Bitcoin is recovering but still under immense liquidation pressure when writing. As BTC faces headwinds, the zone between $70,000 and $72,000 is proving to be a strong resistance level that must be broken for the wave of higher highs registered in Q1 2024 to continue.

The world’s most valuable coin is trading below $70,000 at press time, bouncing higher from around $67,000. The primary crucial support level to watch at press time is $66,000.

However, if bears are relentless, reversing gains of earlier today, more losses could be on the horizon.

Will Bitcoin Drop To The STH Realized Price And Support At $62,300?

Taking to X, one analyst notes that if the ongoing liquidation of long positions continues, BTC could plummet to the “Short-Term Holder Realized Price” (STH Realized Price) of $62,300.

The trader sees this level as a zone of low long liquidity. Accordingly, it could be a limited support where BTC bulls might find entry to plug losses.

The STH Realized Price is usually used to gauge sentiment. Essentially, it represents all BTC’s average purchase price within 155 days. Those who choose to hold BTC during this time are often referred to as short-term holders or mainly speculators aiming to scalp price volatility.

While the STH Realized Price serves as a sentiment indicator, the line plotted can act as support. If BTC prices continue plunging, trending below the STH Realized Price, it could force coin holders to liquidate since they are in the red.

On the other hand, if prices approach the STH Realized Price, traders might choose to buy, convincing holders that they are at near-breakeven.

The STH Realized Price is currently $62,300, but the one-to-three-month Realized Price is $66,600.

Therefore, if Bitcoin loses $66,000, the liquidation might accelerate the dump toward the 155-day STH Realized Price.

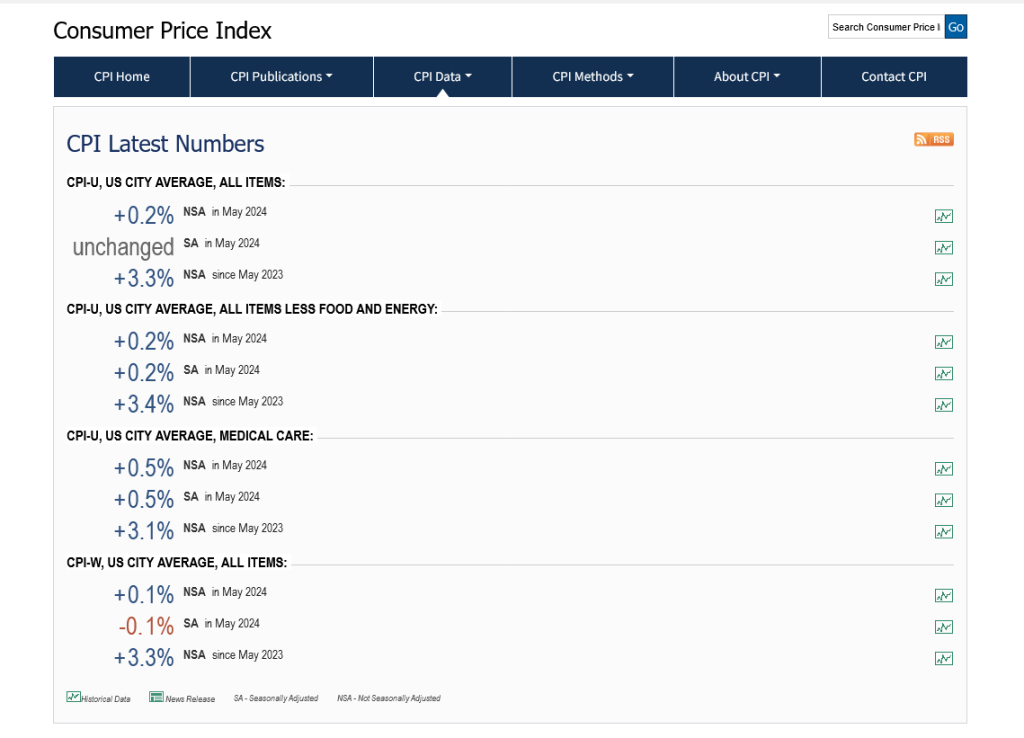

Eyes On The FOMC Amid High Inflation And Solid Employment Data In The United States

As the crypto market remains on edge, investors are closely watching the upcoming Federal Open Market Committee (FOMC) meeting. Given the strong labor market conditions, the central bank is expected to leave interest rates unchanged at 5.50%.

Last week, employment data exceeded expectations. According to the United States Bureau of Labor Statistics (BLS), 272,000 new jobs were created in June, far more than the 185,000 economists projected.

However, solid non-farm payrolls (NFP) data poured cold water on hopes of an imminent rate cut.

Even so, with inflation dropping to 3.3% year-to-date, according to the BLS, the odds of a rate cut is higher, a huge boost for Bitcoin bulls.

Feature image from Canva, chart from TradingView

Be the first to comment