Warning: Attempt to read property "post_excerpt" on null in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 392

Warning: Trying to access array offset on false in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 394

Warning: Attempt to read property "post_title" on null in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 394

[ad_1]

Following the events of the past week, it is more of a matter of “when” rather than of “if” the Bitcoin price will hit a historic six-figure value. The crypto commentary channels and waves have been largely occupied with the premier cryptocurrency potentially reaching $100,000 over the last few weeks.

A six-figure value for BTC is not only an impressive milestone for the entire crypto industry but also one that comes with “unfavorable” events such as liquidations for short traders. Here is an on-chain insight into “what next” if the Bitcoin price climbs above $100,000.

What’s Next For BTC’s Price After $100,000?

In a recent report, blockchain analytics firm Glassnode shared an insight into the on-chain performance of the premier cryptocurrency since starting its latest rally. While the $100,000 price mark seems inevitable, the blockchain firm expects Bitcoin price to lose some of its momentum after crossing the target.

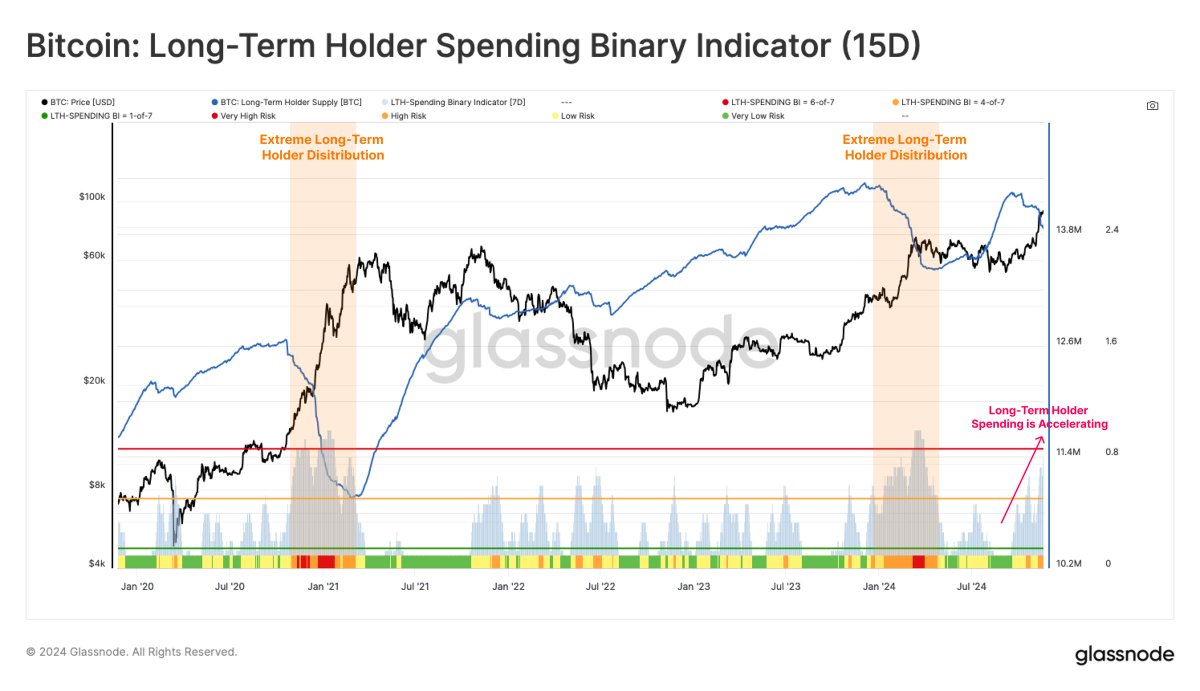

One of the rationales behind this projection lies in the recent behavior of an investor cohort known as the Long-term holders (LTH). According to Glassnode, the long-term holders are beginning to offload their assets for profits and may be waiting to sell more coins as the price action continues to grow strong.

Source: Glassnode/X

Based on data from the LTH Spending Binary Indicator, which tracks the intensity of the sell-side pressure of the long-term holders, these major investors have been increasingly distributing their assets. This Spending Binary metric shows that the LTH balance has declined on 11 of the last 15 days.

While the demand from institutional investors, specifically via the US spot exchange-traded funds (ETFs), has absorbed 90% of the sell-side pressure from long-term investors, Glassnode noted that the spending pressure of this investor cohort has begun to outpace ETF net inflows in recent days. This pattern was also noticed earlier in February 2024.

According to Glassnode, if the sell-side pressure continues to outpace the ETF demand, it could result in short-term price volatility or lead to price consolidation. The on-chain firm said:

However, since 13 November, LTH sell-side pressure has begun to outpace ETF net inflows, echoing a pattern observed in late February 2024, where the imbalance between supply and demand led to increased market volatility, and consolidation.

$1.89 Billion To Be Liquidated If Bitcoin Price Crosses This Level

In a November 22 post on X, prominent crypto analyst Ali Martinez sounded a warning to the Bitcoin bears. According to data from CoinGlass, a massive $1.89 billion looks set for liquidation if the Bitcoin price hits $100,625.

Source: Ali_charts/X

As of this writing, the premier cryptocurrency is valued at $99,424, reflecting a 1.4% price increase in the past day. Data from CoinGecko shows that the Bitcoin price has been on a much more impressive run on the weekly timeframe, surging by nearly 10% in the past seven days.

The price of Bitcoin on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

[ad_2]

Source link