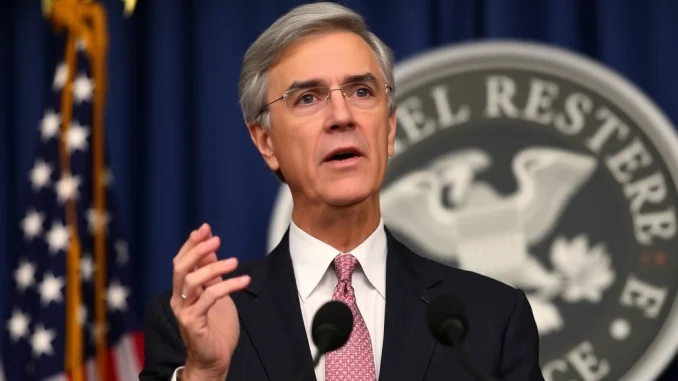

Federal Reserve Chair Jerome Powell has sent ripples through financial markets by hinting at potential Fed rate cuts if economic conditions worsen. For crypto investors, this could mean a pivotal shift in market dynamics. Here’s what you need to know.

Why Jerome Powell’s Statement Matters for the U.S. Economy

Powell emphasized that current interest rates are restrictive enough to allow for future cuts if necessary. This comes as the Fed balances two key priorities:

- Preventing runaway inflation

- Supporting employment growth

How Fed Rate Cuts Could Impact Crypto Markets

Historically, lower interest rates have correlated with:

| Market | Typical Reaction |

|---|---|

| Bitcoin | Increased investment as alternative asset |

| Traditional Markets | Initial volatility followed by stabilization |

The Inflation-Labor Market Tightrope

Powell identified two triggers that could prompt Fed action:

- Sustained weakness in labor market data

- Inflation stabilizing at or below target levels

What This Means for Your Crypto Portfolio

While Powell stressed patience, savvy investors should:

- Monitor Fed meeting minutes closely

- Watch for shifts in institutional crypto investment patterns

- Consider dollar-cost averaging during potential volatility

The Fed’s willingness to adjust rates demonstrates their commitment to economic stability. For crypto markets, this could present both challenges and opportunities in the coming months.

Frequently Asked Questions

When might the Fed implement rate cuts?

Powell didn’t specify a timeline but suggested cuts would depend on economic data, particularly regarding inflation and employment.

How do rate cuts typically affect Bitcoin?

Lower rates often weaken the dollar, making Bitcoin and other cryptocurrencies more attractive as alternative investments.

What inflation level would trigger Fed action?

The Fed targets 2% inflation. Sustained readings at or below this level might prompt rate adjustments.

Should crypto investors be worried about Powell’s comments?

Not necessarily. While rate changes create volatility, they may also increase institutional interest in crypto as an inflation hedge.