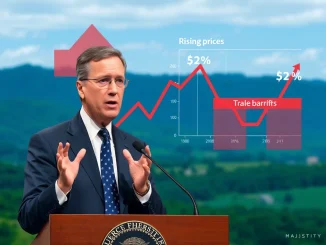

Could rising inflation reshape the crypto landscape? Atlanta Fed President Raphael Bostic recently warned of prolonged elevated inflation, sending ripples through financial markets. While he ruled out sharp price spikes, his cautious stance on monetary policy changes creates an intriguing backdrop for cryptocurrency investors navigating economic uncertainty.

Fed Inflation Outlook: What Bostic Really Said

In his latest remarks, Raphael Bostic made several key points about the U.S. economic situation:

- Inflation will likely remain above the Fed’s 2% target for some time

- Price increases won’t be dramatic spikes but persistent elevation

- The current monetary policy stance remains appropriate

- Economic uncertainty makes policy changes premature

Monetary Policy Stance: Why the Fed Isn’t Budging

Bostic emphasized the Federal Reserve’s cautious approach, highlighting three main reasons for maintaining current policies:

| Factor | Impact |

|---|---|

| Labor market conditions | Still showing strength despite inflation |

| Economic growth | Moderating but not collapsing |

| Financial stability | Markets adjusting to higher rates |

Crypto Markets React to Economic Uncertainty

The intersection of Fed policy and cryptocurrency markets creates fascinating dynamics:

- Bitcoin often behaves as an inflation hedge during periods of monetary uncertainty

- Stablecoin demand may increase if traditional banking faces pressure

- Altcoins could see volatility as investors assess risk appetite

Actionable Insights for Crypto Investors

Given Bostic’s inflation warning and policy outlook, crypto traders should consider:

- Diversifying across asset classes to manage risk

- Monitoring Fed speeches for policy clues

- Assessing inflation-protected crypto strategies

The Fed’s cautious approach to inflation creates both challenges and opportunities for crypto markets. While Bostic sees no immediate policy shift, his warning about persistent price pressures suggests investors should prepare for continued volatility. The coming months will test whether cryptocurrencies can maintain their appeal as alternative assets during prolonged economic uncertainty.

Frequently Asked Questions

How does Fed policy affect cryptocurrency prices?

Fed policy influences investor risk appetite and dollar strength, which indirectly impacts crypto valuations. Tighter policy typically strengthens the dollar and reduces risk appetite, while looser policy has the opposite effect.

Why is Raphael Bostic important for crypto investors?

As a voting member of the Federal Open Market Committee, Bostic’s views provide insight into potential Fed actions that could affect market liquidity and risk sentiment.

Can cryptocurrencies hedge against inflation?

Some investors view Bitcoin as a potential inflation hedge due to its fixed supply, though this relationship hasn’t been consistently proven during recent inflationary periods.

What crypto sectors benefit from economic uncertainty?

Decentralized finance (DeFi) platforms, privacy coins, and stablecoins often see increased interest during periods of economic instability as investors seek alternatives to traditional systems.