The cryptocurrency world often grapples with questions of fairness and transparency. Recently, a major MYX airdrop has become the center of a storm. Allegations of insider trading crypto have rocked the community. A prominent blockchain analysis platform, Bubblemaps, raised these serious concerns. This situation highlights the ongoing need for vigilance in the decentralized space.

Unpacking Bubblemaps’ Initial Allegations Against MYX

Blockchain analysis platform Bubblemaps recently made significant claims. They alleged potential insider trading crypto by the MYX team. Bubblemaps cited direct links between the team and specific wallets. These wallets collectively received a staggering $170 million from a recent airdrop. Initially, Bubblemaps reported an institution receiving these MYX tokens. This distribution occurred across 100 newly created wallets. Such findings immediately raised red flags among observers. Consequently, the crypto community demanded further investigation into these transactions. Transparency remains a cornerstone of trust in this evolving market.

Tracing Suspicious Connections with Blockchain Analysis

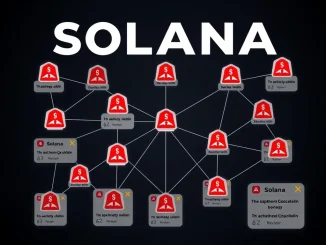

Bubblemaps conducted thorough blockchain analysis. Their investigation began by tracking the MYX creator wallet, identified as 0x8eEB. Researchers then analyzed fund transfers across two distinct chains. This meticulous process led to a critical discovery. They identified one key recipient address: 0x4a31. Importantly, this address reportedly mirrored the pattern of 95 other Sybil wallets. Furthermore, Bubblemaps established a direct link. Address 0x4a31 connected to 0xeb5A. Significantly, address 0xeb5A associates with the MYX creator. These intricate connections fueled the Bubblemaps allegations. They suggest a coordinated effort rather than random distribution. Thus, the evidence points towards potential illicit activities.

The MYX Team Controversy and Their Response

The Bubblemaps allegations placed the MYX team under intense scrutiny. Consequently, the team faced pressure to address these serious claims. According to Bubblemaps, the MYX team provided only a vague response. They stated that some users had requested address changes. This explanation, however, failed to satisfy critics. Many found the response insufficient and lacking detail. It did not directly counter the specific wallet links identified by Bubblemaps. The MYX team controversy therefore continues to grow. A lack of clear communication can erode community trust. Transparency becomes paramount in such situations. Vague answers often raise more questions than they resolve.

Understanding Insider Trading in the Crypto Space

What exactly constitutes insider trading crypto? Generally, it involves using non-public information for personal financial gain. In traditional markets, this practice is illegal. It undermines market fairness. In the decentralized world, regulations are still evolving. However, the ethical implications remain clear. If a project team knows about an upcoming airdrop, they possess privileged information. Distributing airdrop tokens to wallets they control, before public knowledge, could be insider trading. This practice gives them an unfair advantage. It potentially devalues the tokens for legitimate participants. Therefore, such actions can severely damage a project’s reputation. It also harms investor confidence.

Impact on Trust and the Future of MYX Airdrops

The MYX team controversy carries significant weight. Allegations of insider trading crypto can deeply harm a project’s credibility. Investors rely on fair play and transparency. When these principles are questioned, trust diminishes rapidly. A successful airdrop should benefit the wider community. It aims to foster adoption and decentralization. Conversely, if insiders exploit it, the purpose is corrupted. This situation could deter future participants from MYX projects. It might also influence the perceived integrity of future MYX airdrops. Projects must uphold the highest ethical standards. This ensures a healthy and trustworthy ecosystem for all users. Consequently, clear communication is vital for rebuilding confidence.

Broader Implications for Blockchain Analysis and Market Integrity

This incident underscores the vital role of blockchain analysis. Platforms like Bubblemaps provide crucial oversight. They help maintain market integrity. Their ability to trace complex transactions is invaluable. Such scrutiny acts as a deterrent against malpractice. It also empowers the community to hold projects accountable. As the crypto market matures, regulatory bodies may take note. Allegations of insider trading crypto could attract official attention. This could lead to stricter guidelines for airdrops and token distributions. Ultimately, maintaining a fair and transparent environment benefits everyone. It strengthens the entire decentralized finance (DeFi) ecosystem. Therefore, robust analysis tools are essential.

The MYX airdrop saga remains a developing story. Bubblemaps allegations of insider trading cast a shadow over the project. The crypto community awaits a more comprehensive response from the MYX team. This incident serves as a stark reminder. Transparency and ethical conduct are paramount in the digital asset space. Moving forward, clear communication and accountability will be key. They will help restore confidence and ensure market fairness. The integrity of decentralized finance depends on these foundational principles.

Frequently Asked Questions (FAQs)

Q1: What are the main allegations against the MYX team?

A1: Bubblemaps alleges potential insider trading by the MYX team. They claim the team is linked to wallets that received $170 million from a recent MYX airdrop. These wallets showed patterns consistent with Sybil attacks.

Q2: Who is Bubblemaps, and what role do they play?

A2: Bubblemaps is a blockchain analysis platform. They specialize in identifying connections between wallets. Their role here is to provide on-chain data and analysis. This helps uncover suspicious activities like the alleged insider trading crypto.

Q3: How did Bubblemaps identify the alleged connections?

A3: Bubblemaps tracked the MYX creator wallet (0x8eEB). They then analyzed fund transfers on two chains. This process identified recipient address 0x4a31. This address matched other Sybil wallets and linked to a known MYX creator address (0xeb5A). This detailed blockchain analysis forms the basis of their claims.

Q4: How did the MYX team respond to these allegations?

A4: The MYX team provided a vague response. They stated that some users had requested address changes. Many in the community found this explanation insufficient. It did not address the specific wallet links identified by Bubblemaps. This fuels the MYX team controversy.

Q5: What are the potential consequences of these allegations for MYX?

A5: The allegations could severely damage MYX’s reputation and community trust. It might deter future participants from their projects. It could also attract scrutiny from regulatory bodies. Ultimately, it questions the fairness of the MYX airdrop distribution.

Q6: Why is insider trading a concern in cryptocurrency?

A6: Insider trading undermines the principle of fairness. It gives an unfair advantage to those with privileged information. In crypto, it can devalue tokens for legitimate users. This practice erodes trust in projects and the wider decentralized market.