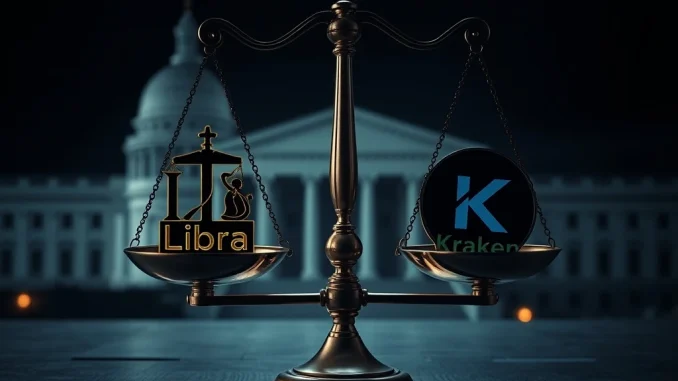

The world of cryptocurrency is no stranger to intrigue, but a recent development in the ongoing Libra probe has sent ripples across the digital asset landscape. A significant Kraken transfer of $500,000, directly linked to a meeting involving Argentine President Javier Milei, is now under intense scrutiny. This isn’t just about a large sum of money moving; it’s about the timing, the players, and the potential implications for how digital currencies are regulated globally. The question on everyone’s mind: What exactly was going on behind the scenes?

Unraveling the Shocking Kraken Transfer

At the heart of the escalating Libra probe is a transaction that occurred on January 30th. Approximately $500,000 was moved to Kraken, a centralized cryptocurrency exchange known for its Know-Your-Customer (KYC) protocols. What makes this particular Kraken transfer so significant is its precise timing: it happened concurrently with a high-level meeting between Hayden Davis, a key figure in the Libra project, Mauricio Novelli (another Libra promoter), and Argentine President Javier Milei. Official presidential records confirm this gathering aimed to “analyze blockchain and decentralized technologies.”

However, investigators are now digging deeper, scrutinizing whether the timing and sheer scale of this half-million-dollar transaction suggest a deliberate attempt to obscure financial activities. For a project like Libra, which was once backed by tech giants like Meta before its eventual dissolution in 2024, such financial maneuvers raise serious red flags. Argentine prosecutors are actively seeking cooperation from Kraken to identify the wallet’s true owner and assess any direct ties to the Libra initiative. Local media reports have further fueled suspicions, highlighting that this payment coincided with similar transfers made just hours after the presidential meeting, intensifying concerns about efforts to bypass standard regulatory compliance measures.

The Milei Crypto Connection Under Fire

President Javier Milei’s involvement has added a complex political layer to the unfolding case. Initially, President Milei asserted that his public social media commentary about Libra was made in his capacity as a private individual. However, a recent court ruling has contradicted this stance, deeming his actions attributable to his official role as President. This legal shift potentially exposes him to significant legal liability, transforming what might have seemed like personal endorsements into actions with governmental implications.

The precise timing of the Kraken transfer—occurring during a high-level governmental discussion on blockchain technology—has prompted analysts to question its purpose. Was it a strategic financial maneuver designed to obscure liabilities? Or perhaps an attempt to mislead oversight bodies? A spokesperson for a leading FinTech regulatory group commented that such loopholes are “often exploited in cross-border digital currency operations,” underscoring the transaction’s potential to form a strong basis for legal action if it can be proven that it demonstrates deliberate evasion of Anti-Money Laundering (AML) protocols. The spotlight on the Milei crypto connection is intense, as the probe now touches the highest levels of government.

Hayden Davis and the Web of Discrepancies

The figure of Hayden Davis, a central promoter of the Libra project, remains a focal point in this escalating investigation. The $500,000 Kraken transfer is believed to be directly tied to him, making his actions and testimonies critical to the probe’s progress. Investigators have already identified significant discrepancies in statements from various project stakeholders, and this new transaction data could prove instrumental in clarifying those inconsistencies.

Anonymous sources close to the investigation suggest that this particular transaction “adds a new layer to the narrative,” potentially filling in crucial gaps in earlier statements from Libra executives. Furthermore, internal documents obtained during the ongoing probe indicate that Meta’s legal team was well aware of the risks associated with third-party exchange partnerships, even though the company has yet to publicly comment on these findings. The focus on Hayden Davis highlights the individual accountability that regulators are increasingly seeking in the often-opaque world of cryptocurrency projects.

The Broader Implications for Crypto Regulation

The Libra probe serves as a powerful illustration of the broader challenges inherent in regulating decentralized finance (DeFi). While the ethos of crypto often champions decentralization, investigations frequently pivot on centralized entities like Kraken. These exchanges, subject to stringent compliance rules such as KYC and AML, have become critical nodes for authorities attempting to trace illicit financial flows within the digital currency ecosystem. Regulators are now intensely examining whether these platforms, perhaps inadvertently, facilitated transactions that circumvented standard verification processes—a practice that could lead to violations of both U.S. and international financial regulations.

This case is not just about one project; it’s about setting precedents for the future of crypto regulation. As cross-border collaborations in the blockchain sector continue to grow, the complexities of jurisdiction and enforcement become increasingly apparent. The outcome of this investigation could significantly influence how regulators approach digital asset projects, particularly those with global aspirations and intricate financial architectures. It underscores the urgent need for clearer, more unified international regulatory frameworks to manage the inherent risks of a rapidly evolving financial landscape.

The Future of Oversight: Setting Precedents

As the investigation into the Libra project continues to unfold across U.S. and Argentine jurisdictions, its implications extend far beyond the specific individuals involved. The meticulous analysis of this $500,000 Kraken transfer, and its connection to the Milei crypto meeting, could set significant legal and regulatory precedents for addressing similar cases in the future. It’s a high-stakes test for the intersection of cutting-edge blockchain technology and traditional regulatory oversight.

The focus remains on whether this transaction will definitively implicate key stakeholders, or if it will reveal systemic compliance failures embedded within the Libra project’s financial architecture. With amicus curiae briefs already urging the direct interrogation of President Milei, and probes advancing simultaneously in multiple jurisdictions, the crypto world watches closely. This case is poised to redefine the boundaries of accountability and transparency in the digital asset space, emphasizing that even in a decentralized world, compliance and ethical conduct remain paramount.

Frequently Asked Questions (FAQs)

Q1: What is the core issue in the ongoing Libra probe?

The core issue is a $500,000 Kraken transfer that occurred simultaneously with a meeting between Libra promoters Hayden Davis, Mauricio Novelli, and Argentine President Javier Milei. Investigators are scrutinizing whether this transaction was a deliberate attempt to obscure financial activities and bypass regulatory compliance measures.

Q2: How is President Javier Milei involved in the Libra investigation?

President Milei met with Libra promoters to discuss blockchain technologies. While he initially claimed his social media comments on Libra were private, a court ruling has deemed his actions attributable to his official role, potentially exposing him to legal liability. The timing of the transaction during this high-level meeting is a key point of scrutiny.

Q3: Why is the Kraken transfer significant?

The Kraken transfer is significant because Kraken is a centralized exchange with KYC records, making the transaction traceable. Its timing, coinciding precisely with the Milei meeting, raises suspicions of deliberate coordination to obscure financial activities and potentially evade Anti-Money Laundering (AML) protocols.

Q4: What role does Hayden Davis play in this probe?

Hayden Davis is identified as a key figure in the Libra cryptocurrency project. The $500,000 Kraken transfer is directly tied to him, and investigators believe this transaction could help clarify discrepancies found in earlier testimonies from project stakeholders.

Q5: What are the broader implications of this case for crypto regulation?

This case highlights the challenges in regulating decentralized finance, particularly regarding cross-border digital currency operations and the role of centralized exchanges. It could set precedents for how regulators address similar cases, emphasizing the need for stronger AML/KYC protocols and potentially influencing future international crypto regulatory frameworks.