Warning: Attempt to read property "post_excerpt" on null in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 392

Warning: Trying to access array offset on false in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 394

Warning: Attempt to read property "post_title" on null in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 394

[ad_1]

Bitcoin and Ethereum ETFs (exchange-traded funds) recorded the highest multi-week inflows in the session ending Friday, September 27. This comes amid ongoing chatter about the crypto market’s recovery.

With a track record of less-than-desirable returns in September, given it has historically been Bitcoin’s worst-performing month, markets anticipate better fortunes in October as the month nears its end.

Crypto ETFs Inflows At Multi-Week Highs

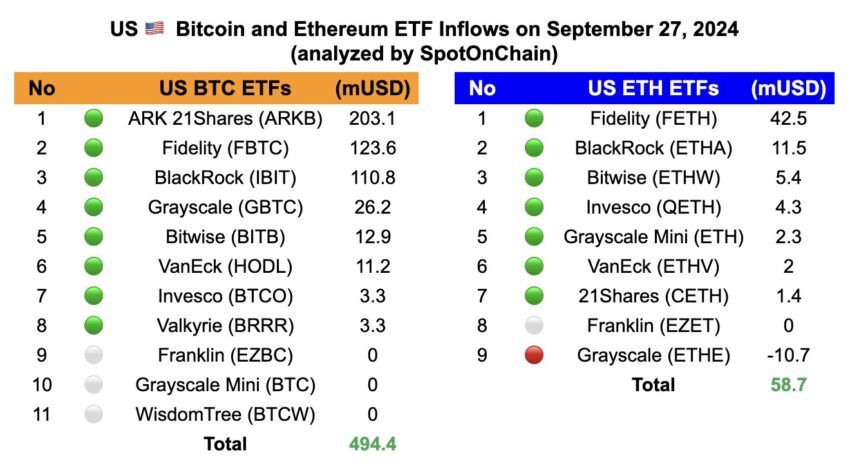

Crypto investors bought 7,526 Bitcoin (BTC) and 22,310 Ethereum (ETH) on Friday, resulting in net inflows of $494.4 million and $58.7 million for Bitcoin and Ethereum ETFs, respectively.

Spotonchain, an on-chain insights tool, reported that these inflows catapulted total weekly flows to levels last seen weeks ago. Specifically, Bitcoin (BTC) ETFs recorded a total of $1.11 billion in positive flows, marking the largest weekly inflow since July 19.

On the other hand, Ethereum (ETH) ETFs had up to $84.6 million in total inflows between Monday and Friday, the largest weekly inflow since August 9.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

Data from Farside Investors corroborates the report. It shows BlackRock’s IBIT ETF led the inflows daily, save for Monday, where it recorded $11.5 million, against Fidelity’s FBTC, which recorded $24.9 million in positive flows.

Since their debut in the US market in January 2024, spot Bitcoin ETFs have been a magnet for institutional investors. They offer direct portfolio inclusion of Bitcoin, bypassing the challenges of direct purchase and secure storage.

As BeInCrypto reported, more than 1,000 institutional investors signed on within just two 13F filing periods. This highlights how the market’s response to BTC ETFs has been overwhelmingly positive.

Meanwhile, in the ETH ETF market, all issuers are struggling as the financial instrument continues to underperform. Nevertheless, mustering positive flows for both markets is not easy.

It comes as investors continue to bet on crypto market recovery, with Bitcoin holding well above $65,500.

Bitcoin price strength is closely tied to broader economic indicators that suggest a rise in liquidity. Such a turnout often benefits Bitcoin due to its sensitivity to liquidity changes. For starters, China is considering fiscal aid for its citizenry amidst a struggling economy. Similarly, the US Federal Reserve recently cut interest rates, which often bodes well for risk-on assets.

Various economists have commented on the rising liquidity, including macro researcher Julien Bittel.

“Liquidity is on the rise again, and Bitcoin – being extremely sensitive to changes in liquidity conditions – has the potential to move explosively as fresh liquidity flows into the system. The macro environment is shifting. A major liquidity wave is now on the horizon, and when it hits, Bitcoin looks primed for a strong push higher in Q4,” Bittel said.

Similarly, the Global Money Index (GMI) also shows rising liquidity. This metric measures the volume of money in circulation among consumers and banks.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

An increase in the GMI typically signals more funds circulating and ready for spending. This could lead to increased Bitcoin purchases.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link