XRP Price News: The Surprising Shift as DeepSnitch AI Outperforms with 165% Presale Surge

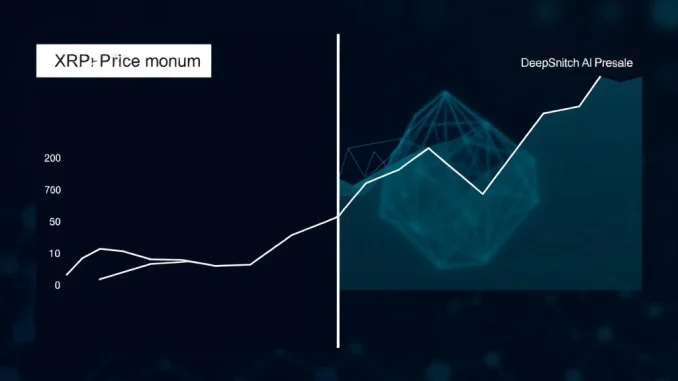

Global, May 2025: Recent XRP price news highlights a period of consolidation for the Ripple-affiliated asset, contrasting sharply with market movements elsewhere in the cryptocurrency sector. While XRP demonstrates stalled momentum, a newer project named DeepSnitch AI has captured significant attention by attracting over $1.55 million from large-scale investors and posting a 165% surge during its presale phase. This divergence underscores a broader trend where capital is flowing toward projects perceived to offer tangible, real-world utility beyond established payment networks.

XRP Price News: Analyzing the Current Stalemate

The XRP price has entered a phase of notable consolidation. Market data from major exchanges shows the asset trading within a narrow band, failing to break through key resistance levels that analysts identified earlier in the year. This period of stalled momentum follows a volatile few years for XRP, heavily influenced by its ongoing legal proceedings with the U.S. Securities and Exchange Commission (SEC). Although Ripple secured several partial legal victories, the clarity many investors hoped would trigger a sustained rally has been slow to materialize in the price action. Market sentiment appears cautious, with trading volumes for XRP declining relative to the broader altcoin market. Analysts point to several factors for this stagnation, including macroeconomic pressures on risk assets and a competitive landscape where newer blockchain solutions are vying for the cross-border payment niche Ripple pioneered.

The Rise of DeepSnitch AI and the $1.55M Whale Movement

Concurrent with XRP’s flat performance, the DeepSnitch AI project has generated considerable buzz. The project’s presale, a fundraising event where tokens are sold to early investors before a public listing, has concluded with a reported 165% increase from its initial offering price. More notably, blockchain analytics firms tracked substantial transactions totaling more than $1.55 million flowing into the presale from wallets commonly associated with cryptocurrency “whales”—entities holding large amounts of capital. This level of institutional or high-net-worth interest at such an early stage is often interpreted as a strong signal of confidence in a project’s underlying technology and business model. The presale structure itself, which often includes vesting periods to prevent immediate sell pressure, suggests a longer-term investment horizon from these backers.

Understanding the “Utility Chase” in Modern Crypto Investing

The contrasting fortunes of XRP and DeepSnitch AI point to a pivotal shift in cryptocurrency investment theses. Following the market cycles of 2021-2023, which were often driven by speculation and narrative, 2025 appears to be a year where demonstrable utility is a primary filter for capital allocation. Investors are increasingly scrutinizing a project’s actual use case, its technological differentiation, and its potential for real-world adoption. DeepSnitch AI, as the name implies, is marketing itself at the intersection of artificial intelligence and blockchain security, proposing solutions for smart contract auditing and decentralized finance (DeFi) protocol safety. This addresses a clear and persistent pain point in the ecosystem: the billions lost to hacks and exploits. In contrast, while Ripple’s payment network has real-world banking partners, the direct utility and value accrual to the XRP token itself remains a topic of ongoing debate and evolution within the community.

Comparative Analysis: Established Networks vs. Emerging Tech

A side-by-side examination reveals the different stages and value propositions of these assets. XRP operates within a mature, enterprise-focused ecosystem with existing partnerships but faces regulatory legacy issues and questions about decentralized governance. DeepSnitch AI represents an emerging, technology-first approach targeting a specific and growing problem within the crypto industry itself. The following table outlines key comparative metrics based on available public information:

| Metric | XRP (Ripple Network) | DeepSnitch AI |

|---|---|---|

| Primary Use Case | Cross-border payment settlement | AI-powered smart contract & security auditing |

| Current Phase | Mainnet, scaling adoption | Presale, pre-mainnet launch |

| Recent Price Action | Consolidation, low volatility | 165% presale surge |

| Notable Investor Activity | General market trading | $1.55M+ from identified whale wallets |

| Key Market Driver | Legal clarity, banking adoption | Demand for DeFi security solutions |

This comparison is not to declare one project superior but to illustrate the market’s current appetite. High-risk, high-reward capital is flowing toward nascent projects solving acute, in-demand problems, while more established assets with broader, slower-moving use cases are seeing patient capital wait for larger catalysts.

Historical Context and Market Cycle Implications

The dynamic between a large-cap stalwart like XRP and a surging presale project is not new in cryptocurrency history. Similar patterns emerged in prior cycles, where innovation capital rotated from older narratives to new ones. For instance, the initial coin offering (ICO) boom of 2017 saw capital flood into new tokens, sometimes at the expense of Bitcoin and Ethereum dominance in the short term. The current interest in AI-blockchain convergence projects like DeepSnitch AI mirrors earlier fervor around decentralized finance (DeFi) and non-fungible tokens (NFTs). However, a key difference in 2025 is the increased sophistication of investors. The “whale” activity targeting DeepSnitch AI suggests due diligence is being applied, focusing on teams, technology, and tokenomics, rather than pure speculation. This could indicate a healthier, if still volatile, maturation within the altcoin market.

Conclusion: A Market Defining Its Next Phase

The current XRP price news, marked by stalled momentum, and the parallel 165% presale surge for DeepSnitch AI collectively paint a picture of a cryptocurrency market in transition. The chase for real, actionable utility is becoming the dominant narrative, steering investment away from pure protocol tokens toward applied technological solutions. While XRP’s journey is far from over and its role in global finance continues to develop, the immediate market enthusiasm has pivoted to address critical infrastructure gaps within the crypto ecosystem itself. The significant capital commitment from large investors into DeepSnitch AI’s presale underscores a belief that the next wave of substantial value creation may come from projects that secure and enable the broader decentralized web, rather than those seeking to interface with traditional systems. This divergence is a crucial development for any observer of cryptocurrency trends and XRP price news in 2025.

FAQs

Q1: What does “stalled momentum” mean for XRP?

In financial markets, “stalled momentum” refers to an asset’s price moving sideways with low volatility after a previous trend, failing to gain upward or downward traction. For XRP, it indicates a lack of strong buying or selling pressure despite recent company developments.

Q2: What is a cryptocurrency presale?

A presale is an early-stage fundraising event where a project sells its tokens to select investors, often at a discounted rate, before the tokens are listed on public exchanges. It provides the project with capital to develop its product.

Q3: Why is “whale” investment significant?

“Whale” investment is significant because these large, often sophisticated investors typically conduct extensive research. Their commitment of substantial capital ($1.55M+ in this case) is seen as a validation of the project’s potential, though it does not guarantee success.

Q4: How does DeepSnitch AI’s utility differ from Ripple’s?

Ripple’s utility focuses on facilitating fast, cheap cross-border payments for financial institutions. DeepSnitch AI proposes utility within the crypto space itself, using artificial intelligence to audit smart contract code and improve blockchain security, targeting a different problem set.

Q5: Does a successful presale mean a project will succeed long-term?

Not necessarily. A successful presale provides funding and initial interest, but long-term success depends on the team’s execution, technological delivery, market adoption, and broader crypto market conditions. Many projects with strong presales have failed to deliver a functional product.

Related News

- Bitcoin Set To Rally As Analysts Back 25 Bps Cut By Fed

- Bitcoin (BTC) Price Consolidation, Ethereum (ETH) Predictions After ETF Approvals, and More: Bits Recap May 27

- Best Altcoin to Hold in 2025: Analyst Says this DOGE Killer is Set to Skyrocket

Related: Crucial Debate: OKX CEO Star Xu Counters Claims That DEXs and CEXs Are Identical

Related: Binance Cross Margin Trading Expands with Crucial PAXG, ASTER, SUI, and XRP Pairs