Bitcoin Holders Display Remarkable Conviction: Long-Term Investors Refuse to Sell Despite Soaring Prices

In a striking display of market confidence, long-term Bitcoin holders are demonstrating remarkable conviction by refusing to sell their assets even as the cryptocurrency’s price continues its impressive ascent toward the $100,000 threshold. This behavior, confirmed by on-chain data analysis, suggests a fundamentally different market psychology compared to previous bull cycles and provides crucial insights into the current phase of Bitcoin’s evolution as a mature asset class. The phenomenon represents a significant shift in investor behavior that could have profound implications for market stability and future price trajectories.

Bitcoin Holders Demonstrate Unprecedented Discipline

Recent blockchain analysis reveals a fascinating trend among Bitcoin’s most committed investors. Despite the cryptocurrency breaking through the $94,200 resistance level and reaching $97,500, long-term holders are maintaining their positions with notable discipline. This behavior contrasts sharply with typical market patterns where significant price appreciation often triggers profit-taking. According to CryptoQuant contributor Carmelo Alemán, the current market dynamics indicate a maturation of investor psychology and a stronger belief in Bitcoin’s long-term value proposition. The data suggests these investors view current price levels not as peaks to capitalize on, but as waypoints in a longer journey toward higher valuations.

Historical context provides essential perspective for understanding this phenomenon. During previous bull markets, similar price surges frequently prompted substantial selling from long-term holders seeking to realize profits. However, the current cycle displays markedly different characteristics. Several factors likely contribute to this shift, including increased institutional adoption, clearer regulatory frameworks in major markets, and growing recognition of Bitcoin as a legitimate store of value. Furthermore, the macroeconomic environment characterized by persistent inflation concerns and currency devaluation fears in traditional markets continues to drive interest in Bitcoin as a potential hedge against systemic financial risks.

Understanding the Value Days Destroyed Metric

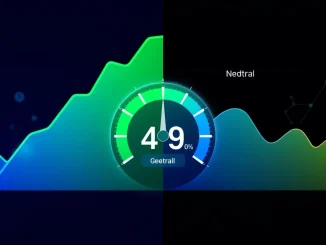

The primary indicator revealing this holding behavior is the Value Days Destroyed (VDD) metric, which currently registers at just 0.53. This technical measurement provides crucial insights into market dynamics by quantifying the trading activity of older coins. Essentially, VDD tracks when previously dormant Bitcoin moves between wallets, with higher values indicating greater activity from long-term holders. The current low reading suggests minimal movement from these investors despite significant price appreciation. For comparison, during the 2017 bull market peak, VDD values frequently exceeded 3.0, while the 2021 cycle saw readings above 2.5 during major price movements.

To better understand this metric’s significance, consider these key characteristics of Value Days Destroyed:

- Age-weighted measurement: VDD assigns greater weight to older coins, making it particularly sensitive to movements by long-term holders

- Market sentiment indicator: Low values suggest confidence in future price appreciation, while high values may indicate profit-taking or capitulation

- Cycle comparison tool: The metric allows analysts to compare current market behavior with historical patterns across different Bitcoin cycles

- Supply dynamics insight: VDD helps identify whether circulating supply is becoming more concentrated in long-term hands or distributed among newer investors

Carmelo Alemán emphasizes that as long as VDD remains at these depressed levels, the current upward trend can be considered a healthy bull phase. This assessment stems from the understanding that sustainable bull markets typically feature gradual distribution from long-term holders to new investors, rather than rapid, panic-driven selling that can create volatile price swings and undermine market stability.

Expert Analysis of Current Market Structure

Market analysts point to several structural factors supporting the current holding behavior. The increasing institutional participation through regulated investment vehicles like spot Bitcoin ETFs has created additional demand pressure while providing long-term holders with confidence about continued market development. Additionally, the upcoming Bitcoin halving event, scheduled for April 2024, creates natural holding incentives as investors anticipate reduced new supply entering the market. Historical patterns show that halving events typically precede extended periods of price appreciation, though past performance never guarantees future results.

The concentration of trading activity among short-term holders, as indicated by the low VDD metric, creates interesting market dynamics. Short-term traders typically exhibit higher sensitivity to price movements and news events, potentially increasing short-term volatility while long-term holders provide underlying stability. This bifurcation between short-term and long-term participants represents a maturation of Bitcoin’s market structure, resembling patterns seen in established asset classes where different investor types serve complementary roles in price discovery and market functioning.

Comparative Analysis with Previous Bull Markets

Examining historical data reveals how dramatically current holder behavior differs from previous cycles. The table below illustrates key differences between the current market phase and comparable periods in prior bull markets:

| Market Cycle | Price Level | VDD Reading | Long-term Holder Behavior | Market Outcome |

|---|---|---|---|---|

| 2017 Peak | $19,783 | 3.2 | Significant profit-taking | Sharp correction followed by extended bear market |

| 2021 Peak | $68,789 | 2.7 | Moderate selling pressure | Gradual decline over 12 months |

| Current (2025) | $97,500 | 0.53 | Minimal selling activity | Ongoing bull phase with continued accumulation |

This comparative analysis highlights the unprecedented nature of current holder behavior. The dramatically lower VDD reading suggests either greater conviction among long-term investors or a structural change in how Bitcoin functions within investment portfolios. Some analysts speculate that increased institutional adoption has created a new class of “permanent holders” who view Bitcoin not as a trading asset but as a strategic reserve similar to gold in traditional portfolios. This perspective shift, if accurate, could have profound implications for Bitcoin’s volatility profile and long-term price discovery mechanism.

Implications for Market Stability and Future Trajectory

The current holding pattern among long-term Bitcoin investors carries significant implications for market stability. When older coins remain dormant, the effective circulating supply decreases, potentially creating upward pressure on prices as new demand enters the market. This dynamic differs substantially from markets where long-term holders actively distribute their holdings during price increases, which typically creates resistance levels and limits upward momentum. The reduced selling pressure from this cohort suggests fewer natural sellers exist at current price levels, potentially supporting continued appreciation if demand remains robust.

However, analysts caution that this situation also creates potential risks. Should long-term holders eventually decide to realize profits, the concentrated selling could create substantial downward pressure, particularly if it coincides with other negative market developments. Market participants should monitor several indicators for signs of changing behavior, including increases in exchange inflows from older wallet cohorts, rising VDD metrics, and changes in the distribution of Bitcoin across different wallet age groups. These indicators provide early warning signals about potential shifts in long-term holder sentiment that could precede significant market movements.

Macroeconomic Context and Investor Psychology

The broader economic environment provides essential context for understanding current holder behavior. With traditional financial markets facing persistent inflation concerns, geopolitical uncertainties, and unprecedented debt levels across major economies, Bitcoin increasingly functions as what analysts term “digital gold”—a non-sovereign store of value with predictable monetary policy. This narrative gains traction particularly among investors concerned about currency debasement and seeking assets with limited supply characteristics. The fixed maximum supply of 21 million Bitcoin creates scarcity dynamics that appeal to investors worried about unlimited fiat currency creation by central banks worldwide.

Investor psychology plays a crucial role in the current holding behavior. Behavioral finance research suggests that after experiencing multiple market cycles, long-term Bitcoin investors may have developed greater risk tolerance and conviction about the asset’s fundamental value proposition. The memory of previous cycles where selling too early resulted in missed substantial gains likely influences current decision-making. Additionally, the growing accessibility of Bitcoin through regulated investment products has reduced the psychological barriers to maintaining positions during volatility, as investors no longer need to manage private keys or navigate complex technical processes to maintain their exposure.

Conclusion

The remarkable discipline displayed by long-term Bitcoin holders during the current price surge represents a significant evolution in cryptocurrency market dynamics. The persistently low Value Days Destroyed metric, despite prices approaching $100,000, indicates strong conviction among committed investors and suggests a fundamentally healthy bull market phase. This behavior contrasts sharply with previous cycles and reflects Bitcoin’s maturation as an asset class with increasingly sophisticated participants. While market conditions remain dynamic and subject to change, the current holding patterns provide valuable insights into investor psychology and market structure that will likely influence Bitcoin’s trajectory throughout 2025 and beyond. The continued refusal of long-term Bitcoin holders to sell despite impressive gains underscores the growing perception of Bitcoin as a strategic holding rather than a speculative trading vehicle.

FAQs

Q1: What does the Value Days Destroyed (VDD) metric measure?

A1: The Value Days Destroyed metric measures the trading activity of older Bitcoin by assigning greater weight to coins that have remained dormant for longer periods. A low VDD reading indicates minimal movement from long-term holders, while higher values suggest increased selling activity from this investor cohort.

Q2: Why are long-term Bitcoin holders not selling during the current price surge?

A2: Several factors likely contribute to this behavior, including greater conviction about Bitcoin’s long-term value proposition, anticipation of further price appreciation, increased institutional adoption providing market stability, and Bitcoin’s growing role as a hedge against traditional financial system risks.

Q3: How does current holder behavior compare to previous Bitcoin bull markets?

A3: Current holder behavior differs dramatically from previous cycles. During the 2017 and 2021 bull markets, Value Days Destroyed metrics were significantly higher (3.2 and 2.7 respectively), indicating substantial selling from long-term holders. The current reading of 0.53 suggests unprecedented holding discipline.

Q4: What are the potential risks if long-term holders eventually decide to sell?

A4: If long-term holders eventually decide to realize profits, the concentrated selling could create substantial downward price pressure, particularly if it coincides with other negative market developments. This potential selling represents a source of future supply that investors should monitor through on-chain metrics.

Q5: How does institutional adoption affect long-term holder behavior?

A5: Increased institutional adoption through regulated investment vehicles like Bitcoin ETFs creates additional demand while providing validation that supports long-term holder conviction. Institutions typically employ longer investment horizons than retail traders, potentially reinforcing holding behavior among all investor types.

Related News

- Urgent: BlockDAG Private Sale Nears Close as SHIB and SOL Encounter Market Downturn

- Animoca Minds: The Revolutionary Platform Opening Access to AI Agents for Everyone

- Binance Unveils Exciting APR Perpetual Futures Listing with 50x Leverage

Related: Solana Price Analysis: Expert Warns of Potential Drop to $67 After Critical $90 Rejection

Related: Chainlink Dominates DEPIN Projects in Crucial Social Activity Ranking