Have you ever wondered what truly drives the sudden, dramatic price movements in the volatile world of cryptocurrency? One day, a token might be trading steadily, and the next, it experiences an OP Token Surge that leaves investors both thrilled and perplexed. This was precisely the scenario that unfolded on July 28, 2025, when Optimism’s native token, OP, witnessed an impressive short-term price jump of over 8%, hitting $0.8013. This rapid ascent was directly tied to a pivotal announcement: its listing on Upbit, a major South Korean cryptocurrency exchange. But what does such an event truly signify for the token, and the broader crypto landscape?

Understanding the **Upbit Listing** Impact

The news of OP’s Upbit Listing sent immediate ripples through the market. Upbit, being one of South Korea’s largest and most influential crypto exchanges, holds significant sway over local and international trading volumes. When an exchange of this caliber adds a new token, it’s not just a simple administrative task; it’s a gateway to new liquidity and a broader investor base.

For OP, the listing included trading pairs for Korean Won (KRW), Bitcoin (BTC), and Tether (USDT). The inclusion of a KRW pair is particularly crucial. South Korea has a vibrant and often highly speculative crypto market, where local fiat pairs can trigger immense buying pressure from retail investors. This direct access allows Korean traders to easily buy and sell OP without first converting their won into another cryptocurrency, streamlining the process and reducing friction. The BTC and USDT pairs further expanded its reach, offering flexibility for traders accustomed to stablecoin or Bitcoin-denominated trading.

The immediate surge underscores a common phenomenon in crypto: the ‘exchange listing pump.’ This often happens because:

- Increased Accessibility: More people can now easily buy the token.

- Enhanced Liquidity: More trading pairs mean easier buying and selling without significant price impact.

- Visibility and Credibility: A listing on a reputable exchange lends legitimacy and brings the token to the attention of a wider audience.

- Speculative Trading: Traders anticipate the listing and ‘buy the rumor,’ hoping to ‘sell the news’ for a quick profit.

Why Did the **OP Token Surge** So Dramatically?

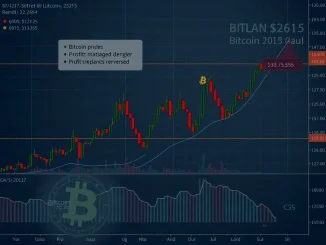

The immediate 8% OP Token Surge to $0.8013 was a clear reflection of this immediate influx of demand and speculative interest. It demonstrated the power of a major exchange listing to ignite short-term price action, even in a market that might otherwise be experiencing headwinds. This specific surge was notable because it occurred while Bitcoin and Ethereum, the market’s two largest cryptocurrencies, were facing intraday declines. OP’s ability to defy this broader bearish trend highlighted its asset-specific drivers.

However, the rapid increase was, as often seen, transient. Post-event data showed OP reverting to pre-listing levels, a pattern that experienced crypto traders are well familiar with. This ‘buy the rumor, sell the news’ dynamic means that while listings can create significant short-term volatility and liquidity, they don’t always translate into sustained momentum. The initial excitement often dissipates once the event is priced in, and traders who bought in anticipation begin to take profits.

This transient nature is a crucial lesson for investors. While the prospect of quick gains is tempting, relying solely on listing news for long-term investment strategies can be risky. Fundamental analysis, understanding the project’s utility, ecosystem development, and long-term vision, remains paramount.

Navigating **Altcoin Price Volatility**

The OP event serves as a microcosm for understanding broader Altcoin Price Volatility. Altcoins, by their nature, are often more susceptible to rapid price swings than their larger counterparts like Bitcoin or Ethereum. Several factors contribute to this:

- Lower Market Capitalization: Smaller market caps mean that relatively smaller amounts of capital can have a disproportionately large impact on price.

- Liquidity Concentration: Trading volume might be concentrated on a few exchanges, making prices more sensitive to large orders.

- News Sensitivity: Altcoins often react more dramatically to specific news events—be it exchange listings, partnership announcements, or technological upgrades—as these events can significantly alter their perceived value or utility.

- Retail Investor Influence: Altcoin markets often see a higher proportion of retail investors, whose collective sentiment can shift quickly, leading to rapid pumps and dumps.

For investors, understanding these dynamics is key. While high volatility presents opportunities for significant gains, it also carries substantial risks. Diversification, setting clear entry and exit strategies, and avoiding emotional decisions are critical when navigating the altcoin market.

Broader **Crypto Market Dynamics** and Bitcoin News Today

While the OP token’s performance was asset-specific, it unfolded within a larger context of Crypto Market Dynamics. Despite OP’s surge, the broader market showed signs of caution. Bitcoin and Ethereum faced intraday declines, highlighting that even positive news for a single altcoin doesn’t necessarily pull the entire market up. This reinforces the fragmented nature of the crypto space, where macro trends and individual token narratives can sometimes diverge.

Recent Bitcoin News Today indicated heightened derivatives activity, with open interest for Bitcoin hitting $34.1 billion. This metric often reflects the level of leverage and speculative bets in the market. Ethereum’s perpetual trading volumes also surpassed Bitcoin’s for the first time in recent months, signaling increased interest and liquidity in ETH derivatives. These macro-level metrics provide a pulse on overall market sentiment and investor positioning, even if they weren’t directly tied to OP’s specific price movement.

The market remained cautious ahead of the typically quieter August period, often characterized by lower trading volumes and less significant price action. The absence of immediate major regulatory or macroeconomic catalysts meant that token-specific events, like the Upbit listing, gained more prominence in driving isolated price movements.

What’s Next for OP and the Market?

Looking ahead, the focus for OP and other tokens will extend beyond mere exchange listings. While initial listings provide a liquidity boost, sustained demand depends on more fundamental factors. For Optimism, this includes ongoing ecosystem developments, adoption of its Layer 2 scaling solution, and future upgrades that enhance its utility and appeal.

The broader crypto market will also be watching for upcoming regulatory developments. Hong Kong’s Stablecoins Ordinance, set to take effect on August 1, is one such event that could shape the regulatory landscape for stablecoins and, by extension, impact the wider market’s confidence and liquidity. Such regulatory clarity can either foster innovation or introduce new challenges, influencing investor sentiment significantly.

For OP, future price action will largely depend on whether additional market catalysts—such as further strategic exchange listings in other major regions, significant partnerships, or major protocol upgrades—can generate sustained demand. The July 28 listing on Upbit, while impactful in the short term, serves as a powerful reminder of how liquidity-driven spikes can sometimes overshadow the slower, more fundamental progress of a project.

Conclusion

The OP Token Surge following its Upbit Listing was a textbook example of how exchange listings can trigger immediate, albeit transient, price action in the crypto market. It highlighted the influence of major exchanges, particularly in liquidity-rich regions like South Korea, and underscored the inherent Altcoin Price Volatility. While the event generated significant short-term excitement, it also reinforced the importance of looking beyond fleeting pumps. As the Crypto Market Dynamics continue to evolve, influenced by everything from Bitcoin News Today to specific token developments, investors are reminded that true value often lies in a project’s long-term utility and ecosystem growth, rather than just a single, explosive event.

Frequently Asked Questions (FAQs)

Q1: What caused the OP Token Surge on July 28?

The OP Token experienced a short-term price surge of over 8% primarily due to its listing on Upbit, a major South Korean cryptocurrency exchange. The listing included new trading pairs for Korean Won (KRW), Bitcoin (BTC), and Tether (USDT, driving immediate buying interest and increased liquidity.

Q2: Is an Upbit listing always a guarantee of sustained price growth for a token?

No, an Upbit listing, or any major exchange listing, is not a guarantee of sustained price growth. While it typically causes a short-term price pump due to increased accessibility and speculative trading (often called ‘buy the rumor, sell the news’), prices often revert to pre-listing levels once the initial excitement fades and traders take profits. Long-term growth depends on the token’s fundamental utility, ecosystem development, and broader market conditions.

Q3: How does the OP Token’s performance relate to broader Crypto Market Dynamics?

While the OP Token’s surge was an asset-specific event, it occurred within a broader market context where Bitcoin and Ethereum were experiencing intraday declines. This highlights the fragmented nature of crypto markets, where individual tokens can defy general market trends based on their own catalysts. However, overall market sentiment, driven by factors like Bitcoin’s open interest and Ethereum’s trading volumes, still provides an important backdrop.

Q4: What are the main factors contributing to Altcoin Price Volatility?

Altcoin price volatility is influenced by several factors, including their relatively lower market capitalization (meaning smaller investments can cause larger price swings), concentrated liquidity on fewer exchanges, heightened sensitivity to news events (like listings or partnerships), and a higher proportion of retail investors whose collective sentiment can shift rapidly.

Q5: What should investors consider after an event like the OP Token’s Upbit listing?

Investors should look beyond the immediate price pump. It’s crucial to research the project’s long-term fundamentals, its technology, adoption rates, and development roadmap. They should also be mindful of market psychology, set realistic expectations, and consider diversification to mitigate risks associated with high volatility.