DIN Cryptocurrency Reclaims Crucial $0.0125 Resistance: Analysts Assess Market Trajectory

Global, May 2025: The DIN cryptocurrency has successfully reclaimed the $0.0125 price level, a technical threshold market analysts have monitored closely for weeks. This movement has sparked renewed discussion among traders and analysts regarding the asset’s near-term trajectory and the underlying factors, including its fundamental technology and association with artificial intelligence (AI) development, driving current attention.

DIN Cryptocurrency Reclaims a Key Technical Level

In cryptocurrency markets, specific price points often act as significant psychological and technical barriers. The $0.0125 level for DIN had previously served as both support and resistance at different times throughout 2024 and early 2025. A successful reclaim, where the price consolidates above this level after a period below it, is typically viewed by technical analysts as a potential shift in market structure. This move suggests increased buying pressure has overcome the selling interest that previously clustered around that price. Market data from several exchanges confirms DIN has sustained trading above $0.0125 for multiple consecutive sessions, indicating a consolidation phase may be underway. Analysts note that the next critical levels to watch are often historical points where previous price volatility occurred, which can be identified by reviewing the asset’s full trading history.

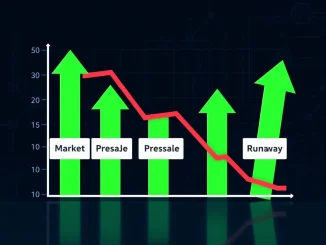

Analyzing the Potential for Significant Price Appreciation

Following the breach of a major resistance level, market commentators frequently project potential price targets. Some analysts have referenced a technical analysis model that suggests a possible 400% appreciation from the reclaimed base. It is crucial to understand that such projections are probabilistic models based on historical chart patterns and are not guarantees of future performance. These models often measure the distance of a prior price range and project that distance upward from a breakout point. The inherent volatility of cryptocurrency markets means outcomes can deviate substantially from any single model. Investors typically cross-reference these technical signals with on-chain data, such as wallet activity and network utilization, to form a more complete picture. The current interest appears partially driven by traders seeking assets with high volatility potential, a common characteristic of smaller-market-cap tokens like DIN.

The Role of Fundamentals and the AI Narrative

Beyond chart patterns, analysts point to DIN’s stated fundamentals and thematic positioning as contributors to its market attention. The project’s whitepaper and development updates emphasize integrations within decentralized AI and machine learning ecosystems. This aligns with a broader sector-wide trend where assets associated with AI and decentralized computation have experienced notable investor interest. The “AI narrative” in crypto refers to projects building infrastructure for AI model training, data marketplaces, or AI-powered decentralized applications. Market observers note that narratives can drive short-to-medium-term sentiment, but long-term viability depends on tangible product development, user adoption, and network security. For DIN, sustained developer activity, partnership announcements, and measurable growth in its core protocol metrics would be factors analysts monitor to assess whether the fundamental story supports the technical price action.

Understanding Cryptocurrency Resistance Levels and Breakouts

For newer market participants, the concept of resistance is foundational to technical analysis. A resistance level is a price point where an asset has historically struggled to rise above due to a concentration of sell orders. A breakout occurs when the price moves above this level with significant volume, suggesting a shift in supply and demand dynamics.

- Confirmation: A breakout is considered more valid if the price closes above resistance for multiple periods and if trading volume is higher than average.

- Retest: It is common for the price to dip back to the former resistance level, which then may act as new support, offering a secondary confirmation of the breakout.

- False Breakout: Sometimes price briefly spikes above resistance only to fall back below, trapping buyers; this is why analysts await confirmation.

The process of reclaiming a level, as seen with DIN at $0.0125, often involves this retest phase, adding to the level’s technical significance on future charts.

Market Context and Comparative Asset Performance

The movement in DIN occurs within a specific context of the broader digital asset market. While major assets like Bitcoin and Ethereum often set the overall trend, smaller-capacity tokens can experience independent rallies based on project-specific news or sector rotations. The AI and decentralized compute sector has seen variable performance, with some projects achieving significant milestones while others have faded. This underscores the importance of differentiated research. Comparing DIN’s volume profile, developer commits, and community growth metrics against similar projects in its niche provides a relative strength analysis. Furthermore, general market liquidity conditions, regulatory news, and macroeconomic factors like interest rate policies invariably impact trader appetite for risk assets, including cryptocurrencies of all sizes.

Conclusion: A Notable Technical Event Warrants Cautious Analysis

The DIN cryptocurrency’s reclaim of the $0.0125 resistance level marks a notable technical event that has captured analyst and trader attention. While technical models project scenarios of substantial appreciation, these are inherently speculative and must be balanced against the project’s ongoing fundamental progress and the volatile nature of the asset class. The confluence of a technical breakout with the persistent market interest in AI-related blockchain projects forms the core of the current discussion around DIN. As always, informed participation in cryptocurrency markets requires a disciplined approach that considers technical signals, fundamental research, and prudent risk management.

FAQs

Q1: What does it mean for a cryptocurrency to “reclaim” a resistance level?

A reclaim occurs when an asset’s price moves back above a previously identified resistance level and holds there, suggesting the prior selling pressure at that price has been absorbed and the level may now become support.

Q2: How do analysts arrive at a figure like a “400% surge” projection?

Such projections are often derived from technical analysis patterns, like measuring the height of a prior consolidation range and extrapolating it upward from a breakout point. They are hypothetical price targets, not forecasts.

Q3: What is the “AI narrative” in cryptocurrency?

It refers to significant market interest and investment flowing into blockchain projects that are building infrastructure for or integrating with artificial intelligence, such as decentralized data storage for AI training, AI-powered dApps, or compute marketplaces.

Q4: Is a breakout above resistance always a reliable buy signal?

No. Breakouts require confirmation through sustained price action above the level and supporting volume. False breakouts are common, so traders often wait for a successful retest of the new support level before considering a position.

Q5: What should investors research beyond the price chart for a token like DIN?

Key areas include the project’s whitepaper, active development progress (GitHub commits), real-world use cases and partnerships, tokenomics (supply distribution), the competency of the team, and activity within its decentralized community.

Related: Bitcoin Neo-Bank Breakthrough: Core's SatPay Aims to Redefine BTC Financial Infrastructure

Related: UK FCA Stablecoins: Regulator Reveals Four Firms for Critical Sandbox Testing Before 2027 Rules

Related: $SHOLA Token Launch: Shola's Strategic Collaboration with Pump.fun on Solana