ETH/BTC Ratio Reveals Stunning Early Signs of Major 2025 Market Shift

The cryptocurrency market is witnessing a potentially significant development in early 2025 as the ETH/BTC ratio displays compelling technical signals that could indicate a major market shift. According to recent analysis, this critical metric measuring Ethereum’s performance against Bitcoin reached a notable low in April 2025 before beginning a recovery phase that mirrors historical patterns from previous market cycles. This development comes amid substantial growth in Ethereum’s fundamental metrics, including stablecoin adoption and decentralized finance activity, suggesting a possible resurgence for the second-largest cryptocurrency by market capitalization.

ETH/BTC Ratio Technical Analysis Reveals Historical Patterns

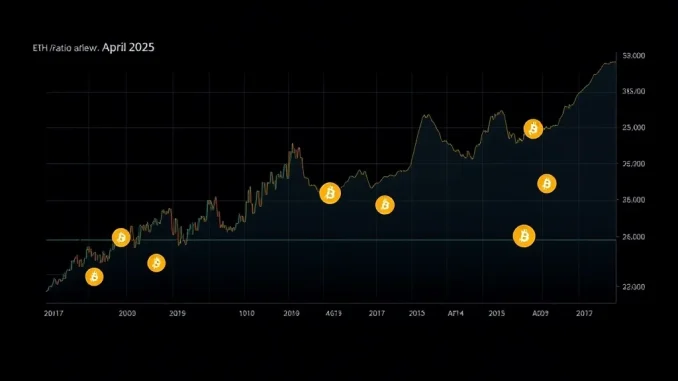

Technical analysts are closely monitoring the ETH/BTC ratio, which serves as a crucial indicator of relative strength between the two leading cryptocurrencies. Prominent analyst Michaël van de Poppe recently highlighted that the ratio reached a significant low around 0.017 in April 2025, marking what could be a pivotal turning point. Following this low, the ratio demonstrated substantial recovery, climbing to 0.043 by August 2025 before experiencing a modest correction to 0.034 in October. This pattern bears striking resemblance to the 2019 market cycle, where similar technical developments preceded a substantial Ethereum rally against Bitcoin.

The technical landscape reveals several key developments since spring 2025. First, the ratio successfully broke above the 365-day moving average, a major technical threshold that often signals trend reversals. Second, the correction in October 2025, while noticeable, did not return to the April lows, suggesting underlying strength in the recovery structure. Third, market sentiment appears to be shifting, with van de Poppe noting that contrarian indicators often emerge when assets are declared “dead” by mainstream narratives. These technical elements collectively suggest the ETH/BTC ratio may have established a durable foundation for continued recovery.

Comparative Analysis with Historical Cycles

Historical data provides valuable context for understanding current market developments. During the 2019 cycle, the ETH/BTC ratio experienced a similar pattern of establishing a low point followed by substantial recovery. The ratio increased from approximately 0.017 to 0.043 before undergoing a healthy correction. This historical precedent offers analysts a framework for evaluating current market behavior. However, market conditions in 2025 differ significantly from 2019, with substantially larger market capitalizations, increased institutional participation, and more sophisticated financial infrastructure supporting both cryptocurrencies.

Fundamental Growth Supports Ethereum’s Recovery Thesis

Beyond technical indicators, Ethereum demonstrates robust fundamental growth that could support a sustained recovery against Bitcoin. The stablecoin ecosystem on Ethereum has experienced remarkable expansion throughout 2025, with total supply increasing by more than 65% year-to-date. According to DefiLlama data, the market capitalization of stablecoins on Ethereum now exceeds $163.9 billion, doubling the previous peak recorded in 2021. This growth reflects Ethereum’s strengthening position as the primary infrastructure for digital payments and decentralized finance applications.

Transaction volume data further reinforces Ethereum’s fundamental strength. Token Terminal reports indicate that stablecoin transfer volume on Ethereum reached $8 trillion during the fourth quarter of 2024 alone. This substantial activity demonstrates real-world utility and adoption beyond speculative trading. Additionally, the tokenized real-world assets (RWA) sector continues to expand, utilizing Ethereum’s blockchain to digitize traditional assets like real estate and bonds. These developments create a solid foundation for potential market performance improvements.

Developer Activity and Network Innovation

Sustained developer activity represents another crucial fundamental metric supporting Ethereum’s potential recovery. The network maintains one of the largest and most active developer communities in the cryptocurrency space, consistently implementing upgrades and improvements. This ongoing innovation addresses scalability challenges and enhances network functionality. Historical patterns suggest that strong developer activity often correlates with future adoption and value appreciation, as technological improvements create new use cases and improve user experience.

Market Context and Current Conditions

The cryptocurrency market in early 2025 operates within a complex global economic environment characterized by evolving regulatory frameworks and increasing institutional adoption. Bitcoin continues to dominate market attention, particularly following the approval and implementation of spot Bitcoin exchange-traded funds in major jurisdictions. However, Ethereum’s ecosystem demonstrates unique strengths in decentralized finance, non-fungible tokens, and enterprise blockchain applications. These differentiated use cases could drive independent performance relative to Bitcoin as market maturity increases.

Several factors contribute to the current market environment. First, institutional interest in cryptocurrency continues to grow, though with varying emphasis between Bitcoin and Ethereum. Second, regulatory clarity remains an evolving landscape, with different jurisdictions taking distinct approaches to cryptocurrency classification and oversight. Third, technological advancements in both Bitcoin’s layer-2 solutions and Ethereum’s ongoing upgrades create competitive dynamics that could influence relative performance. These factors collectively create a complex backdrop for evaluating the ETH/BTC ratio’s potential trajectory.

Analyst Perspectives and Market Sentiment

Market analysts offer diverse perspectives on the ETH/BTC ratio’s significance. Some emphasize technical patterns and historical precedents, while others focus on fundamental metrics and adoption trends. The consensus acknowledges that the ratio represents more than just price comparison—it reflects shifting capital allocation, changing investor preferences, and evolving perceptions of relative value between the two leading cryptocurrencies. Current sentiment appears cautiously optimistic regarding Ethereum’s prospects, though analysts emphasize the importance of monitoring multiple indicators rather than relying on single metrics.

Potential Implications for Investors and Traders

The ETH/BTC ratio’s behavior carries significant implications for market participants. For long-term investors, sustained improvement in the ratio could signal changing dynamics in the cryptocurrency hierarchy. For active traders, ratio movements create opportunities for relative value strategies and pairs trading approaches. However, market participants should consider several important factors. First, cryptocurrency markets remain highly volatile, with rapid price movements in both directions. Second, correlation between major cryptocurrencies can change unexpectedly during market stress events. Third, regulatory developments could disproportionately impact specific assets or sectors within the cryptocurrency ecosystem.

Risk management considerations remain paramount when evaluating ratio-based strategies. Historical data demonstrates that while patterns may resemble previous cycles, outcomes are never guaranteed. Diversification across assets, careful position sizing, and ongoing monitoring of both technical and fundamental developments represent prudent approaches. Additionally, investors should consider their specific time horizons and risk tolerance when making allocation decisions based on ratio analysis.

Conclusion

The ETH/BTC ratio displays compelling early signs of a potential market shift in 2025, combining technical patterns reminiscent of historical cycles with robust fundamental growth in Ethereum’s ecosystem. While the ratio’s recovery from April 2025 lows suggests changing dynamics between the two leading cryptocurrencies, market participants should monitor multiple indicators and maintain realistic expectations about potential outcomes. The coming months will provide additional data points to evaluate whether current developments represent a temporary fluctuation or the beginning of a more substantial trend. Regardless of short-term movements, both Ethereum and Bitcoin continue to demonstrate innovation and adoption that strengthens the broader cryptocurrency ecosystem.

FAQs

Q1: What is the ETH/BTC ratio and why is it important?

The ETH/BTC ratio measures Ethereum’s price relative to Bitcoin’s price. It serves as a key indicator of relative strength between the two largest cryptocurrencies and can signal shifting market dynamics, capital flows, and changing investor preferences within the digital asset space.

Q2: What technical signals suggest a potential market shift in 2025?

Several technical developments indicate potential change, including the ratio reaching a low in April 2025 followed by recovery, breaking above the 365-day moving average, and demonstrating resilience during market corrections without returning to previous lows. These patterns resemble historical cycles that preceded Ethereum outperformance.

Q3: How do fundamental metrics support Ethereum’s potential recovery?

Ethereum demonstrates strong fundamental growth, including a 65% increase in stablecoin supply during 2025, $8 trillion in quarterly stablecoin transfer volume, expanding tokenized real-world asset applications, and sustained developer activity. These metrics suggest underlying ecosystem strength beyond price movements.

Q4: How does the current situation compare to historical market cycles?

The current technical pattern shows similarities to the 2019 cycle, where the ETH/BTC ratio established a low before substantial recovery. However, market conditions differ significantly in terms of scale, institutional participation, regulatory environment, and technological maturity, making direct comparisons challenging.

Q5: What should investors consider when evaluating the ETH/BTC ratio?

Investors should consider multiple factors including technical patterns, fundamental metrics, market sentiment, regulatory developments, and their own investment time horizons and risk tolerance. Ratio analysis provides valuable insights but should complement rather than replace comprehensive market evaluation and risk management practices.

Related News

- RESOLV Cryptocurrency Reaches $0.07787 as Analysts Spot Crucial Bullish Pattern in Emerging Altcoin

- Upbit Issues Urgent Alert: AVAX Deposit and Withdrawal Suspension on July 19

- Binance Alpha Unveils STBL: Pioneering New Horizons in On-Chain Trading

Related: Pumpfun Whale Dumps 3.37B PUMP in Stunning $7.23M Exit – On-Chain Data Reveals All

Related: IoTeX Bridge Exploit: Devastating $8M Private Key Compromise Shakes Crypto Security

Related: Bitcoin vs. Gold: Historic Lows in 14-Month Bear Market Signal Potential Turning Point