NEW YORK, January 22, 2025 – The nascent U.S. spot Ethereum ETF market confronts mounting pressure as investment products hemorrhage hundreds of millions for a second consecutive session. According to definitive data from TraderT, these funds recorded total net outflows of $238.55 million on January 21, signaling a potential shift in institutional and retail sentiment toward the world’s second-largest cryptocurrency. This substantial movement follows a similar pattern of withdrawals from the previous trading day, raising critical questions about near-term demand for regulated Ethereum exposure.

Ethereum ETF Outflows: A Detailed Breakdown

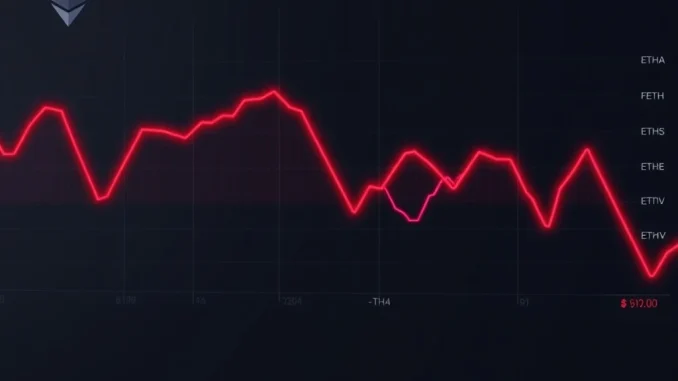

TraderT’s granular data reveals a stark disparity in performance among the various fund issuers. BlackRock’s iShares Ethereum Trust (ETHA) dominated the outflow activity, experiencing a substantial withdrawal of $283.46 million. Consequently, this single fund accounted for the majority of the day’s total negative movement. Following ETHA, Fidelity’s Ethereum Fund (FETH) saw outflows of $30.89 million, while Grayscale’s Ethereum Trust (ETHE) and VanEck’s Ethereum Trust (ETHV) recorded more modest exits of $11.38 million and $4.42 million, respectively. However, Grayscale’s Mini Ethereum Trust emerged as the sole bright spot, attracting a net inflow of $10.01 million. This divergence suggests investors may be rotating between fund structures or fee profiles rather than exiting the asset class entirely.

Contextualizing the Cryptocurrency ETF Landscape

The performance of spot Ethereum ETFs exists within a broader and more established ecosystem of digital asset investment vehicles. For instance, the U.S. Bitcoin spot ETF market, which launched nearly a year prior, has demonstrated both periods of massive inflows and sustained outflows, often correlating with Bitcoin’s price volatility and macroeconomic conditions. Furthermore, the global regulatory environment for cryptocurrency ETFs remains fragmented, with jurisdictions like Canada and Europe offering their own products. Analysts frequently compare early Ethereum ETF flows to the initial trajectory of Bitcoin ETFs, which also experienced volatility before achieving more consistent growth. This historical precedent provides crucial context for interpreting current Ethereum fund movements.

Expert Analysis on Market Sentiment and Mechanics

Market structure experts point to several plausible drivers behind the consecutive outflow days. Primarily, profit-taking following Ethereum’s significant price appreciation in late 2024 could be a key factor. Additionally, some investors might be reallocating capital ahead of anticipated Federal Reserve policy announcements or in response to broader equity market corrections. The mechanics of the ETF creation/redemption process also play a role; authorized participants redeem shares for the underlying ETH when selling pressure outweighs buying interest, directly leading to the reported outflows. This process, while mechanically neutral, provides a transparent window into real-time investor demand.

The Impact of Fees and Fund Structures

A critical element influencing investor choice is the fee structure of each Ethereum ETF. Grayscale’s Mini Ethereum Trust, which attracted inflows, typically carries a lower management fee compared to its larger, legacy ETHE trust. This highlights a competitive dynamic where cost efficiency can drive capital movement even during broader market uncertainty. The table below summarizes the key data from January 21:

| Fund Name (Ticker) | Issuer | Net Flow (USD) | Flow Direction |

|---|---|---|---|

| iShares Ethereum Trust (ETHA) | BlackRock | -$283.46M | Outflow |

| Fidelity Ethereum Fund (FETH) | Fidelity | -$30.89M | Outflow |

| Grayscale Ethereum Trust (ETHE) | Grayscale | -$11.38M | Outflow |

| VanEck Ethereum Trust (ETHV) | VanEck | -$4.42M | Outflow |

| Grayscale Mini Ethereum Trust | Grayscale | +$10.01M | Inflow |

This data underscores several important trends for market observers:

- Market Leader Pressure: BlackRock’s ETHA, as the largest fund by assets, naturally sees the largest absolute flows, both in and out.

- Fee Sensitivity: The inflow into Grayscale’s lower-fee Mini Trust suggests a segment of investors is highly cost-conscious.

- Concentrated Movement: The outflow was not evenly distributed, indicating specific investor strategies rather than a blanket sell-off.

Historical Precedent and Future Trajectory

Early-stage volatility is a common feature for new financial products, especially in the cryptocurrency domain. The Bitcoin ETF market endured similar periods of outflows before establishing a longer-term growth trend. Key factors that will influence the future trajectory of Ethereum ETF flows include:

- Ethereum Network Upgrades: Successful implementation of technical improvements can bolster investor confidence.

- Regulatory Clarity: Clear guidelines from the SEC and other global regulators reduce uncertainty.

- Macroeconomic Conditions: Interest rate decisions and inflation data heavily impact risk asset appetite.

- Institutional Adoption: Increased use of Ethereum for decentralized finance (DeFi) and other applications strengthens its fundamental case.

Conclusion

The $238.5 million in net outflows from U.S. spot Ethereum ETFs for a second straight day presents a significant data point for the digital asset investment landscape. While the movement, led by BlackRock’s ETHA, indicates short-term selling pressure, the simultaneous inflow into a lower-cost fund reveals a nuanced market. Ultimately, the performance of these Ethereum ETF products will serve as a critical barometer for institutional and sophisticated retail sentiment toward Ethereum. As the market matures, observing flow patterns, fee competition, and external catalysts will be essential for understanding the evolving role of regulated cryptocurrency exposure in traditional portfolios.

FAQs

Q1: What does “net outflow” mean for an Ethereum ETF?

A1: A net outflow occurs when the dollar value of shares redeemed (sold) by investors exceeds the value of shares created (bought). This requires the fund issuer to sell some of the underlying Ethereum holdings, directly reflecting more selling than buying pressure in the market for that ETF.

Q2: Why did only Grayscale’s Mini Ethereum Trust see inflows?

A2: Grayscale’s Mini Trust typically has a lower management fee than its larger Ethereum Trust (ETHE) and some competitor funds. Investors may be rotating into the lower-cost option to maintain Ethereum exposure while reducing ongoing expenses, a common strategy during uncertain market periods.

Q3: Are these outflows causing the price of Ethereum to drop?

A3: There is a correlation, but causation is complex. ETF outflows require the sale of ETH, which can add selling pressure to the market. However, Ethereum’s price is influenced by many global factors, including trading on unregulated exchanges, derivatives markets, macroeconomic news, and broader cryptocurrency sentiment.

Q4: How does this compare to the early days of Bitcoin spot ETFs?

A4: Similar patterns of volatility and occasional multi-day outflow streaks were observed in the first several months of Bitcoin ETF trading. This is considered a normal part of a new financial product finding its equilibrium as market makers, arbitrageurs, and long-term investors establish positions.

Q5: Where does the outflow data come from, and how reliable is it?

A5: The data is sourced from TraderT, a firm that aggregates and publishes daily flow information directly from fund issuers and exchange data. This information is considered highly reliable as it is based on official creation/redemption activity reported by the ETFs themselves to meet regulatory transparency requirements.