Cardano ADA Price Revisits Critical Zone That Sparked Historic 2100% Rally

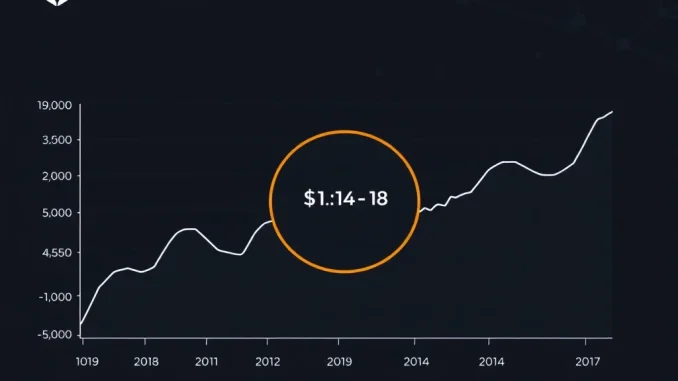

Global, May 2025: The Cardano (ADA) cryptocurrency has once again entered a price band between $0.14 and $0.18, a region that technical analysts identify as a critical historical support and launchpad. This zone preceded two of ADA’s most significant bull runs in its history, sparking renewed debate among traders and investors about whether past patterns can inform future price action. Market participants are now scrutinizing on-chain data, development milestones, and broader macroeconomic conditions to assess the potential for a repeat performance.

Cardano ADA Price Enters Historically Significant Territory

Technical analysis in cryptocurrency markets often involves studying historical price action to identify patterns and key levels. For Cardano’s ADA, the price range of approximately $0.14 to $0.18 has emerged as a focal point. In late 2020, ADA consolidated within this zone before initiating a rally that saw its price increase by over 2,100% in the following months, peaking above $3.00 in 2021. A similar, though less dramatic, consolidation around these levels in 2023 preceded a subsequent rally of approximately 600%. The recurrence of ADA’s price in this region naturally draws analytical attention, as it represents a long-term tested area of investor accumulation and momentum shift.

It is crucial to understand that technical analysis is not a predictive science but a probabilistic framework. Revisiting a historical level does not guarantee an identical outcome. The context of each market cycle differs substantially. The 2020-2021 rally occurred during a period of unprecedented monetary stimulus and a surge in retail interest in digital assets. Today’s market operates under different macroeconomic conditions, with altered regulatory landscapes and a more mature, institutional participant base. Therefore, while the chart pattern presents an intriguing narrative, it must be weighed against fundamental and on-chain realities.

Analyzing the Technical Structure and Market Sentiment

The current market structure for ADA shows several key characteristics. On higher timeframes, such as the weekly chart, the $0.14–$0.18 band has acted as both robust support and resistance at different points in the asset’s lifecycle. A breakdown below this zone could signal a bearish continuation, while a sustained hold or bounce could reinforce its importance as a foundational support level. Traders monitor volume profiles and order book data to gauge buying and selling pressure at these levels.

- On-Chain Metrics: Data from analytics platforms show changes in holder behavior, exchange flows, and network activity. A decrease in ADA held on exchanges can indicate a shift toward long-term holding, which is often a precursor to reduced selling pressure.

- Development Activity: The fundamental health of the Cardano network, measured by GitHub commits, protocol upgrades, and dApp development, provides a backdrop for price action. A robust development pipeline can support long-term valuation.

- Broader Market Correlation: ADA’s price does not move in isolation. Its performance remains correlated, though not perfectly, with Bitcoin and the wider crypto market. Macroeconomic factors influencing risk assets globally play a significant role.

Sentiment indicators, while often subjective, also contribute to the analysis. Social media discussion volume, search trend data for “Cardano” or “ADA,” and the positioning of derivatives traders offer a glimpse into market psychology. A convergence of neutral-to-negative sentiment at a key support level can sometimes create conditions for a contrarian rally, as overly pessimistic positioning is unwound.

The Role of Network Fundamentals and Ecosystem Growth

Beyond the chart, Cardano’s intrinsic value proposition hinges on its technological roadmap and ecosystem adoption. The network has undergone several major upgrades, most notably the transition to a proof-of-stake consensus mechanism and the implementation of smart contract capability through the Alonzo hard fork. These developments transformed Cardano from a theoretical project into a platform capable of hosting decentralized applications (dApps), decentralized finance (DeFi) protocols, and non-fungible token (NFT) projects.

The growth of the Total Value Locked (TVL) in Cardano’s DeFi ecosystem, while smaller than leaders like Ethereum or Solana, shows a trajectory of organic development. Furthermore, partnerships with governments and institutions for digital identity and supply chain solutions provide real-world utility narratives that extend beyond speculative trading. For long-term investors, these fundamentals may provide a stronger rationale for investment than technical patterns alone, though the two are often intertwined. A thriving ecosystem can attract users and capital, potentially creating positive feedback loops for the native token’s demand.

Historical Precedents and the Danger of Narrative-Driven Investing

Drawing direct parallels between past and present market cycles carries inherent risk. Financial markets are complex adaptive systems where yesterday’s signal can become today’s noise. The “history repeating” narrative is powerful and easily understood, which can lead to self-fulfilling prophecies in the short term as traders act on the same analysis. However, it can also lead to significant disappointment if external variables have changed too drastically.

For instance, the regulatory environment for cryptocurrencies in 2025 is more defined than in 2020. The participation of large, traditional asset managers through spot Bitcoin and potentially Ethereum ETFs has altered capital flows. The advent of Central Bank Digital Currencies (CBDCs) and increased scrutiny from bodies like the Financial Stability Board introduce new dynamics. An investor relying solely on a 2020 chart pattern without accounting for these structural shifts may misjudge the risk-reward profile. A balanced approach considers the technical setup as one piece of a larger mosaic that includes regulation, institutional adoption, and global liquidity conditions.

Conclusion

Cardano’s ADA token finds itself at a technically significant Cardano ADA price juncture, retesting a zone that has twice served as a springboard for major rallies. This occurrence provides a valuable case study for market technicians and long-term holders alike. While the historical pattern is undeniable and warrants close observation, informed investment decisions must synthesize this technical data with a clear-eyed assessment of Cardano’s on-chain fundamentals, development progress, and the prevailing macroeconomic climate. The question of “history repeating” remains open, but the convergence of price at this critical level undeniably marks a pivotal moment for one of cryptocurrency’s most prominent blockchain projects.

FAQs

Q1: What were the past ADA rallies linked to the $0.14–$0.18 zone?

In late 2020, ADA consolidated around $0.14–$0.18 before rallying over 2100% to above $3.00 by 2021. In 2023, a similar consolidation preceded a rally of approximately 600%.

Q2: Does a price returning to a historical level guarantee the same outcome?

No. Technical analysis suggests probabilities, not certainties. Each market cycle has unique fundamental and macroeconomic drivers that can lead to different outcomes, even from similar chart patterns.

Q3: What fundamental factors should be considered alongside the ADA price chart?

Key factors include Cardano’s network development activity (GitHub commits, upgrades), growth in its DeFi ecosystem (Total Value Locked), on-chain metrics like holder distribution, and broader cryptocurrency market trends.

Q4: How does broader market sentiment affect ADA’s price potential?

ADA is a risk asset and is highly correlated with Bitcoin and general crypto market sentiment. Macroeconomic conditions, such as interest rate policies and institutional investment flows, significantly impact overall market direction and thus ADA’s price trajectory.

Q5: What is the main risk of relying on the “history repeating” narrative for investing?

The primary risk is narrative-driven investing, where one compelling story (like a past rally) overrides analysis of changed fundamentals, increased competition, or a different regulatory landscape, potentially leading to poor risk assessment.

Related: Bitcoin Neo-Bank Breakthrough: Core's SatPay Aims to Redefine BTC Financial Infrastructure

Related: UK FCA Stablecoins: Regulator Reveals Four Firms for Critical Sandbox Testing Before 2027 Rules

Related: $SHOLA Token Launch: Shola's Strategic Collaboration with Pump.fun on Solana