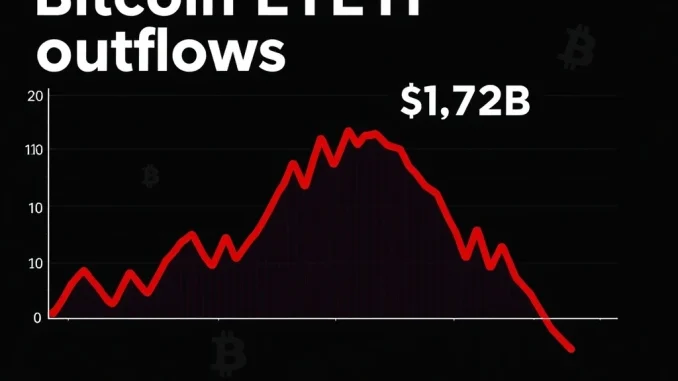

New York, January 2025: The cryptocurrency market faces a significant test of confidence as spot Bitcoin exchange-traded funds (ETFs) recorded $1.72 billion in net withdrawals over just five trading days. This substantial capital outflow represents the largest concentrated withdrawal since the approval of spot Bitcoin ETFs in the United States, occurring against a backdrop of extreme fear sentiment that has gripped digital asset markets. The movement signals a potential shift in institutional and retail investor behavior toward Bitcoin exposure through regulated financial products.

Understanding the $1.72 Billion Bitcoin ETF Withdrawal

The data from Farside Investors reveals a consistent pattern of disengagement beginning last week. The five consecutive days of net outflows culminated in $103.5 million withdrawn on Friday alone, extending what market analysts describe as a “pronounced risk-off” period. These withdrawals occurred during a trading week shortened by the Martin Luther King Jr. Day holiday, potentially amplifying the per-day impact of the capital movement. Bitcoin’s price, hovering around $87,948 during this period, remained well below the psychologically significant $100,000 threshold that many investors had anticipated would be tested following ETF approvals.

Spot Bitcoin ETFs, which directly hold Bitcoin and track its price, were hailed as a watershed moment for cryptocurrency adoption when approved by the U.S. Securities and Exchange Commission. These products were designed to provide traditional investors with regulated, accessible exposure to Bitcoin without the complexities of direct cryptocurrency ownership. The recent withdrawals therefore represent more than simple profit-taking; they indicate a reassessment of Bitcoin’s near-term prospects through the lens of mainstream financial instruments.

The Psychology Behind Market Fear Indicators

The Crypto Fear & Greed Index, a widely monitored sentiment gauge, has remained entrenched in “extreme fear” territory with a score of 25. This marks a continuous presence in this pessimistic zone since Wednesday, creating what analysts describe as a “self-reinforcing cycle of caution.” The index synthesizes multiple data points including volatility, market momentum, social media sentiment, and surveys to produce its daily reading. A score below 30 consistently indicates fear, while below 20 suggests extreme fear—a threshold the market has been flirting with throughout this withdrawal period.

Historical analysis reveals that extended periods in extreme fear territory often precede significant market movements. However, the direction of those movements—whether further declines or sharp rebounds—depends on underlying fundamentals rather than sentiment alone. The current sentiment reading coincides with several concerning developments:

- Reduced social media discussion volume about Bitcoin and ETFs

- Declining search interest in cryptocurrency investment topics

- Increased mentions of traditional safe-haven assets in financial media

- Elevated put option activity in Bitcoin derivatives markets

Institutional Behavior Versus Retail Sentiment

Analytics platform Santiment notes a divergence between retail and institutional behavior during this period. Their data suggests “retail traders are leaving the ship, while money and attention turn to more traditional assets.” This observation aligns with trading volume patterns showing decreased activity from smaller wallet addresses contrasted with continued accumulation by larger, presumably institutional, holders. The lack of corresponding social media excitement about potential buying opportunities at lower prices further supports this assessment of retail disengagement.

Interestingly, this retail retreat occurs without the panic-selling characteristics typically associated with market bottoms. Instead, Santiment researchers describe a “quiet exodus” marked by diminished online discussion and what their metrics suggest could be “supply distribution indicating a bottom may be forming.” This nuanced reading of market psychology highlights the complex interplay between public sentiment, capital flows, and price discovery in cryptocurrency markets.

Macroeconomic Context and Alternative Asset Flows

The capital exiting Bitcoin ETFs appears partially redirected toward traditional safe-haven assets, particularly precious metals. Gold has approached the $5,000 per ounce threshold while silver tests $100—levels that represent significant psychological barriers in commodity markets. Nik Bhatia, founder of The Bitcoin Layer, observed on social media platform X: “With gold at nearly $5,000 and silver at $100, sentiment on bitcoin is so low it feels like the post-FTX era at $17,000.” This comparison references the severe market contraction following the FTX exchange collapse in November 2022, when Bitcoin bottomed near $15,500.

Several macroeconomic factors contribute to this asset rotation:

| Factor | Impact on Bitcoin | Impact on Gold |

|---|---|---|

| Interest Rate Expectations | Negative (higher rates reduce appeal of non-yielding assets) | Mixed (traditional inflation hedge) |

| Dollar Strength | Negative (inverse correlation) | Negative (historical inverse relationship) |

| Geopolitical Uncertainty | Positive (digital gold narrative) | Positive (traditional safe haven) |

| Inflation Concerns | Positive (store of value narrative) | Positive (historical inflation hedge) |

Bob Loukas, a noted market cycle analyst, offers a contrarian perspective: “Sentiment is at its lowest, and one could argue that a strong countertrend rebound is brewing.” This view finds support in options market data showing increased institutional buying of longer-dated Bitcoin call options despite the spot price weakness—a strategy typically employed when sophisticated investors anticipate future appreciation but acknowledge near-term uncertainty.

Historical Precedents and Market Structure Analysis

The current $1.72 billion withdrawal represents approximately 3.2% of the total assets under management in spot Bitcoin ETFs at their peak. While significant in absolute terms, this percentage outflow remains within historical norms for established ETF products during risk-off periods. For comparison, gold ETFs experienced outflows exceeding 5% of AUM during the March 2020 market turmoil before seeing substantial reallocation later that year.

Market structure provides additional context for interpreting these flows. The creation/redemption mechanism of ETFs means that authorized participants (typically large financial institutions) can create new shares by depositing Bitcoin with the fund or redeem shares by withdrawing Bitcoin. Large redemptions therefore represent these institutional participants adjusting their inventory rather than necessarily reflecting the decisions of end investors. This technical nuance means the $1.72 billion outflow could represent inventory management by market makers rather than a fundamental loss of confidence in Bitcoin itself.

The timing of these withdrawals coincides with quarterly portfolio rebalancing periods for many institutional investors. This regular process often involves reducing positions that have exhibited high volatility or reassessing asset allocations based on updated risk parameters. Bitcoin’s characteristic volatility makes it particularly susceptible to such rebalancing flows, especially during periods of macroeconomic uncertainty when portfolio managers prioritize capital preservation.

Regulatory and Tax Considerations

January represents a significant period for tax-related selling in the United States, as investors realize losses to offset capital gains from the previous year. The tax treatment of cryptocurrency transactions—particularly the wash sale rules that don’t currently apply to digital assets as they do to securities—creates unique selling pressure absent from traditional markets. Investors can sell Bitcoin at a loss for tax purposes and immediately repurchase it, creating apparent selling pressure without necessarily indicating a change in long-term conviction.

Additionally, regulatory developments continue to influence institutional participation. While spot Bitcoin ETFs operate within clear regulatory frameworks, ongoing uncertainty about cryptocurrency classification, custody requirements, and banking relationships creates friction for some traditional asset managers. These structural considerations sometimes outweigh short-term price movements in institutional decision-making processes.

Future Implications and Market Development

The response to this withdrawal episode will test the maturity of Bitcoin as an asset class through regulated vehicles. Previous cryptocurrency market cycles featured dramatic retail-driven volatility, but the ETF structure introduces different dynamics including:

- Daily transparency of flows through regulatory filings

- Participation by traditionally conservative investors

- Integration with existing portfolio management systems

- Clear separation between asset custody and trading execution

Market analysts will monitor whether these outflows represent a temporary risk-off rotation or the beginning of a more sustained reassessment of Bitcoin’s role in diversified portfolios. The coming weeks will reveal whether institutional interest proves resilient or whether the “digital gold” narrative faces its most serious challenge since the ETF approvals.

Technical analysts note that Bitcoin maintains its long-term bullish structure despite recent weakness, with the 200-day moving average continuing to provide support. The $87,948 level mentioned in flow data represents a consolidation area that has contained prices during previous periods of uncertainty. A decisive break below this level could trigger additional selling, while holding above it might establish a foundation for recovery once sentiment improves.

Conclusion

The $1.72 billion withdrawal from spot Bitcoin ETFs highlights the ongoing evolution of cryptocurrency markets as they integrate with traditional finance. While the magnitude of outflows captures attention, the underlying story involves complex interactions between retail sentiment, institutional behavior, macroeconomic factors, and market structure. The extreme fear reading on sentiment indicators reflects genuine uncertainty but may also create conditions for contrarian opportunities as the market processes this information. As with previous volatility episodes in Bitcoin’s history, the response to this challenge will likely shape market development for months to come, testing both the resilience of investor conviction and the robustness of the newly established ETF infrastructure.

FAQs

Q1: What caused the $1.72 billion Bitcoin ETF withdrawal?

The withdrawal resulted from multiple factors including extreme fear sentiment, rotation into traditional safe-haven assets like gold, quarterly portfolio rebalancing by institutions, and tax-related selling pressure. It represents a confluence of technical, psychological, and macroeconomic influences rather than a single catalyst.

Q2: How does the Crypto Fear & Greed Index work?

The index aggregates multiple data points including volatility (25%), market momentum/volume (25%), social media (15%), surveys (15%), Bitcoin dominance (10%), and trends (10%) to produce a daily score from 0-100. Scores below 30 indicate fear, while below 20 suggest extreme fear—the zone where the market has been trading.

Q3: Are institutional investors abandoning Bitcoin?

Data suggests divergence: while ETF flows show withdrawals, blockchain analytics indicate continued accumulation by large wallet addresses. This pattern suggests some institutional participants are adjusting ETF inventory while others maintain or increase direct Bitcoin holdings, reflecting different strategies and time horizons.

Q4: How do Bitcoin ETF withdrawals affect the Bitcoin price?

ETF withdrawals require authorized participants to sell Bitcoin to fund redemptions, creating direct selling pressure. However, the impact depends on overall market liquidity, concurrent buying from other sources, and whether the selling represents temporary inventory adjustment or fundamental repositioning.

Q5: What historical patterns compare to current Bitcoin ETF outflows?

Similar patterns occurred in gold ETF markets during risk-off periods, with outflows sometimes exceeding 5% of assets under management before subsequent recovery. In cryptocurrency specifically, the post-FTX period saw extreme fear sentiment eventually give way to a sustained rally, though each cycle has unique characteristics.