Bitcoin Retirement Plans: Bitwise CIO Reveals Shocking Volatility Comparison with NVIDIA

NEW YORK, April 2025 – The debate surrounding cryptocurrency inclusion in retirement accounts intensifies as Bitwise Chief Investment Officer Matt Hougan presents compelling data showing Bitcoin’s volatility has actually trailed behind technology giant NVIDIA over the past year. This revelation challenges conventional arguments against digital asset allocation in 401(k) plans and follows significant regulatory developments that could reshape retirement investing.

Bitcoin Retirement Plans Face Institutional Scrutiny

Traditional retirement planning approaches now confront unprecedented challenges from emerging asset classes. The cryptocurrency sector, particularly Bitcoin, generates substantial discussion among financial professionals and policymakers. Recent executive actions have opened pathways for pension and retirement funds to consider digital assets, creating both opportunity and controversy within the investment community.

Senator Elizabeth Warren consistently voices concerns about investor protection, warning that cryptocurrency exposure might introduce unacceptable risks for retirement savers. Conversely, institutional advocates highlight Bitcoin’s maturation and growing correlation with macroeconomic trends. This regulatory tension reflects broader questions about financial innovation and portfolio diversification in modern retirement planning.

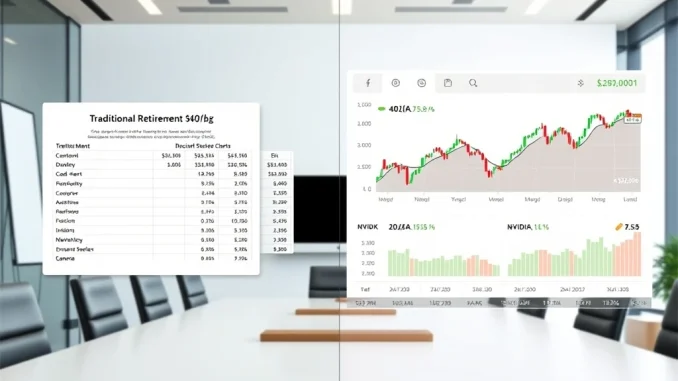

Volatility Analysis: BTC Versus Traditional Tech Stocks

Matt Hougan’s comparison between Bitcoin and NVIDIA stock reveals surprising volatility metrics that contradict common perceptions. According to historical data analysis, Bitcoin exhibited approximately 45% annualized volatility over the past twelve months. Meanwhile, NVIDIA demonstrated volatility exceeding 55% during the same period, driven by artificial intelligence sector developments and chip manufacturing dynamics.

This volatility comparison matters significantly for several reasons:

- Risk assessment frameworks often treat cryptocurrencies differently than traditional equities

- Portfolio construction models typically exclude digital assets from standard allocations

- Regulatory guidelines frequently impose stricter standards on emerging asset classes

- Retirement plan fiduciaries face legal uncertainties about cryptocurrency inclusion

Financial analysts note that volatility represents just one dimension of risk assessment. Liquidity profiles, correlation benefits, and long-term return characteristics also require thorough examination when evaluating retirement portfolio components.

Institutional Adoption Timeline and Regulatory Developments

The cryptocurrency regulatory landscape evolved substantially throughout 2024 and early 2025. Executive orders created new pathways for institutional participation, while legislative proposals sought to establish clearer guidelines for digital asset custody and reporting. This regulatory progression mirrors historical patterns observed with previously novel investment vehicles entering mainstream portfolios.

Several major financial institutions now offer cryptocurrency exposure through various retirement products, though adoption rates vary significantly across plan providers. Fidelity Investments, ForUsAll, and Bitwise itself provide examples of companies navigating the complex intersection of retirement planning and digital assets. Their approaches demonstrate different methodologies for addressing volatility concerns and fiduciary responsibilities.

Comparative Asset Analysis Framework

Evaluating Bitcoin within retirement portfolios requires examining multiple dimensions beyond simple volatility comparisons. The following table illustrates key metrics across different asset classes commonly considered for long-term investment strategies:

| Asset Class | 5-Year Annualized Volatility | Correlation to S&P 500 | Inflation Hedge Properties |

|---|---|---|---|

| Bitcoin (BTC) | 62% | 0.45 | High |

| NVIDIA (NVDA) | 58% | 0.82 | Low |

| Gold (GLD) | 16% | -0.12 | Moderate |

| Total Stock Market | 18% | 1.00 | Low |

| Long-Term Treasury Bonds | 12% | -0.35 | Variable |

This comparative analysis reveals that while Bitcoin demonstrates higher long-term volatility than traditional assets, its correlation patterns and inflation-resistant characteristics offer potential diversification benefits. Portfolio construction theory suggests that properly sized allocations to imperfectly correlated assets can potentially reduce overall portfolio risk despite individual component volatility.

Retirement Plan Fiduciary Considerations

Plan sponsors and investment committees face complex decisions when evaluating cryptocurrency options for retirement plans. The Employee Retirement Income Security Act (ERISA) establishes stringent fiduciary standards requiring prudent investment selection and diversification. Recent Department of Labor guidance emphasizes careful evaluation of cryptocurrency investments, though it stops short of outright prohibition.

Several key considerations emerge for retirement plan fiduciaries:

- Custody and security protocols for digital assets differ significantly from traditional securities

- Valuation methodologies require transparent pricing mechanisms and regular assessment

- Participant education becomes crucial when introducing novel investment options

- Fee structures for cryptocurrency products often include unique custody and transaction costs

Financial advisors increasingly recommend that retirement plans considering cryptocurrency exposure implement specific governance frameworks. These frameworks typically include investment policy statement amendments, specialized due diligence checklists, and enhanced participant communication strategies.

Historical Context: Technology Adoption in Retirement Portfolios

The current debate about Bitcoin in retirement plans echoes previous discussions about emerging asset classes. International equities, real estate investment trusts, and emerging market debt all faced initial skepticism before achieving mainstream acceptance. Each innovation required regulatory clarification, infrastructure development, and educational efforts to achieve widespread adoption.

Technology stocks themselves followed a similar trajectory, with early concerns about volatility and valuation eventually giving way to substantial allocations within retirement portfolios. The NASDAQ Composite index, heavily weighted toward technology companies, now represents a standard component of many target-date funds and balanced portfolios. This historical pattern suggests that novel assets typically undergo extended evaluation periods before achieving broad institutional acceptance.

Global Perspectives on Crypto Retirement Allocation

International approaches to cryptocurrency in retirement systems vary considerably, offering comparative insights for U.S. policymakers and plan sponsors. Several countries have implemented more progressive frameworks, while others maintain restrictive positions. These global differences reflect varying regulatory philosophies and retirement system structures.

Australia’s superannuation system permits limited cryptocurrency exposure through self-managed funds, subject to specific custody requirements. German pension funds can allocate to cryptocurrency under the Spezialfonds structure, though adoption remains limited. Canadian registered retirement savings plans allow cryptocurrency holdings through certain regulated exchanges and custodians. These international examples demonstrate alternative approaches to balancing innovation with investor protection in retirement systems.

Conclusion

The debate about Bitcoin retirement plans continues evolving as new data challenges conventional assumptions about cryptocurrency volatility. Matt Hougan’s comparison with NVIDIA stock highlights the importance of consistent evaluation frameworks across asset classes. Institutional adoption progresses alongside regulatory clarification, though significant questions remain about optimal implementation approaches. Retirement plan fiduciaries must carefully weigh diversification benefits against unique risks as cryptocurrency integration advances within institutional frameworks. The coming years will likely determine whether digital assets become normalized retirement portfolio components or remain niche alternatives for specialized investors.

FAQs

Q1: What specific volatility comparison did Matt Hougan make regarding Bitcoin?

Hougan noted that Bitcoin exhibited lower volatility than NVIDIA stock over the past year, with BTC showing approximately 45% annualized volatility compared to NVDA’s 55%+ during the same period.

Q2: How does recent regulatory action affect cryptocurrency in retirement plans?

Executive orders have created pathways for pension and retirement funds to hold cryptocurrencies, though specific implementation requires compliance with existing fiduciary standards and Department of Labor guidance.

Q3: What are the main arguments against including Bitcoin in 401(k) plans?

Opponents cite volatility concerns, custody challenges, valuation difficulties, and potential fiduciary liability as primary reasons to exclude cryptocurrencies from retirement accounts.

Q4: How do Bitcoin’s correlation characteristics affect retirement portfolio construction?

Bitcoin demonstrates moderate correlation with traditional equities (approximately 0.45 with S&P 500), potentially offering diversification benefits when properly sized within a broader portfolio.

Q5: What historical parallels exist for new asset classes entering retirement portfolios?

International equities, REITs, and technology stocks all faced initial skepticism before achieving mainstream acceptance, suggesting cryptocurrency may follow a similar adoption trajectory.

Related News

- 🔥 Forget PEPE & SHIB—This New Meme Coin Could Be the Ultimate 7000% Moonshot Before 2026!

- Top 5 Altcoins to Grab Now – Win Back Your Losses Fast!

- 🔥 Top 3 Unexpected Meme Coins Ready to 500x in the 2025 Bull Market!

Related: Bitcoin's Institutional Sell Pressure Eases as Coinbase Premium Gap Narrows Sharply

Related: Strategic Shift: Public Miner Sells Entire Bitcoin Stockpile as Self-Managed Hashrate Climbs to Top