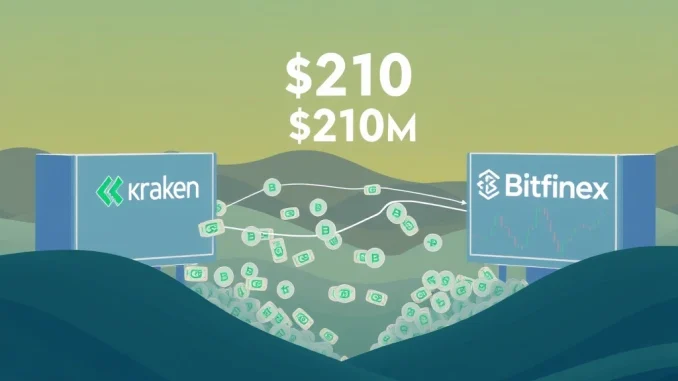

A ripple of excitement and speculation recently swept through the crypto world. A substantial USDT transfer, totaling a staggering $210 million, was observed moving from Kraken, a prominent U.S.-based cryptocurrency exchange, to Bitfinex, another major global platform. This colossal movement, meticulously tracked by blockchain monitoring service Whale Alert, has ignited a flurry of discussions among market participants. What exactly does such a massive transfer signify, and what are the potential ripple effects on the broader crypto ecosystem? Let’s dive in.

Unpacking the Monumental USDT Transfer

The recent $210 million USDT transfer is more than just a large number; it represents a significant capital shift within the digital asset space. Tether’s USDT, being the largest stablecoin pegged 1:1 to the U.S. dollar, is a crucial tool for traders and institutions alike. Its primary purpose is to facilitate large trades, manage liquidity across exchanges, and capitalize on price discrepancies without the volatility associated with other cryptocurrencies.

- Scale: The sheer magnitude of $210 million immediately grabs attention, indicating a major strategic move by a significant market player.

- Origin & Destination: Moving from Kraken, known for its strong regulatory compliance and institutional services, to Bitfinex, a hub for high-liquidity trading and its historical ties to Tether, suggests specific intentions.

- Tracking: Blockchain monitoring services like Whale Alert play a vital role in providing transparency, allowing the market to observe such large-scale movements in near real-time.

Why Kraken and Bitfinex? The Dynamics of Crypto Arbitrage

The choice of exchanges for this monumental USDT transfer is particularly insightful. Kraken and Bitfinex, while both major players, serve slightly different niches within the crypto landscape. This transfer could signal an intent to leverage Bitfinex’s deep order books or access its over-the-counter (OTC) capabilities for executing large transactions with minimal price slippage. One of the most common speculations surrounding such transfers is the pursuit of crypto arbitrage opportunities.

Crypto arbitrage involves exploiting small price differences for the same asset across different exchanges. For instance, if USDT trades at $1.001 on Kraken and $0.999 on Bitfinex, a savvy trader could theoretically buy on Bitfinex and sell on Kraken for a quick profit, provided the transaction fees don’t negate the gain. While USDT is pegged to the dollar, minor fluctuations can occur, especially during periods of high volume or specific market events. Large transfers like this one provide the necessary liquidity to execute such strategies effectively.

Beyond arbitrage, the transfer might also facilitate large-scale OTC deals. These private transactions allow institutions or ‘whales’ to buy or sell substantial amounts of cryptocurrency without impacting the public order books, ensuring discretion and better price execution for significant volumes.

Stablecoin Liquidity: The Silent Force Behind Market Stability

Unlike transfers of volatile assets like Bitcoin or Ethereum, a stablecoin liquidity transfer doesn’t directly alter the supply of cryptocurrencies or immediately trigger price changes. However, it can profoundly influence market sentiment and liquidity dynamics. The inflow of $210 million USDT to Bitfinex, for example, might indicate an increased demand for stablecoins on that platform, potentially linked to upcoming trades or redemptions of other cryptocurrencies.

Furthermore, large-scale USDT movements often reinforce confidence in Tether’s operational resilience. The fact that such a significant amount can be moved seamlessly, maintaining its 1:1 peg to the U.S. dollar, underscores the stablecoin’s reliability in facilitating large capital reallocations. While the direct market impact is indirect, these transfers can act as precursors to significant buying or selling pressure if the stablecoin is subsequently used to execute trades on other cryptocurrencies, thereby influencing their prices.

Decoding Whale Activity: Insights into Market Moves

This $210 million USDT transfer vividly highlights the role of “whale activity” in shaping crypto markets. Whales are entities or individuals holding substantial cryptocurrency reserves, and their large transfers are often tactical maneuvers to optimize strategies. For instance, moving USDT between exchanges can enable arbitrageurs to exploit price gaps for profit, while institutions might redistribute assets to balance liquidity across various platforms.

Tracking such movements is a key tool for market analysts and savvy traders. Platforms like Whale Alert and various blockchain explorers provide real-time data on these large transactions, allowing market participants to infer potential trends and anticipate future market shifts. However, interpreting these transfers requires careful contextual analysis:

- Direction of Funds: Whether funds move from an exchange to a private wallet (often signaling accumulation or long-term holding) or between exchanges (suggesting trading, arbitrage, or liquidity management) offers crucial clues about the actor’s intent.

- Frequency: Repeated large transfers to or from an exchange may signal sustained strategies, while isolated events could indicate opportunistic moves.

Understanding these patterns helps market participants make more informed decisions, even amidst the speculative nature of interpreting whale movements.

The Enduring Significance of Stablecoins

Despite the speculative nature of interpreting this specific USDT transfer, the event unequivocally underscores the importance of stablecoins in facilitating large-scale operations within the crypto market. USDT’s dominance makes it a critical asset for traders and institutions, enabling swift and efficient capital reallocation across diverse platforms. As the crypto market continues its journey towards maturity, the intricate interplay between stablecoin transfers and broader market dynamics will undoubtedly remain a focal point for investors, analysts, and regulators alike.

These movements are not just isolated incidents; they are vital pulses reflecting the health, strategies, and evolving landscape of the global cryptocurrency market. Keeping an eye on these significant transfers offers a glimpse into the sophisticated operations that underpin the digital economy.

Frequently Asked Questions (FAQs)

1. What was the recent significant USDT transfer?

A $210 million USDT transfer was recently reported, moving from the Kraken cryptocurrency exchange to Bitfinex, sparking widespread speculation in the crypto community.

2. Why do large USDT transfers happen between exchanges?

Large USDT transfers between exchanges typically occur for several reasons, including exploiting crypto arbitrage opportunities (profiting from price differences), managing liquidity across platforms, or facilitating large over-the-counter (OTC) deals without impacting public order books.

3. How do stablecoin transfers affect the crypto market?

While stablecoin transfers like USDT do not directly alter the supply or price of volatile cryptocurrencies, they can influence market sentiment and liquidity dynamics. They often precede significant buying or selling pressure on other assets and reinforce confidence in the stablecoin’s peg and operational resilience.

4. What is ‘whale activity’ in crypto?

‘Whale activity’ refers to the large-scale transactions executed by individuals or entities holding substantial amounts of cryptocurrency. These ‘whales’ often move funds strategically for purposes like arbitrage, liquidity management, or large private deals, and their movements are closely watched by market analysts.

5. How can one track large crypto transfers?

Large crypto transfers can be tracked using blockchain monitoring services like Whale Alert or by directly using blockchain explorers for specific networks. These tools provide real-time data on significant transactions, allowing for analysis of fund movements and potential market implications.

6. What is the significance of USDT in the crypto ecosystem?

USDT (Tether) is the largest stablecoin, pegged 1:1 to the U.S. dollar. Its significance lies in its role as a bridge between fiat and crypto, enabling swift and efficient capital reallocation, facilitating large trades, and providing stability for traders during volatile market conditions.