companies to integrate decentralized technologies, and set new standards for transparency and efficiency in the industry.