Coinbase’s Groundbreaking Move: Launching Regulated Predictive Markets via Kalshi Across America

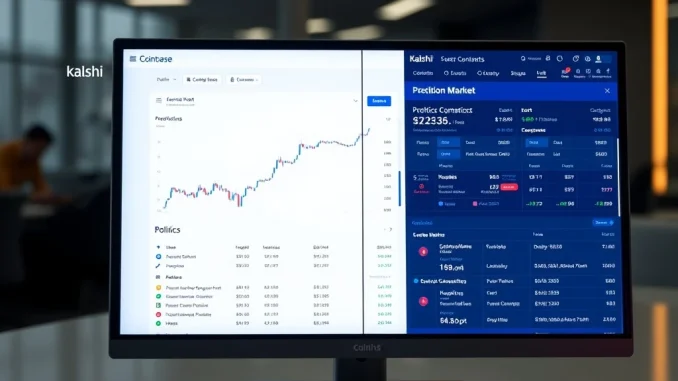

San Francisco, January 2026: In a strategic expansion that blurs traditional financial boundaries, cryptocurrency exchange giant Coinbase has officially launched regulated predictive markets throughout the United States. Through a partnership with CFTC-approved platform Kalshi, Coinbase now enables users across all 50 states to place legal bets on real-world events—from political elections to economic indicators—directly within its interface. This move represents a significant evolution for the exchange, positioning it as a comprehensive financial platform far beyond simple crypto trading.

Coinbase’s Strategic Expansion into Predictive Markets

The integration of Kalshi’s predictive markets into Coinbase’s platform marks a calculated diversification for the publicly traded exchange. Unlike unregulated crypto prediction platforms, this offering operates under the regulatory oversight of the Commodity Futures Trading Commission (CFTC), providing legal legitimacy that has historically been a barrier in the United States. Users can access these markets with deposits in U.S. dollars or the stablecoin USDC, with a remarkably low minimum bet of just $1. This accessibility threshold represents a deliberate strategy to democratize participation in prediction markets, traditionally dominated by institutional players or limited to offshore platforms.

The technical integration appears seamless within Coinbase’s existing user interface. Account holders can navigate to the new markets section without additional verification hurdles, leveraging their existing balances and security protocols. This frictionless access contrasts sharply with standalone prediction platforms that require separate accounts and compliance checks. For now, Kalshi remains the exclusive provider of these contracts through Coinbase, though company statements suggest potential future partnerships with additional regulated prediction market operators as the ecosystem matures.

The Regulatory Landscape and Legal Framework

Predictive markets have navigated a complex legal history in the United States, often falling into gray areas between financial instruments and gambling. The 2006 Unlawful Internet Gambling Enforcement Act created significant barriers, but regulatory interpretations have evolved. Kalshi’s approval by the CFTC establishes a crucial precedent, treating these markets as financial event contracts rather than gambling wagers. This distinction enables their legal operation across state lines, bypassing the patchwork of state gambling regulations that complicate sports betting platforms.

The regulatory framework imposes specific constraints on market design. Contracts must relate to measurable economic or geopolitical events with objectively verifiable outcomes, excluding purely entertainment-based events like sports scores or award shows. This focus on “event contracts of economic interest” aligns prediction markets more closely with traditional hedging instruments than with speculative gambling. Market size limits and position caps, enforced through Kalshi’s CFTC compliance protocols, further distinguish these regulated markets from their unregulated counterparts.

- Regulatory Status: CFTC-regulated as event contracts

- Geographic Availability: All 50 U.S. states and territories

- Contract Types: Politics, economics, climate events, corporate outcomes

- Prohibited Markets: Sports, entertainment, purely speculative events

- Minimum Position: $1 per contract

- Settlement: Cash-settled in USD or USDC

Historical Context of Prediction Markets

Prediction markets are not a novel financial innovation. Their conceptual roots trace back to 16th-century commodity futures and 19th-century political betting parlors. In modern times, the Iowa Electronic Markets, operating since 1988 under CFTC no-action letters, demonstrated the informational efficiency of prediction markets for election forecasting. The 2012 JOBS Act initially sparked interest in equity-based crowdfunding platforms that resembled prediction mechanisms, while blockchain technology enabled decentralized platforms like Augur and Polymarket to emerge outside U.S. regulatory jurisdiction.

The critical evolution represented by the Coinbase-Kalshi partnership lies in its mainstream integration. Previous prediction markets existed either as academic experiments with limited participation or as offshore platforms with regulatory uncertainty. By embedding these markets within America’s most recognizable cryptocurrency exchange—one already serving over 100 million verified users—the offering achieves unprecedented scale and legitimacy. This mainstreaming follows a broader trend of financial innovation convergence, where traditional finance, cryptocurrency, and alternative investment vehicles increasingly occupy shared digital spaces.

Market Implications and Competitive Landscape

The launch significantly alters the competitive dynamics in both cryptocurrency exchanges and prediction markets. Coinbase’s “Everything Exchange” strategy, first outlined in December 2025, explicitly aims to create a unified platform for diverse financial activities. This predictive markets initiative represents the first tangible expansion beyond core crypto services since that strategy announcement. The move pressures competing exchanges like Kraken and Gemini to consider similar diversification, potentially triggering a wave of consolidation between crypto platforms and regulated fintech services.

| Platform | Regulatory Status | Minimum Bet | Payment Methods | Monthly Volume |

|---|---|---|---|---|

| Kalshi (via Coinbase) | CFTC-Regulated | $1 | USD, USDC | Not Disclosed |

| Polymarket | Offshore/Unregulated | $5 | Crypto Only | $500M+ |

| Iowa Electronic Markets | CFTC No-Action | $5 | USD Only | $2-5M |

| Manifold Markets | Unregulated/Play Money | $0.01 | Virtual Credits | $10M |

Market valuations reflect growing investor enthusiasm. Kalshi achieved an $11 billion valuation in its 2025 funding round, while offshore competitor Polymarket reached $9 billion despite regulatory ambiguities. These valuations suggest substantial growth expectations, with analysts projecting the global prediction market sector could exceed $50 billion in annual transaction volume by 2028. Coinbase’s entry provides institutional credibility that may accelerate adoption among traditional finance participants who previously avoided the space due to compliance concerns.

Technical Integration and User Experience

From a technical perspective, the integration represents a sophisticated interoperability achievement. Coinbase’s infrastructure must reconcile its existing crypto-native architecture with Kalshi’s regulated event contract platform. The shared settlement layer using USDC—the regulated stablecoin Coinbase partially helped develop—provides a technical bridge between the systems. This creates a seamless user experience where funds can move between crypto trading, staking, and prediction markets without traditional banking intermediaries.

Security considerations are paramount given the regulatory scrutiny. The implementation includes enhanced compliance protocols for prediction market participation, including additional identity verification for larger positions and automated monitoring for market manipulation patterns. These measures exceed standard crypto exchange security, reflecting the heightened oversight associated with CFTC-regulated products. The architecture reportedly maintains separation between prediction market operations and core exchange functions, creating regulatory firewalls while maintaining user convenience.

Educational Resources and Risk Management

Recognizing that prediction markets represent unfamiliar territory for many crypto traders, Coinbase has developed extensive educational materials. These resources explain contract mechanics, settlement procedures, and risk factors distinct from cryptocurrency volatility. The platform emphasizes that prediction markets involve binary outcomes with different risk profiles than continuously traded assets. This educational focus addresses both regulatory expectations for investor protection and practical considerations for user retention in a new product category.

Risk management features include position limits scaled to account verification levels, mandatory cooling-off periods between certain contract types, and clear disclosures about the informational nature of market prices. Unlike decentralized prediction platforms where liquidity can vanish, Kalshi’s market-making commitments ensure consistent bid-ask spreads. These safeguards aim to prevent the extreme volatility and liquidity crises that have plagued some crypto-adjacent financial innovations while maintaining market efficiency.

Broader Industry Implications and Future Trajectory

The launch signals a maturation phase for cryptocurrency infrastructure companies. As regulatory clarity increases—however gradually—leading exchanges face pressure to diversify revenue streams beyond trading fees. Prediction markets offer attractive economics with different volatility correlations than crypto markets, potentially stabilizing platform revenues during cryptocurrency downturns. This diversification aligns with shareholder expectations for publicly traded crypto companies to demonstrate sustainable business models beyond market speculation.

Industry observers note potential ripple effects across multiple sectors. Traditional bookmakers may face increased competition for politically-focused betting, while financial data providers might incorporate prediction market probabilities into their analytics offerings. Perhaps most significantly, the legitimization of prediction markets through mainstream platforms could accelerate their adoption as hedging tools for businesses exposed to geopolitical or regulatory risks. Corporations unable to find traditional insurance for certain event risks might increasingly turn to these markets for customized protection.

The development also intersects with broader Web3 convergence trends. As tokenization of real-world assets advances, prediction market contracts represent another form of tokenized exposure—in this case to event outcomes rather than physical assets. This conceptual alignment suggests potential future integrations where prediction market positions could serve as collateral in decentralized finance protocols or as components in structured financial products. Such innovations remain theoretical but illustrate the expanding design space opened by regulated prediction market infrastructure.

Conclusion

Coinbase’s launch of regulated predictive markets via Kalshi represents a strategic inflection point for both the exchange and the broader financial innovation landscape. By successfully navigating regulatory complexities to offer legal event contracts across all 50 states, Coinbase expands its identity beyond cryptocurrency trading toward comprehensive digital finance. The $1 minimum bet democratizes access to sophisticated financial instruments while the seamless integration within an existing trusted platform addresses previous adoption barriers. As prediction markets gain mainstream legitimacy through this partnership, they may evolve from niche forecasting tools to integrated components of personal and institutional finance, blurring traditional boundaries between speculation, hedging, and information discovery in increasingly innovative ways.

FAQs

Q1: What exactly are predictive markets in the context of Coinbase’s new offering?

Predictive markets are platforms where participants trade contracts whose value depends on the outcome of future events. Coinbase, through partner Kalshi, offers CFTC-regulated contracts on political, economic, and geopolitical events that settle based on objectively verifiable outcomes.

Q2: How is this different from sports betting or gambling?

These markets are regulated as financial event contracts rather than gambling. Key distinctions include: contracts must relate to economic or geopolitical events (not entertainment), they’re regulated by the CFTC (not gaming commissions), and they serve price discovery and hedging functions beyond mere speculation.

Q3: Can I use cryptocurrency to participate in these predictive markets?

Yes, deposits can be made in USDC (a regulated stablecoin) as well as U.S. dollars. However, settlement occurs in the currency of deposit, and contracts themselves are denominated in dollars rather than cryptocurrency volatility.

Q4: What types of events can I bet on through Coinbase’s predictive markets?

Available contracts include political elections, economic indicators (like inflation rates), corporate outcomes (merger completions), climate events, and policy decisions. Sports, entertainment awards, and purely speculative events are excluded under CFTC regulations.

Q5: Are there limits to how much I can bet or win?

Yes, position limits apply based on account verification level and contract type. These limits are designed to prevent market manipulation and excessive risk concentration. Maximum potential gains are theoretically unlimited but practically constrained by market liquidity and position caps.

Q6: How does this affect Coinbase’s core cryptocurrency business?

The predictive markets represent a diversification strategy that complements rather than replaces crypto services. They provide alternative engagement during crypto market downturns and attract users interested in financial innovation beyond digital assets. The integration allows seamless movement between product types within one platform.

Related News

- Remittix Presale: Analyzing the 300% Bonus Mechanism and Shrinking Token Supply Dynamics

- Bitcoin Price Prediction: Analysts Say It Can Touch $110 in Upcoming Days — Nexchain Leads Presale ICO List With $4.1M Raised

- OpenAI enhances AI safety with new red teaming methods

Related: SUI Price Faces Critical Test as Grayscale's Revolutionary GSUI ETF Launches Tomorrow

Related: Bitcoin Dominance Weakens as Ethereum Gains Momentum: A Critical 2025 Market Shift