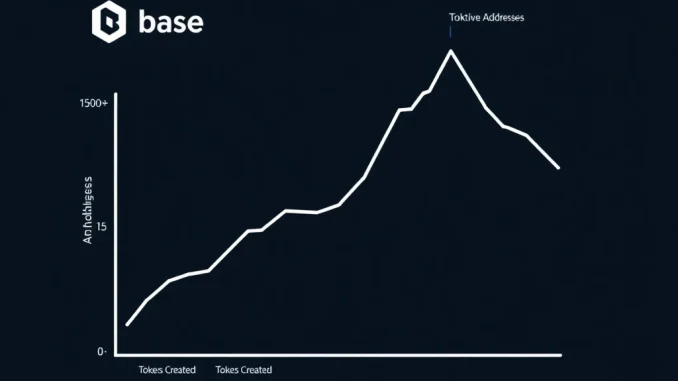

Global, May 2025: A significant divergence in key metrics is raising pointed questions about the current state of the Base blockchain. According to data reported by Wu Blockchain, the number of Base network active addresses has fallen to its lowest point in a year and a half. This notable decline in user engagement unfolds against a paradoxical backdrop: a massive surge in new token creation on the same network, with daily figures sometimes exceeding 100,000 tokens. Concurrently, the overall transaction count on Base is also trending downward, painting a complex picture of ecosystem dynamics that demands closer examination.

Base Network Active Addresses Hit Critical Low

The core metric of daily active addresses (DAAs) serves as a fundamental health indicator for any blockchain network. It measures the number of unique addresses that successfully initiate a transaction on a given day, representing real user participation. For Base, a Layer 2 scaling solution built on Ethereum by Coinbase, this metric has entered a pronounced slump. Reaching an 18-month low signals a potential cooling of organic user activity, which contrasts sharply with the network’s earlier growth phases following its public launch. Analysts typically scrutinize such trends to gauge whether a network is attracting sustained usage or experiencing speculative churn. The decline suggests that while the infrastructure may be hosting significant asset creation, the breadth of individual users interacting with those assets is contracting.

Understanding the Surge in Token Issuance

In direct contrast to the falling user count, the pace of token creation on Base has accelerated dramatically. The past month has witnessed periods where over 100,000 new tokens were deployed on the network daily. This explosion is largely facilitated by the proliferation of easy-to-use token creation tools and memecoin culture, where communities rapidly launch tokens often tied to internet trends. Several factors drive this surge:

- Low-Cost Deployment: Base’s low transaction fees make it economically viable to create and experiment with countless tokens.

- Cultural Momentum: The network has become a favored hub for memecoin activity, attracting developers and speculators.

- Technical Accessibility: Simplified smart contract templates allow users with minimal coding experience to launch tokens.

However, this high volume of issuance does not inherently translate to widespread adoption or value. Many of these tokens see minimal liquidity and are held by a very small cohort of creators and early participants, which may explain the disconnect from the active address metric.

The Transaction Volume Conundrum

Adding another layer to the analysis is the reported downward trend in the total number of transactions on the Base network. Typically, a surge in token creation would generate a flurry of related transactions—deployments, initial liquidity provisions, and early trading. The fact that both transactions and active addresses are declining while token counts soar presents a puzzle. It implies that the token issuance activity may be concentrated among a shrinking group of sophisticated actors or automated systems, rather than sparking broad-based transactional engagement. This scenario can occur when activity is dominated by airdrop farmers, sybil attackers creating multiple tokens from few addresses, or large-scale deployers using scripts, rather than genuine, diverse user interaction.

Historical Context and Layer 2 Competition

To fully appreciate this moment for Base, one must consider the competitive landscape of Ethereum Layer 2 networks. Platforms like Arbitrum, Optimism, and Polygon zkEVM are in a constant battle for developers, users, and total value locked (TVL). Base enjoyed a first-mover advantage in accessibility due to its integration with Coinbase’s massive user base. Periods of frenzied activity, often driven by viral memecoins or major airdrop campaigns, are common in this space but are frequently followed by consolidation phases. The current data may indicate Base is in such a consolidation phase, where initial hype dissipates and the network’s long-term utility is tested. Historical patterns on other chains show that sustainable growth is built on foundational DeFi applications, NFT ecosystems, and real-world utility, not token creation volume alone.

Implications for Developers and Investors

This divergence in metrics carries practical implications. For developers considering building on Base, the environment presents both opportunity and caution. The low barrier to token creation fosters innovation and experimentation but may also contribute to a noisy, saturated environment where quality projects are harder to surface. For investors and users, the data underscores the importance of looking beyond superficial activity metrics. A high number of token deployments can be a misleading indicator of ecosystem health if it is not coupled with growing, engaged users and meaningful transaction volume. It highlights the critical difference between speculative asset generation and the development of usable, recurring applications that solve real problems.

Conclusion

The current state of the Base network active addresses reaching an 18-month low amidst a token issuance boom presents a classic case of quantitative versus qualitative growth in blockchain ecosystems. The data reveals a network experiencing intense asset creation concentrated among potentially fewer participants, while broader user engagement and transaction volume wane. For Base, the path forward likely hinges on transitioning from a phase dominated by speculative token launches to one anchored by durable applications that attract and retain a growing, active user base. This moment serves as a valuable reminder that in the metrics-driven world of crypto, not all activity is created equal, and sustainable growth requires genuine user adoption.

FAQs

Q1: What are “active addresses” on a blockchain?

Active addresses refer to the number of unique cryptocurrency addresses that successfully initiate a transaction on a network within a specific time period, typically a day. It is a key metric for measuring genuine user participation and engagement.

Q2: Why would token issuance surge while active addresses fall?

This can happen when token creation is driven by a small group of developers, automated systems, or speculators using a limited set of addresses. It indicates the activity is concentrated and not representative of broad, organic user growth on the network.

Q3: Is a decline in active addresses always bad for a blockchain?

Not necessarily. It can signal the end of a speculative hype cycle and a shift towards consolidation. The key is what follows: a continued decline may indicate waning interest, while stabilization could precede growth driven by more substantial, utility-based applications.

Q4: How does Base’s transaction cost affect these trends?

Base’s low fees directly enable the high volume of token issuance by making deployment economically trivial. However, low fees alone do not guarantee sustained user activity if the applications and tokens being created lack lasting utility or appeal.

Q5: What should be watched to see if Base’s user engagement recovers?

Observers should monitor for growth in active addresses paired with increases in transaction volume related to core DeFi protocols, NFT marketplaces, or other non-token-creation applications. A rebound driven by diverse, usable dApps would be a stronger sign of health than another spike in token launches.