Binance Unveils Exciting FLUID Perpetual Futures with 75x Leverage

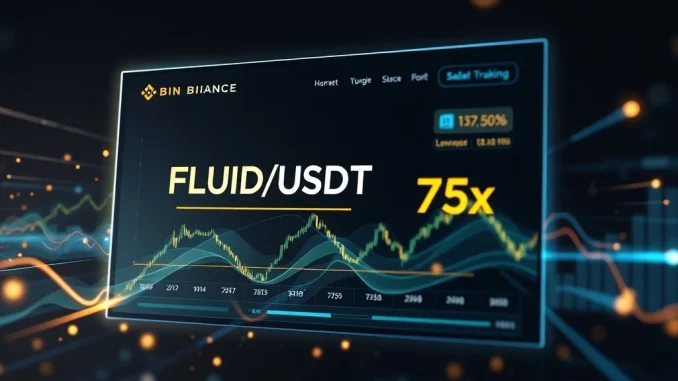

The cryptocurrency market constantly evolves. Thus, leading exchanges frequently introduce new trading opportunities. Binance, a global leader in digital asset trading, has announced a significant development. It plans to list a **FLUID/USDT perpetual futures** contract. This move provides traders with a new avenue for engagement. This exciting **Binance listing** will offer up to **75x leverage**, significantly expanding trading possibilities for the FLUID token.

Unpacking Binance’s FLUID Perpetual Futures Listing

Binance confirmed this new offering on its official website. The addition of the FLUID/USDT perpetual futures contract marks a notable event. Perpetual futures contracts allow traders to speculate on asset prices without an expiry date. This flexibility makes them popular in the fast-paced crypto market. The contract will utilize USDT as the margin asset. This provides stability and familiarity for many traders.

Furthermore, the availability of up to **75x leverage** stands out. Leverage amplifies both potential gains and losses. Consequently, it attracts experienced traders seeking higher exposure. However, it also demands careful risk management. This **Binance listing** introduces FLUID to a broader audience of derivatives traders. It potentially increases the token’s liquidity and market presence.

What is FLUID and Why Does it Matter?

FLUID is a decentralized liquidity aggregator. It aims to bridge traditional finance and decentralized finance (DeFi). The project focuses on providing institutional-grade liquidity and execution. It seeks to reduce latency and improve capital efficiency. Its goal is to make digital asset trading more accessible and efficient for large-scale participants. Therefore, a listing on Binance, a major global exchange, is crucial for its growth. This exposure can significantly boost FLUID’s adoption and trading volume.

Understanding Perpetual Futures Contracts and Crypto Futures

Perpetual futures contracts are a cornerstone of **crypto futures** trading. Unlike traditional futures, they do not have a settlement date. Instead, they employ a mechanism called a ‘funding rate.’ This rate ensures the contract price stays close to the underlying asset’s spot price. Traders pay or receive funding rates periodically. This mechanism prevents large divergences between the futures and spot markets.

The concept of leverage is central to **perpetual futures**. Leverage allows traders to open larger positions with a smaller amount of capital. For instance, with 75x leverage, a trader can control a position worth $7,500 with just $100. While this can lead to substantial profits, it also carries significant risks. A small adverse price movement can result in rapid liquidation of a trader’s position. Thus, understanding the mechanics of leverage is paramount for successful trading.

Navigating High-Leverage Trading on Binance

Binance offers various tools to manage risks associated with high-leverage trading. These include stop-loss orders and take-profit orders. Traders can also choose between isolated and cross margin modes. Isolated margin limits the risk to a specific position. Conversely, cross margin uses the entire futures account balance as collateral. New traders should thoroughly understand these options. They must also start with lower leverage to gain experience. The **Binance listing** of FLUID perpetual futures opens new doors. However, it also underscores the need for educated trading decisions.

The Impact of the Binance Listing on FLUID’s Market Dynamics

A **Binance listing** often brings increased visibility and liquidity to a token. This is particularly true for perpetual futures contracts. They attract a diverse range of traders. These include speculators, arbitrageurs, and institutional players. Increased liquidity can lead to tighter bid-ask spreads. It can also result in more efficient price discovery for FLUID. Furthermore, the ability to short FLUID via perpetual futures provides new hedging opportunities. This flexibility benefits market participants.

The FLUID token itself plays a vital role in its ecosystem. It powers the Fluid Finance platform. This platform aims to provide seamless cross-chain liquidity. The **Binance listing** elevates FLUID’s profile within the broader crypto community. It validates the project’s potential. This development could attract more users and developers to the Fluid ecosystem. Therefore, the impact extends beyond just trading volume.

Future Prospects for FLUID and Crypto Futures Trading

The continuous expansion of **crypto futures** offerings on platforms like Binance signals a maturing market. More sophisticated financial instruments become available. This allows for more complex trading strategies. The inclusion of FLUID highlights the growing interest in projects that bridge traditional finance and blockchain. This trend is likely to continue. Traders should stay informed about new listings and market developments. Such knowledge is key to navigating the dynamic crypto landscape.

In conclusion, Binance’s decision to list the FLUID/USDT perpetual futures contract is a notable event. It offers traders new opportunities. It also enhances FLUID’s market presence. However, as with all leveraged trading, prudence and risk management remain essential. This **Binance listing** reflects the ongoing innovation within the digital asset space.

Frequently Asked Questions (FAQs)

What is FLUID?

FLUID is a decentralized liquidity aggregator. It aims to provide institutional-grade liquidity and efficient execution for digital assets. It connects traditional finance with decentralized finance (DeFi) ecosystems.

What are perpetual futures contracts?

Perpetual futures contracts are a type of derivative. They allow traders to speculate on the future price of an asset without an expiration date. A ‘funding rate’ mechanism keeps their price anchored to the underlying asset’s spot price.

What does 75x leverage mean in this context?

75x leverage means traders can open a position 75 times larger than their initial margin. For example, with $100, a trader can control a $7,500 position. This amplifies both potential profits and losses significantly.

How can traders access the FLUID/USDT perpetual futures contract?

Traders can access the FLUID/USDT perpetual futures contract on the Binance futures trading platform. They will need a Binance account and to enable futures trading functionality.

What are the primary risks associated with high-leverage trading on Binance?

The primary risks include rapid liquidation of positions due to small price movements, amplified losses, and the potential for margin calls. It is crucial to use risk management tools like stop-loss orders and to trade responsibly.

When did Binance list the FLUID perpetual futures contract?

Binance announced the listing of the FLUID/USDT perpetual futures contract to be effective at a specific time, as stated on its official website. Traders should check Binance’s announcements for the exact launch schedule.

Related News

- BNB ETP Achieves Landmark Listing on Nasdaq Stockholm, Opening Nordic Markets

- US Stock Market Plunges at Open: Understanding the Crypto Market Impact

- Bitcoin-Linked Annuity: Delaware Life's Revolutionary Product Using BlackRock's IBIT ETF

Related: MicroStrategy Short Interest Skyrockets: The $4.8B Bet Against Wall Street's Bitcoin Bellwether

Related: Bitcoin Technical Shock: Weekly RSI Plunges Below Mt. Gox, 2018 Bear, and COVID Crash Lows

Related: Revolutionary Partnership: 4AI and DeAgentAI Build Trustless Infrastructure for Autonomous AI Agents