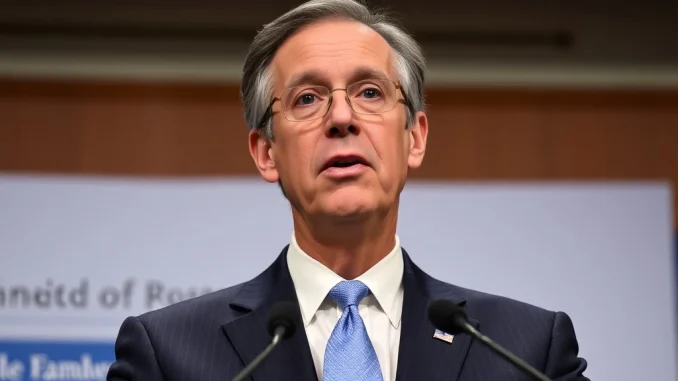

In the fast-paced world of cryptocurrency, every whisper and every silence from global financial leaders can send ripples across the market. So, when Jerome Powell, the powerful Chairman of the U.S. Federal Reserve, steps onto a public stage, the financial world holds its breath. His recent appearance at a banking regulation conference, however, was notable not for what he said about the economy or interest rates, but for what he deliberately avoided: any comments on monetary policy. This strategic silence has its own profound implications, especially for those navigating the often-volatile crypto landscape.

Jerome Powell’s Calculated Approach at the Fed Conference

On a recent Tuesday, the financial community tuned in as U.S. Federal Reserve (Fed) Chairman Jerome Powell opened a significant banking regulation conference. Yet, for all the anticipation, Powell’s remarks were remarkably brief and devoid of the usual market-moving commentary. He meticulously sidestepped any discussion on the Fed’s monetary policy, including the trajectory of interest rates or the broader economic outlook. Furthermore, he skillfully navigated away from addressing any perceived pressure from U.S. President Donald Trump, a common point of contention in previous public appearances.

This deliberate avoidance was not accidental. As noted by financial observer Walter Bloomberg on X (formerly Twitter), Powell’s brevity and focus were largely dictated by a pre-meeting ‘blackout period.’ This is a standard protocol observed by Fed officials to prevent any unintended market signals or insider trading ahead of crucial policy-setting meetings. Instead, Powell redirected the conversation, emphasizing the critical importance of feedback on improving capital rules for large banks. This pivot highlights the Fed’s ongoing commitment to financial stability and the robustness of the banking system, even when direct policy comments are off the table.

Navigating the Significance of Monetary Policy Silence

Why is Jerome Powell’s silence on monetary policy so significant? In an era where every word from central bank chiefs is dissected for clues about future economic direction, a deliberate lack of commentary speaks volumes. Here’s why this matters:

- Preventing Speculation: During blackout periods, any hint about future interest rate hikes, cuts, or quantitative easing/tightening could trigger massive market reactions, potentially leading to instability or unfair trading advantages.

- Maintaining Neutrality: By remaining silent, Powell ensures that market participants focus on the upcoming official announcements, where policy decisions are communicated clearly and comprehensively after thorough deliberation.

- Focus on Core Mandates: His shift to banking regulation underscores another vital aspect of the Fed’s dual mandate: maintaining financial stability. Even without discussing inflation or employment, the Fed is constantly working to ensure the banking system is sound.

For crypto investors, understanding this silence is crucial. While not directly about Bitcoin or Ethereum, the Fed’s overall stance on the economy and its communication strategy profoundly influence investor sentiment and risk appetite. A stable, predictable Fed, even when silent, can contribute to a more predictable macro environment, which in turn can impact digital asset valuations.

The Critical Role of Banking Regulation and Capital Rules

Even though monetary policy was off-limits, Powell chose to focus on a topic of immense importance: banking regulation and the refinement of capital rules for large banks. But what exactly are ‘capital rules,’ and why are they so crucial?

Capital rules dictate the amount of financial reserves banks must hold to absorb potential losses. Think of it as a safety net. The stronger the net, the better equipped banks are to withstand economic shocks, recessions, or unexpected financial crises without needing taxpayer bailouts.

Here’s a quick breakdown of their importance:

- Financial Stability: Adequate capital prevents bank failures from cascading throughout the financial system, protecting depositors and the broader economy.

- Risk Mitigation: Higher capital requirements encourage banks to take fewer excessive risks, knowing they have more skin in the game.

- Market Confidence: A well-regulated banking sector inspires confidence among investors and the public, leading to smoother economic functioning.

Powell’s emphasis on gathering feedback on these rules signals an ongoing effort to fine-tune the regulatory framework post-2008 financial crisis. This iterative process aims to strike a balance: making banks resilient without unduly stifling their ability to lend and support economic growth. For the crypto world, a stable traditional financial system, underpinned by robust banking regulation, can paradoxically create a more predictable environment for digital asset adoption and integration.

Understanding the Fed’s ‘Blackout Period’

The concept of a ‘blackout period’ is central to understanding why Jerome Powell remained so tight-lipped. This is a crucial communication protocol observed by the Federal Reserve and other central banks globally. Here’s what it entails:

The blackout period typically begins about ten days before a scheduled Federal Open Market Committee (FOMC) meeting – the Fed’s primary monetary policy-making body – and lasts until the meeting concludes and its decisions are publicly announced. During this time, Fed officials, including the Chairman, governors, and regional Fed presidents, refrain from making public comments or speeches that could be interpreted as hinting at future policy moves.

The primary reasons for this strict adherence are:

- Level Playing Field: To ensure that no one has an unfair advantage in financial markets due to privileged information. All market participants should receive policy information simultaneously.

- Unified Message: It allows the FOMC to present a clear, unified message on its policy decisions, rather than having various officials offer potentially conflicting or confusing individual interpretations beforehand.

- Deliberation Integrity: It protects the integrity of the internal policy deliberations, allowing committee members to discuss and decide without external pressure or the need to respond to public speculation.

For anyone tracking financial news, recognizing when a blackout period is in effect is vital. It signals a period of heightened sensitivity and caution from central bankers, meaning that any public appearances will be carefully choreographed to avoid policy discussions.

Broader Implications for Financial Markets and Crypto

While Jerome Powell’s remarks were specifically about banking regulation and avoided direct monetary policy signals, his actions still have ripple effects across all financial markets, including the volatile realm of cryptocurrency.

Here’s how Powell’s conference appearance, or lack thereof in terms of policy hints, can indirectly influence the broader financial landscape:

- Uncertainty and Anticipation: The absence of new policy signals can create a vacuum, leading to increased anticipation for the upcoming FOMC meeting. Markets often react to uncertainty, and this can manifest as either sideways trading or increased volatility as investors position themselves for potential shifts.

- Focus on Data: When central bankers are silent, the market’s attention shifts even more intensely to economic data releases (inflation reports, employment figures, GDP growth). These data points become the primary drivers of investor sentiment and expectations regarding future Fed actions.

- Risk Asset Sensitivity: Cryptocurrencies, being higher-risk assets, are particularly sensitive to shifts in macro sentiment. If the market perceives a more hawkish Fed (i.e., higher interest rates) based on economic data, risk assets like crypto can face headwinds. Conversely, signs of a dovish Fed (lower rates) might provide a tailwind.

- Stability Signals: Powell’s focus on robust capital rules for banks, even without policy comments, sends a strong signal about the Fed’s commitment to financial stability. A stable traditional financial system is generally beneficial for the broader economy, which can indirectly support the long-term growth and adoption of digital assets.

In essence, even Powell’s silence is a form of communication. It reinforces the structured and deliberate nature of Fed policy-making, prompting investors to rely on official data and scheduled announcements rather than impromptu remarks.

Conclusion: A Calculated Calm from the Fed

Jerome Powell’s recent appearance at the banking regulation conference served as a powerful reminder of the Federal Reserve’s meticulous approach to communication, especially during sensitive pre-meeting periods. By carefully avoiding any comments on monetary policy or political pressures, Powell adhered to the established blackout protocols, ensuring that market expectations are not prematurely swayed. His singular focus on the vital role of banking regulation and the continuous improvement of capital rules underscores the Fed’s unwavering commitment to maintaining a robust and stable financial system.

For investors, particularly those in the dynamic cryptocurrency markets, this episode highlights a crucial lesson: while every word from the Fed is scrutinized, sometimes the most significant message lies in what is left unsaid. It signals a period where attention should pivot from speculative commentary to fundamental economic data and official policy announcements, reinforcing the need for a data-driven, patient approach to investment decisions in an ever-evolving financial landscape.

Frequently Asked Questions (FAQs)

Q1: Why did Jerome Powell avoid policy comments at the conference?

A1: Jerome Powell avoided policy comments primarily due to the Fed’s pre-meeting ‘blackout period.’ This protocol prevents Fed officials from making public statements that could influence markets or reveal policy intentions ahead of official Federal Open Market Committee (FOMC) meetings.

Q2: What is the Fed’s ‘blackout period’?

A2: The Fed’s blackout period is a time, typically starting ten days before an FOMC meeting, during which Fed officials refrain from public comments on monetary policy. Its purpose is to ensure a level playing field for all market participants and to allow the FOMC to deliver a unified message on policy decisions.

Q3: What are ‘capital rules for large banks’ that Powell emphasized?

A3: Capital rules are regulations that dictate the minimum amount of financial reserves (capital) that banks must hold. These reserves act as a buffer against potential losses, enhancing the bank’s stability and protecting depositors and the broader financial system from crises.

Q4: How does the Fed’s stance, even when silent, impact the crypto market?

A4: While not directly addressing crypto, the Fed’s actions and communication strategy significantly influence the broader financial markets and investor sentiment. A focus on financial stability (like robust banking regulation) can indirectly create a more predictable economic environment, which often benefits risk assets like cryptocurrencies in the long term. The absence of policy hints also shifts focus to economic data, which then drives market expectations for interest rates, affecting crypto valuations.

Q5: Who is Walter Bloomberg, and why is his reporting significant?

A5: Walter Bloomberg is a prominent financial news aggregator and commentator known for quickly disseminating real-time financial news and market updates, often through social media platforms like X (formerly Twitter). His reports are significant because they often provide timely insights into market-moving events and official statements, making him a widely followed source for financial professionals and investors.