In the dynamic world of digital assets, **XRP News** continues to command significant attention. While much of the broader cryptocurrency market grapples with consolidation and weakened momentum, XRP has demonstrated remarkable resilience. Its ability to maintain a strong position above its 50-day exponential moving average (EMA) at $2.64 is a crucial indicator, signaling underlying mid-term bullish sentiment. This performance offers a stark contrast to major players like Bitcoin and Ethereum, which have recently experienced profit-taking and a decline in momentum. Could this be a sign of something bigger for XRP?

XRP News Today: A Resilient Stand in a Volatile Market

Amidst a period of broader market uncertainty, XRP has carved out a unique narrative. The cryptocurrency, often lauded for its utility in cross-border payments, has successfully held above its 50-day EMA. This technical level is widely watched by traders as it represents the average closing price over the past 50 days, acting as a dynamic support or resistance line. Sustaining above it typically suggests that buyers are in control and the asset is in an uptrend.

This resilience is particularly noteworthy when considering the wider market sentiment. The Altcoin Season Index, a metric that gauges the likelihood of an altcoin bull run, has fallen to 37, significantly below the 75 threshold generally considered indicative of an ‘alt season’. This suggests that capital is not broadly flowing into altcoins as it once was. Yet, XRP’s steadfastness highlights a potential decoupling from these broader trends, drawing the eye of traders and investors looking for assets with clearer utility and strong technical foundations.

Decoding the XRP Technical Analysis: Is $5.50 Within Reach?

For those keen on **XRP Technical Analysis**, the charts tell a compelling story. Despite a 16.61% pullback from its all-time high of $3.70, XRP has remained within a critical range defined by its robust 50-day EMA support and the formidable $3.25 resistance level. Analysts view this $3.25 mark as a pivotal gateway; a decisive breakout above it could ignite a renewed bullish surge.

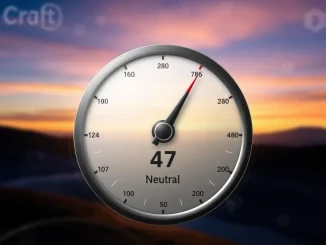

Current technical indicators suggest a balanced market dynamic. The Relative Strength Index (RSI) for XRP has stabilized around 55. This neutral reading indicates that the asset is neither overbought nor oversold, suggesting a period of consolidation rather than an imminent breakdown. This neutrality aligns with a larger Elliott Wave structure, where the recent correction could represent Wave 4 of a broader uptrend. According to crypto strategist Man of Bitcoin, a sustained close above $3.25 could confirm the completion of this corrective phase, potentially propelling XRP towards an ambitious target of $5.50.

Key Technical Levels for XRP:

- Critical Support: $2.64 (50-day EMA)

- Immediate Resistance: $3.25

- Psychological Support: $3.00

- Potential Upside Target: $5.50

Beyond the Charts: On-Chain Data and Institutional Confidence in XRP

The bullish narrative for XRP isn’t solely confined to technical charts; robust on-chain data provides further validation. The XRP Ledger (XRPL) has seen significant growth, with the number of active wallets reaching an impressive 7.24 million. This surge, coupled with elevated daily active addresses, reflects growing adoption and utility, particularly in the burgeoning sectors of Decentralized Finance (DeFi) and cross-border payments. XRP’s inherent speed and low transaction costs make it an attractive option for these applications, distinguishing it from other cryptocurrencies that may face scalability challenges.

Adding to this confidence is the persistent trend of whale accumulation. Large holders, often referred to as ‘whales,’ have continued to add XRP to their portfolios. This accumulation, despite short-term market volatility, is a strong signal of institutional confidence. It suggests that major players see long-term value in XRP’s technology and its ecosystem, viewing current price fluctuations as opportunities for strategic entry rather than reasons for concern. Trading activity on major exchanges further corroborates this, showing a discernible shift toward longer-term accumulation strategies among institutional investors.

The Ripple SEC Settlement and Its Global Impact on XRP

A significant factor underpinning XRP’s recent performance and investor confidence is the progress in the **Ripple SEC Settlement**. The resolution of the protracted legal battle with the U.S. Securities and Exchange Commission has brought much-needed regulatory clarity to XRP’s status in the United States. While this landmark settlement has substantially reduced legal uncertainty, it’s important to acknowledge that it hasn’t entirely alleviated global regulatory risks, as different jurisdictions have varying approaches to digital asset regulation.

However, this newfound clarity has allowed Ripple to focus more intently on its core mission: leveraging XRP as a bridge currency for efficient cross-border transactions. Analysts observe that XRP’s unique role in facilitating instantaneous and low-cost international payments may provide it with a degree of insulation from broader macroeconomic pressures that often affect other crypto markets. This utility-driven demand could serve as a buffer against wider market downturns, making XRP an appealing asset for those seeking stability in a volatile sector.

Navigating Risks and Future XRP Price Prediction Scenarios

While the outlook for XRP appears promising, it’s crucial for investors and traders to acknowledge potential risks and understand various **XRP Price Prediction** scenarios. The crypto market remains inherently volatile, and even strong assets like XRP are not immune to significant price swings.

A primary risk lies in a potential breakdown below the critical 50-day EMA at $2.64. Such a move could trigger renewed bearish pressure, similar to the 50% correction XRP experienced in early July. During that period, profit-taking combined with broader market weakness led to a sharp decline, underscoring the importance of key support levels. Traders are closely monitoring the $3.00 level as a crucial psychological and technical support zone. A sustained break below this point could extend the correction phase, potentially pushing XRP towards lower support levels.

Conversely, the market has recently witnessed a ‘Golden Cross’ event on July 22. This technical signal occurs when a short-term moving average (e.g., the 50-day EMA) crosses above a long-term moving average (e.g., the 200-day EMA). This event is historically associated with the onset of a significant uptrend, reinforcing positive sentiment among XRP holders and could provide further impetus for an upward trajectory. However, ongoing regulatory developments globally and broader macroeconomic shifts will continue to play pivotal roles in shaping XRP’s path forward.

As the cryptocurrency market navigates this period of consolidation and cooldown, XRP’s ability to maintain its position above the 50-day EMA will be a central focus for traders and investors alike. A sustained hold above $2.64 could validate the robust bullish case for a new all-time high, cementing its position as a leading digital asset with tangible utility. Conversely, a breakdown could extend the consolidation phase, testing the patience of its holders. XRP’s performance in the coming weeks and months may also significantly influence broader altcoin sentiment, particularly for smaller-cap projects seeking traction in what is currently a risk-off environment.

Frequently Asked Questions (FAQs)

What is the 50-day EMA and why is it important for XRP?

The 50-day Exponential Moving Average (EMA) is a technical indicator that tracks the average price of an asset over the past 50 days, giving more weight to recent prices. For XRP, holding above its 50-day EMA at $2.64 signifies strong mid-term bullish momentum and acts as a key support level. It suggests that the buying pressure is currently outweighing selling pressure over that period.

What does the $3.25 level mean for XRP’s price?

The $3.25 level is identified as a significant resistance point for XRP. A sustained breakout and close above this level are seen by analysts as a pivotal confirmation of the completion of its recent correction, potentially signaling the start of a new, stronger bullish impulse towards higher price targets, such as $5.50.

How does the Ripple SEC settlement affect XRP?

The settlement between Ripple and the U.S. Securities and Exchange Commission (SEC) has provided much-needed regulatory clarity for XRP’s status in the United States. This reduced legal uncertainty has boosted investor confidence and allowed Ripple to further focus on leveraging XRP for its core utility in cross-border payments, potentially insulating it from some broader market pressures.

What are the main risks for XRP’s price going forward?

Despite positive indicators, key risks for XRP include a potential breakdown below its 50-day EMA ($2.64) or the psychological support level of $3.00, which could trigger renewed bearish pressure and extend its correction phase. Additionally, ongoing global regulatory developments and broader macroeconomic shifts continue to pose potential challenges.

Is XRP used in DeFi and cross-border payments?

Yes, XRP is increasingly being adopted in both Decentralized Finance (DeFi) and cross-border payment solutions. Its underlying technology, the XRP Ledger, offers high speed and low transaction costs, making it highly suitable for facilitating efficient and cheap international transfers and integrating into various DeFi protocols.

What is a ‘Golden Cross’ in crypto trading?

A ‘Golden Cross’ is a bullish technical indicator that occurs when a short-term moving average (e.g., the 50-day EMA) crosses above a long-term moving average (e.g., the 200-day EMA). This event is historically associated with the start of a significant uptrend, reinforcing positive sentiment among traders and investors, though it is not a guaranteed predictor of future price action.