Global, May 2025: The volatile nature of decentralized finance (DeFi) lending protocols has been starkly highlighted by a catastrophic leveraged trade involving the Venus (XVS) token. A single large investor, commonly referred to as a ‘whale,’ has incurred a loss of $1.09 million following a sharp price crash, according to on-chain data reported by blockchain analytics firm AmberCN. This event underscores the extreme risks associated with leveraged positions in the rapidly evolving DeFi landscape, where automated liquidations can trigger swift and significant financial damage.

Anatomy of a $1.09 Million Leveraged XVS Trade Loss

The sequence of events provides a textbook case of leveraged DeFi exposure gone wrong. The investor initiated a substantial position on the Venus Protocol, a leading lending and borrowing platform on the BNB Smart Chain. Their strategy involved using existing XVS tokens as collateral to borrow a stablecoin, which was then used to acquire more of the same volatile asset—a classic and risky leverage play.

Specifically, the whale borrowed 1.4 million USDT against their XVS holdings. They then used this borrowed capital to purchase an additional 532,000 XVS tokens. At the time of this leveraged purchase, the total value of the newly acquired XVS was approximately $2.81 million. This action significantly increased their exposure to the price movements of XVS while introducing the mandatory requirement to maintain a minimum collateral ratio, known on Venus as the ‘Health Factor.’

The Mechanics of DeFi Liquidation on Venus Protocol

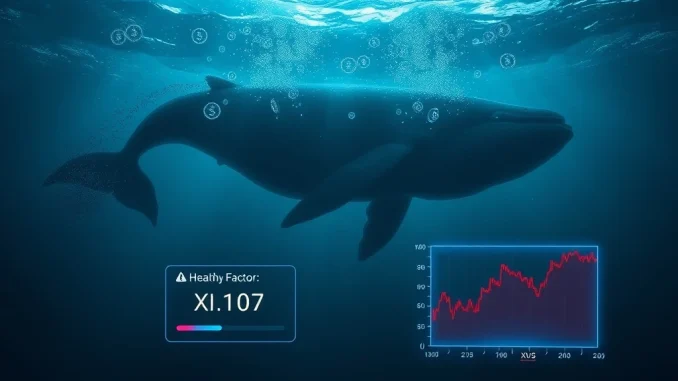

The subsequent market downturn triggered the protocol’s automated safety mechanisms. As the price of XVS began to fall sharply, the value of the investor’s collateral decreased. This caused their Health Factor—a numerical representation of the loan’s safety—to drop perilously low. When this factor falls below 1, the protocol’s liquidation engine automatically activates to protect the system from undercollateralized loans.

In this case, the protocol liquidated a portion of the collateral to repay the debt. A total of 287,000 XVS tokens were seized and sold on the market to cover $930,000 of the outstanding 1.4 million USDT loan. This forced sale in a declining market likely exacerbated the price drop. The cumulative financial damage from the leveraged position and the liquidation resulted in the reported total loss of $1.09 million. The position remains critically undercollateralized, with a Health Factor of just 1.07, leaving it vulnerable to further liquidation if the XVS price dips below $3.20.

- Initial Position: Collateralized XVS to borrow 1.4M USDT.

- Leveraged Purchase: Bought 532,000 XVS (~$2.81M worth).

- Trigger: XVS price fell 29.69% in a single day.

- Liquidation: 287,000 XVS sold to repay $930,000 USDT.

- Outcome: Total loss of $1.09 million; Health Factor at 1.07.

Market Context and the XVS Price Crash

This liquidation event did not occur in a vacuum. According to data from CoinMarketCap, XVS was trading at $3.45 at the time of the report, representing a severe intraday decline of 29.69%. Such dramatic volatility is not uncommon in the cryptocurrency market, particularly for governance tokens of specific DeFi protocols like XVS, which can be highly sensitive to broader market sentiment, protocol-specific news, and liquidity conditions. The sharp drop turned a high-risk leverage strategy into an immediate crisis, demonstrating how quickly market conditions can undermine even large, sophisticated positions.

Historical Precedents and Systemic Risks in DeFi Lending

The Venus Protocol has experienced significant stress tests in the past, most notably during the market turbulence of 2021 and 2022. These events led to bad debt within the system and prompted governance interventions. While protocols have since implemented more robust risk parameters and insurance mechanisms, this latest incident shows that fundamental risks persist. Leveraged positions inherently amplify both gains and losses, and when combined with the transparency and automation of blockchain-based finance, losses become public and irreversible in real-time.

This public nature serves as a powerful, if painful, learning tool for the entire DeFi community. Analysts and risk managers study these events to understand market dynamics, liquidity depths, and the real-world performance of protocol parameters under stress. For individual users, they are a stark reminder of the importance of conservative collateralization, understanding liquidation thresholds, and the dangers of over-leveraging in an unpredictable market.

Conclusion: A Costly Lesson in DeFi Risk Management

The $1.09 million loss from this leveraged XVS trade on the Venus Protocol encapsulates the high-stakes reality of decentralized finance. It underscores critical lessons: leverage magnifies risk, protocol parameters are unforgiving, and market volatility remains the dominant force. While DeFi offers unprecedented access to financial tools, this event reinforces that sophisticated functionality does not eliminate fundamental risk. For the ecosystem to mature, such costly lessons in risk management must lead to more educated participation, improved user interfaces that emphasize danger, and potentially more nuanced protocol designs that can mitigate the severity of such liquidations in the future.

FAQs

Q1: What is the Venus Protocol?

The Venus Protocol is a decentralized finance (DeFi) money market and synthetic stablecoin platform built on the BNB Smart Chain. It allows users to supply collateral to borrow assets or earn interest on deposits, similar to compound finance.

Q2: What does ‘Health Factor’ mean on Venus?

The Health Factor is a numerical representation of the safety of your borrowed position. It is calculated by dividing the value of your collateral by the value of your borrows. If it falls below 1, your position becomes eligible for liquidation to protect the protocol from bad debt.

Q3: How does a leveraged trade work in DeFi?

A user deposits an asset (like XVS) as collateral, borrows a stablecoin (like USDT) against it, and then uses that borrowed stablecoin to buy more of the original asset. This increases their exposure to the asset’s price movements, amplifying both potential profits and losses.

Q4: Why are large investors called ‘whales’ in crypto?

The term ‘whale’ is slang for an individual or entity that holds a large enough amount of a cryptocurrency that their trading activity can significantly influence the market price due to the size of their orders.

Q5: What happens to liquidated assets on Venus?

When a liquidation occurs, a portion of the borrower’s collateral is sold at a discount (a ‘liquidation penalty’) on the open market. The proceeds are used to repay the borrower’s debt. This process is performed automatically by ‘liquidators’—other users or bots—who are incentivized by the discount to keep the protocol healthy.