Is Donald Trump’s foray into cryptocurrency a strategic masterstroke or a recipe for disaster? Economist and notorious crypto skeptic, Peter Schiff, has weighed in, and he’s not holding back. In a blistering critique, Schiff has labeled Trump’s newly announced crypto reserve as potentially the “biggest crypto rug pull of all time.” This explosive accusation has sent ripples through the crypto community and beyond, raising serious questions about transparency, insider trading, and the future of digital assets in the political arena. Let’s dive into Schiff’s fiery claims and unpack what this could mean for the crypto world.

Peter Schiff’s Scathing Attack on Trump’s Crypto Reserve

Peter Schiff, known for his gold advocacy and staunch anti-crypto stance, didn’t mince words in his recent social media outburst. He took to X to voice his concerns, questioning the very foundation of Trump’s crypto strategic reserve announcement. Schiff’s central argument revolves around the suspicion of a “rug pull,” a term in the crypto world that describes a fraudulent scheme where developers abandon a project and abscond with investors’ funds. While not explicitly accusing Trump of direct fraud, Schiff’s choice of words is deliberately provocative, suggesting a lack of legitimacy and potential harm to crypto investors.

Here’s a breakdown of Schiff’s key accusations:

- “Biggest Crypto Rug Pull” Claim: Schiff’s most inflammatory statement is his comparison of Trump’s crypto reserve to a “rug pull.” This immediately casts a shadow of doubt and distrust over the entire initiative, suggesting it’s designed to benefit insiders at the expense of ordinary investors.

- Demand for Congressional Investigation: Schiff isn’t just voicing an opinion; he’s calling for action. By urging a Congressional investigation, he’s escalating the matter to a level of official scrutiny, demanding accountability and transparency from Trump and his associates.

- Questions of Authorship and Insider Knowledge: Schiff raises critical questions about the origin of the Truth Social posts announcing the crypto reserve. He wants to know who wrote them, who knew about them beforehand, and crucially, whether this prior knowledge was used for illicit financial gain.

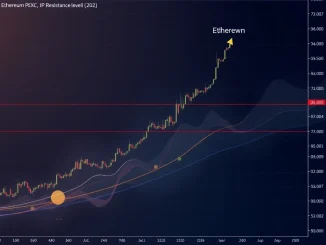

- Suspicions of Insider Trading: This is the crux of Schiff’s concern. He specifically points to potential insider trading in cryptocurrencies like XRP, ADA, SOL, BTC, and ETH. He suspects that individuals with advance information about Trump’s announcement may have profited by trading these assets before and after the public disclosure, taking advantage of market fluctuations caused by the news.

- Call for Review of Communications: To uncover potential wrongdoing, Schiff demands a thorough review of emails and messages involving a wide range of individuals connected to Trump, including his staff, family, donors, and even Truth Social employees. This broad scope indicates the depth of Schiff’s suspicion and his desire for a comprehensive investigation.

Unpacking the “Crypto Rug Pull” Accusation

The term “rug pull” is loaded with negative connotations in the crypto space. It evokes images of scams and financial ruin. When Peter Schiff uses this term in relation to Trump’s crypto reserve, he’s tapping into a deep-seated fear among crypto investors – the fear of being deceived and losing their investments. But is it a fair comparison? Let’s consider what constitutes a typical crypto rug pull:

| Feature | Typical Crypto Rug Pull | Trump’s Crypto Reserve (Schiff’s Implication) |

|---|---|---|

| Project Nature | Often new, obscure, or unaudited crypto projects. | Involves established cryptocurrencies (BTC, ETH, XRP, ADA, SOL) as reserves, but the project’s structure and management are new and unclear. |

| Developer Actions | Developers abruptly abandon the project, often removing liquidity from decentralized exchanges (DEXs), causing token prices to crash. | Schiff implies a potential “rug pull” not through direct abandonment, but through orchestrated market manipulation and insider enrichment under the guise of a “reserve.” |

| Investor Impact | Investors lose significant amounts of money as token value plummets to zero. | Schiff fears investors could be harmed through manipulated market conditions or lack of transparency in the reserve’s management, potentially leading to financial losses if the scheme is revealed to be detrimental. |

| Intent | Primarily designed to defraud investors from the outset. | Schiff suggests the intent behind the crypto reserve might be less about genuine strategic goals and more about creating opportunities for insider trading and financial gain for those connected to Trump. |

While Trump’s crypto reserve isn’t a typical rug pull in the sense of a new project collapsing, Schiff’s accusation highlights the potential for misuse and exploitation within the crypto space, especially when political figures and large sums of money are involved. His use of the term is a powerful rhetorical device to raise alarm bells and demand scrutiny.

The Timeline: Trump’s Truth Social Posts and Community Reaction

The controversy stems from two posts made on Donald Trump’s Truth Social account on March 3rd. These posts, announcing the crypto strategic reserve, were the catalyst for Schiff’s explosive reaction and the broader community’s concerns. Here’s a quick recap of the timeline:

- March 3rd: Trump posts on Truth Social about establishing a crypto strategic reserve. The exact details and purpose of the reserve are not fully clarified in the initial posts.

- Immediate Community Response: The crypto community reacts swiftly, with many expressing skepticism and raising concerns about the lack of transparency and the potential for market manipulation. The speed and nature of the announcement, coupled with Trump’s political profile, trigger immediate suspicion.

- Front-Running and Insider Trading Accusations: Almost instantly, accusations of front-running and insider trading begin to circulate online. Observers point to the possibility that individuals with prior knowledge of the announcement could have traded cryptocurrencies before the public news, profiting from the anticipated market reaction.

- Peter Schiff’s Intervention: Days later, Peter Schiff adds fuel to the fire with his scathing critique, labeling the reserve a potential “rug pull” and demanding a Congressional investigation. His high-profile condemnation amplifies the existing concerns and brings the issue to a wider audience.

Why is Insider Trading a Major Concern?

Insider trading is a serious offense in traditional financial markets, and the crypto world is increasingly grappling with similar concerns. It undermines market fairness and erodes investor trust. Here’s why the allegations of insider trading related to Trump’s crypto reserve are so significant:

- Unfair Advantage: Insider trading gives individuals with non-public information an unfair advantage over ordinary investors. They can make profitable trades based on privileged knowledge, while others are left at a disadvantage.

- Market Manipulation: Insider trading can artificially inflate or deflate asset prices, distorting the true market value and creating instability. This can harm legitimate investors and undermine the integrity of the market.

- Erosion of Trust: If insider trading is perceived to be rampant, it erodes trust in the market. Investors become hesitant to participate if they believe the game is rigged in favor of insiders. This can stifle market growth and innovation.

- Legal and Ethical Implications: Insider trading is illegal in many jurisdictions and is considered unethical. Allegations of insider trading against prominent figures like Donald Trump carry significant legal and reputational risks.

Congressional Investigation: Will it Happen?

Peter Schiff’s call for a Congressional investigation adds a layer of political drama to this crypto controversy. But is a Congressional investigation likely? Several factors will influence this:

- Political Will: Whether Congress decides to investigate will depend on political will. Democrats, and even some Republicans, might see this as an opportunity to scrutinize Trump and his financial dealings. However, partisan divides could also hinder any bipartisan effort.

- Evidence of Wrongdoing: For a Congressional investigation to gain traction, there needs to be credible evidence of potential wrongdoing. Schiff’s accusations raise serious questions, but concrete evidence of insider trading or market manipulation would be needed to compel a formal investigation.

- Public Pressure: Public outcry and media attention can also play a role. If the crypto community and the broader public demand answers and accountability, it could increase the pressure on Congress to act.

- Scope of Investigation: Even if an investigation is launched, its scope and intensity could vary. It could range from a limited inquiry to a full-blown investigation with subpoenas and hearings.

Actionable Insights for Crypto Investors

Regardless of whether a Congressional investigation materializes, this situation offers valuable lessons for crypto investors:

- Be Wary of Hype and Political Endorsements: Political figures entering the crypto space can create hype and volatility. It’s crucial to remain skeptical and conduct your own due diligence, rather than blindly following endorsements.

- Transparency is Key: Demand transparency from any crypto project or initiative, especially those involving public figures. Lack of clarity should be a red flag.

- Monitor for Insider Trading: Be aware of the signs of potential insider trading, such as sudden price spikes or unusual trading volumes before major announcements. Report suspicious activity to relevant authorities.

- Diversify Your Investments: Don’t put all your eggs in one basket, especially when dealing with volatile assets like cryptocurrencies. Diversification can help mitigate risks.

- Stay Informed and Engaged: Keep up-to-date with crypto news and regulatory developments. Engage in discussions within the community and voice your concerns when necessary.

Conclusion: A Crypto Storm Brewing?

Peter Schiff’s explosive accusations against Trump’s crypto reserve have ignited a firestorm of controversy. Whether his “biggest crypto rug pull” claim proves accurate remains to be seen. However, the episode underscores the ongoing challenges of transparency, regulation, and potential manipulation within the burgeoning crypto market. The call for a Congressional investigation highlights the growing intersection of cryptocurrency and politics, a space ripe with both opportunity and peril. For crypto investors, this saga serves as a potent reminder to remain vigilant, critical, and informed as the digital asset landscape continues to evolve and attract increasing scrutiny.