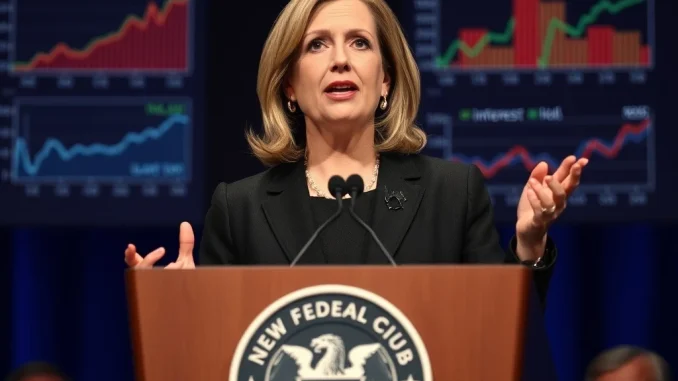

The financial world constantly watches the Federal Reserve for signals regarding future economic conditions. Consequently, these signals profoundly influence various markets, including the volatile cryptocurrency sector. Recently, a significant statement from the Cleveland Fed has sent ripples across investor sentiment. Beth Hammack, the newly appointed president of the Federal Reserve Bank of Cleveland, delivered a stark assessment. She indicated that further interest rate cuts are far from a certainty, given the current economic climate. This declaration carries substantial weight for anyone tracking market trends and economic stability.

Cleveland Fed President Hammack’s Cautious Stance

Beth Hammack’s recent comments have underscored the cautious approach currently adopted by the Federal Reserve. Speaking publicly, she highlighted the persistent challenges in bringing inflation back to target levels. Hammack, a key voice within the central bank, emphasized that the path to lower interest rates is not straightforward. Indeed, her remarks suggest a potential ‘higher for longer’ scenario for borrowing costs. This perspective directly impacts economic planning for businesses and individuals alike. Therefore, understanding her rationale becomes crucial for market participants.

Hammack articulated that the existing inflation outlook remains a primary concern. She firmly believes that inflation is likely to stay elevated for an extended period. Specifically, her projections indicate that high inflation could persist through 2026. Moreover, she estimated that it would take another two to three years to achieve the Fed’s long-term 2% inflation target. This timeline is longer than many market observers had hoped. Consequently, these insights suggest a prolonged period of vigilance from the central bank.

Unpacking the Stubborn Inflation Outlook

The core of Hammack’s argument rests on the enduring strength of inflationary pressures. Several factors contribute to this persistent challenge. For instance, robust consumer spending continues to fuel demand. Furthermore, supply chain disruptions, though easing, still play a role. The labor market also remains tight, contributing to wage growth and, subsequently, higher prices. The Federal Reserve closely monitors these indicators to gauge economic health. However, the current data suggests that the fight against inflation is far from over.

Bringing inflation down to the desired 2% target is a complex endeavor. The Fed employs various tools, primarily adjusting the federal funds rate, to influence economic activity. Raising rates aims to cool demand and reduce price pressures. Conversely, lowering rates stimulates economic growth. Hammack’s statements imply that the conditions necessary for rate reductions are not yet met. Thus, the current monetary policy framework will likely remain restrictive for some time. Investors and businesses must adapt to this reality.

Implications for Monetary Policy and Market Expectations

Hammack’s candid assessment provides a clear signal about the direction of monetary policy. The central bank prioritizes price stability above all else. Consequently, any premature easing of policy could risk reigniting inflationary pressures. This would undermine the progress made so far. Therefore, the Fed is committed to seeing clear and consistent evidence of inflation returning to target before considering significant shifts. This commitment shapes market expectations for future interest rate movements.

Financial markets had previously priced in several interest rate cuts for the coming year. However, recent economic data and hawkish comments from Fed officials have tempered these expectations. Hammack’s remarks further reinforce this shift. Traders are now adjusting their forecasts, anticipating fewer and later rate reductions. This adjustment has a ripple effect across various asset classes, including bonds, equities, and commodities. Ultimately, the Fed’s stance dictates the cost of capital throughout the economy.

The Federal Reserve’s Balancing Act: Inflation vs. Growth

The Federal Reserve operates under a dual mandate: achieving maximum employment and maintaining price stability. Currently, these two objectives present a delicate balancing act. While the labor market remains relatively strong, persistent inflation complicates the picture. Aggressive rate hikes risk slowing economic growth too much, potentially leading to job losses. Conversely, easing policy too soon could embed high inflation, eroding purchasing power. Hammack’s comments reflect this intricate challenge.

Officials at the Cleveland Fed and across the Federal Reserve system are meticulously analyzing incoming data. They consider a wide array of economic indicators, including consumer price index (CPI) reports, producer price index (PPI) data, and employment figures. Each piece of information informs their collective decision-making process. Therefore, the path forward is data-dependent. The Fed will only act when there is compelling evidence that inflation is firmly on a downward trajectory towards its 2% goal. This methodical approach aims to ensure long-term economic health.

How the Inflation Outlook Impacts Cryptocurrency Markets

The Federal Reserve’s monetary policy decisions profoundly affect risk assets, including cryptocurrencies. Higher interest rates typically make traditional, less risky investments more attractive. For example, government bonds offer better yields when rates are high. This often leads investors to reallocate capital away from speculative assets like Bitcoin and Ethereum. Therefore, Hammack’s comments about unlikely interest rate cuts could signal continued headwinds for the crypto market.

Furthermore, a prolonged period of high inflation can erode investor confidence. When the purchasing power of fiat currencies declines, some investors might turn to cryptocurrencies as a hedge. However, the volatility of digital assets also makes them susceptible to broader market sentiment. If the inflation outlook suggests sustained economic uncertainty, risk aversion may prevail. Consequently, the crypto market could experience reduced liquidity and price suppression. Understanding these dynamics is essential for digital asset investors.

Navigating the Future: What Lies Ahead?

The recent statements from the Cleveland Fed provide a sobering assessment of the current economic landscape. Beth Hammack’s cautious stance on further interest rate cuts reinforces the Fed’s commitment to tackling inflation. The projected timeline for inflation to return to the 2% target, extending into 2026 and beyond, highlights the persistent nature of the challenge. This long view will undoubtedly influence strategic decisions across all sectors.

Ultimately, the actions of the Federal Reserve will continue to be a dominant force in global financial markets. Their ongoing efforts to manage inflation, balance employment, and maintain financial stability will shape the economic environment for years to come. Market participants, from institutional investors to individual crypto traders, must remain attentive to these critical policy signals. The journey back to price stability promises to be a patient and data-driven one.

Frequently Asked Questions (FAQs)

Q1: Who is Beth Hammack?

A1: Beth Hammack is the president of the Federal Reserve Bank of Cleveland. She is a key policymaker within the Federal Reserve System, contributing to discussions and decisions on U.S. monetary policy.

Q2: Why are further interest rate cuts not obvious, according to Hammack?

A2: Hammack stated that further interest rate cuts are not obvious due to the current inflation outlook. She believes inflation is likely to remain high, making it challenging to ease monetary policy without risking a resurgence in price pressures.

Q3: What is the Federal Reserve’s inflation target?

A3: The Federal Reserve aims for a long-term inflation target of 2%. This target is considered optimal for maintaining price stability and supporting sustainable economic growth.

Q4: How does the current inflation outlook affect the cryptocurrency market?

A4: A hawkish inflation outlook and the prospect of higher interest rates can negatively impact the cryptocurrency market. Higher rates make traditional assets more attractive, potentially diverting capital from speculative assets like crypto and increasing overall market risk aversion.

Q5: When does the Fed expect inflation to return to its 2% target?

A5: Beth Hammack indicated that inflation is likely to remain high through 2026 and estimated it would take two to three years to bring it back to the 2% target. This suggests a longer timeline than some market participants had anticipated.