Crypto Market Crash Analysis: How DeepSnitch AI, Lighter, and Hyperliquid Signal Potential Recovery Amid Volatility

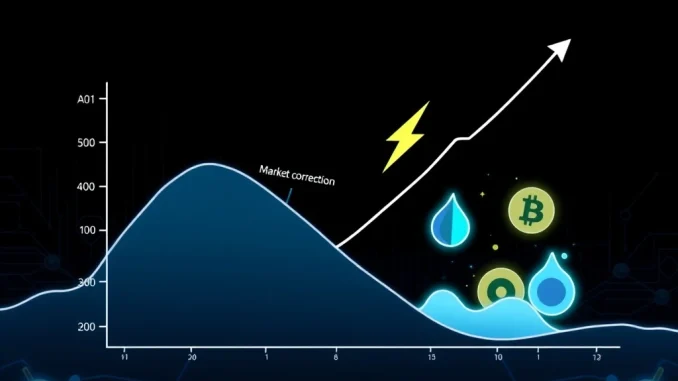

Global, March 2025: The cryptocurrency market experienced significant downward pressure this week, with major digital assets declining between 15-30% across various exchanges. This correction follows a period of sustained growth and has prompted renewed discussions about market cycles, volatility, and long-term viability. While headlines question the sector’s health, analysis of underlying blockchain activity and specific project developments reveals a more nuanced picture. Emerging platforms like DeepSnitch AI, alongside infrastructure projects Lighter and Hyperliquid, continue to attract developer attention and capital, suggesting the market’s narrative extends beyond simple price action.

Crypto Market Crash: Context and Historical Precedence

Market corrections are not uncommon in the cryptocurrency space. Historical data from CoinMarketCap and other aggregators shows that drawdowns of 20% or more have occurred multiple times within broader bull market trends. The current decline appears correlated with macroeconomic factors, including shifting interest rate expectations and profit-taking after a strong quarterly performance. On-chain analytics firm Glassnode reports that, despite price drops, fundamental network metrics for Bitcoin and Ethereum, such as hash rate and active addresses, remain robust. This divergence between price and usage is a critical detail often missed in sensational headlines.

The volatility underscores the market’s maturation phase. Unlike the 2018 crash driven by initial coin offering (ICO) failures or the 2022 downturn linked to centralized lender collapses, current pressures seem more technical and macro-driven. Regulatory clarity in several jurisdictions has improved, and institutional custody solutions are more widespread. These factors contribute to a different underlying structure, even if short-term price movements evoke familiar anxiety among traders.

DeepSnitch AI: Analyzing the 300x ROI Narrative

Amid the market-wide sell-off, discussion has intensified around DeepSnitch AI, a project claiming to leverage artificial intelligence for on-chain analytics and trade execution. The platform’s whitepaper describes a system designed to detect smart contract vulnerabilities and anomalous transaction patterns in real-time. The “300x ROI” figure circulating in community forums appears extrapolated from hypothetical backtesting scenarios presented in early technical documentation, not from realized returns.

It is crucial to distinguish between marketing claims and technological substance. DeepSnitch AI represents a growing trend of integrating AI with blockchain data. Similar projects have sought to use machine learning for purposes like:

- Predictive modeling of liquidity flows

- Automated audit of DeFi protocol code

- Sentiment analysis of social media and news

The genuine opportunity lies in whether such technology can solve persistent problems like security exploits and market manipulation. Its long-term value will depend on adoption by developers and protocols, not speculative trading multiples. Investors should scrutinize the team’s credentials, code repository activity, and partnership announcements for verification.

Infrastructure Focus: Lighter and Hyperliquid’s Role

Parallel to application-layer projects like DeepSnitch, infrastructure developments continue. Lighter markets itself as a low-latency order book protocol for decentralized exchanges (DEXs), aiming to rival the speed of centralized platforms. Hyperliquid is a specialized layer-1 blockchain focused exclusively on perpetual futures trading. Both projects target a specific, high-demand niche: improving the performance and user experience of decentralized trading.

Their development progress during a market downturn is significant. Bear markets historically serve as building periods where focus shifts from speculation to fundamental improvement. The commitment to advancing core infrastructure—throughput, latency, and financial instrument variety—addresses genuine bottlenecks that have limited DeFi’s scalability. Progress in these areas could lay the groundwork for more efficient markets in the next growth cycle, benefiting the entire ecosystem.

Market Psychology and the “Is Crypto Dead?” Question

The recurring “Is crypto dead?” narrative is a feature of the asset class’s volatility and its disruptive potential. Each major downturn resurrects the question, yet the technology and its applications have consistently evolved through previous cycles. The current landscape includes:

| Metric | Status (March 2025) | Context |

|---|---|---|

| Total Value Locked (DeFi) | Down ~20% from peak | Still 3x higher than 2023 lows |

| Developer Activity | Consistent weekly commits | Major ecosystems like Ethereum, Solana show steady growth |

| Institutional Products | New ETF filings pending | Regulated access points expanding globally |

This data suggests contraction, not collapse. The market is experiencing a recalibration where weaker projects may fail, but those with solid technology, clear use cases, and sustainable tokenomics are likely to persist. This process is healthy for long-term ecosystem development, even if it creates short-term portfolio pain.

Conclusion: Volatility Versus Innovation

The recent cryptocurrency market crash presents a complex picture of short-term disappointment and ongoing innovation. While top-cap assets face selling pressure, the continued development of projects like DeepSnitch AI, Lighter, and Hyperliquid indicates that builder activity persists beneath market sentiment. The core question is not whether cryptocurrency is dead, but how the technology is evolving through market cycles. The current phase appears to be separating speculative excess from genuine technological advancement, focusing on scalable infrastructure and novel applications like AI integration. For informed participants, this environment demands analysis of fundamentals, not just price charts.

FAQs

Q1: What caused the latest crypto market crash?

The decline appears driven by a combination of macroeconomic factors, including revised interest rate expectations, and technical market dynamics like profit-taking after a sustained rally. It reflects a typical correction within a volatile asset class.

Q2: Is the “300x ROI” claim from DeepSnitch AI realistic?

Such high-return claims are almost always based on hypothetical models or extreme best-case scenarios, not guaranteed outcomes. Investors should focus on the project’s underlying technology, team, and real-world adoption potential rather than promotional multipliers.

Q3: How do projects like Lighter and Hyperliquid differ from regular cryptocurrencies?

They are infrastructure protocols. Lighter focuses on building a high-performance trading engine for DEXs, while Hyperliquid is a blockchain designed for perpetual futures. Their value is tied to their utility as platforms for other applications, not just as speculative assets.

Q4: Do market crashes mean blockchain technology is failing?

No. Price volatility is distinct from technological progress. Developer activity, code commits, and protocol upgrades often continue during downturns. Many foundational aspects of today’s blockchain ecosystem were built during previous bear markets.

Q5: What should investors monitor during this volatile period?

Key metrics include on-chain fundamentals (transaction counts, active addresses), developer activity on GitHub, updates to project roadmaps, and changes in Total Value Locked in DeFi protocols. These provide a clearer picture of ecosystem health than price alone.

Related: Bitcoin Neo-Bank Breakthrough: Core's SatPay Aims to Redefine BTC Financial Infrastructure

Related: UK FCA Stablecoins: Regulator Reveals Four Firms for Critical Sandbox Testing Before 2027 Rules

Related: $SHOLA Token Launch: Shola's Strategic Collaboration with Pump.fun on Solana