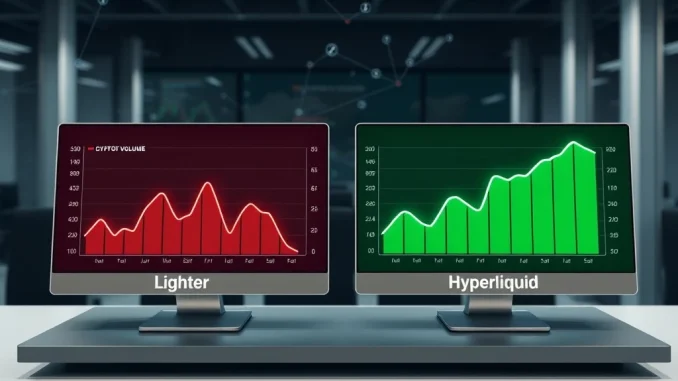

Blockchain data reveals a startling development in decentralized finance: Lighter trading volume has plummeted dramatically following its recent token distribution event, triggering significant shifts in the perpetual futures exchange landscape. According to blockchain analysis platform Cryptorank.io, the decentralized perpetual futures exchange (PerpDEX) experienced a nearly threefold decline in weekly trading volume from its peak, allowing competitor Hyperliquid (HYPE) to reclaim its position as the sector leader. This substantial volume decrease highlights critical market dynamics that every cryptocurrency trader should understand as we navigate the evolving DeFi ecosystem in 2025.

Lighter Trading Volume Analysis Reveals Post-Airdrop Decline

Cryptorank.io reported via social media platform X that Lighter’s weekly trading volume fell significantly after its recent airdrop distribution. The blockchain analytics firm documented a nearly threefold reduction from peak trading levels, representing one of the most substantial post-airdrop declines observed in the PerpDEX sector this year. This trading volume decrease follows a common pattern in decentralized finance where platforms experience temporary activity surges around token distribution events, then settle into more sustainable baseline levels. However, the magnitude of Lighter’s decline has surprised many market observers and prompted deeper analysis of platform fundamentals.

Perpetual futures exchanges represent a crucial segment within decentralized finance, enabling traders to speculate on cryptocurrency price movements without expiration dates. These platforms have gained substantial traction throughout 2024 and into 2025 as traders seek decentralized alternatives to traditional centralized exchanges. The recent volatility in Lighter trading volume provides valuable insights into market behavior, platform sustainability, and the competitive dynamics shaping the rapidly evolving DeFi derivatives landscape. Market analysts now examine whether this represents a temporary correction or signals more fundamental challenges for the platform.

Hyperliquid Reclaims PerpDEX Leadership Position

The decline in Lighter trading volume has directly enabled Hyperliquid (HYPE) to reclaim its position as the leading perpetual futures exchange by trading volume. This development represents a significant shift in the competitive hierarchy of decentralized derivatives platforms. Hyperliquid has maintained consistent trading activity throughout 2025, demonstrating platform resilience despite broader market fluctuations. The platform’s return to the top position highlights the importance of sustainable growth strategies in the highly competitive DeFi sector.

Cryptorank.io also highlighted Variational as another noteworthy platform in its analysis, noting daily trading volumes around the $1 billion level. This mention suggests a growing competitive landscape where multiple platforms compete for market share in the expanding perpetual futures sector. The current market structure reveals three distinct tiers: established leaders like Hyperliquid, recently launched platforms experiencing volatility like Lighter, and steadily growing competitors like Variational. This competitive diversity ultimately benefits traders through improved platform features, competitive fees, and enhanced trading tools.

Understanding Perpetual Futures Exchange Dynamics

Perpetual futures exchanges operate fundamentally differently from traditional spot exchanges or time-bound futures markets. These platforms utilize funding rate mechanisms to maintain contract prices close to underlying asset values, creating unique trading dynamics that experienced traders must understand. The recent fluctuations in Lighter trading volume demonstrate how platform-specific events can significantly impact trading activity across the entire PerpDEX ecosystem. Market participants should consider several factors when evaluating platform stability and longevity.

Firstly, liquidity depth remains crucial for sustainable trading volume. Platforms must maintain sufficient liquidity pools to accommodate large trades without substantial price impact. Secondly, user experience and platform reliability significantly influence trader retention, especially during periods of high market volatility. Thirdly, competitive fee structures and incentive programs play vital roles in attracting and maintaining active trading communities. Finally, platform security and smart contract robustness represent non-negotiable requirements in the decentralized finance space, where vulnerabilities can lead to catastrophic losses.

Post-Airdrop Volume Patterns in DeFi History

Historical analysis reveals that post-airdrop trading volume declines represent a common pattern throughout decentralized finance history. Many platforms experience temporary activity surges around token distribution events as participants claim and potentially trade newly received tokens. However, sustainable platforms typically stabilize at volumes significantly above pre-airdrop levels, while less competitive platforms may return to previous baselines or decline further. The specific characteristics of Lighter’s decline provide valuable case study material for understanding these dynamics.

Several factors typically influence post-airdrop volume sustainability. Platform utility beyond token speculation represents the most crucial determinant of long-term success. Platforms offering unique trading features, superior execution, or innovative financial products generally maintain higher post-airdrop retention rates. Additionally, tokenomics design significantly impacts trading behavior, with well-structured incentive programs encouraging continued platform engagement. Finally, broader market conditions inevitably influence individual platform metrics, making comparative analysis essential for accurate assessment.

The table below illustrates recent PerpDEX trading volume trends:

| Platform | Weekly Volume Change | Current Status | Notable Features |

|---|---|---|---|

| Hyperliquid (HYPE) | +15% | Market Leader | High liquidity, established community |

| Lighter | -67% from peak | Post-airdrop decline | Recent token distribution |

| Variational | +8% | Growing competitor | $1B daily volume threshold |

Market Implications and Trader Considerations

The shifting PerpDEX hierarchy carries significant implications for cryptocurrency traders and DeFi participants. Firstly, liquidity fragmentation across multiple platforms may impact trading execution quality, potentially increasing slippage for large orders. Secondly, competitive dynamics between platforms typically drive innovation, potentially leading to improved trading features and more favorable conditions for users. Thirdly, platform stability concerns may influence where traders choose to execute positions, particularly for longer-term strategies requiring reliable infrastructure.

Experienced traders should monitor several key metrics when evaluating perpetual futures exchanges. Trading volume represents just one indicator among many, alongside liquidity depth, funding rate stability, platform uptime, and security audit history. Additionally, regulatory developments continue shaping the DeFi landscape, with compliance considerations becoming increasingly important for platform sustainability. The current market environment emphasizes the importance of diversification across multiple platforms to mitigate counterparty risk and ensure access to liquidity during volatile market conditions.

Technical Analysis of Volume Decline Patterns

Blockchain data analysis reveals specific patterns in Lighter’s trading volume decline that merit technical examination. The nearly threefold reduction from peak levels occurred over a clearly defined timeframe, suggesting structured rather than chaotic market behavior. This pattern typically indicates that informed market participants systematically adjusted their trading activity based on changing platform dynamics or market conditions. Technical analysts examine such patterns to identify potential support levels where trading volume might stabilize.

Several technical factors commonly influence trading volume on decentralized exchanges. Smart contract efficiency directly impacts transaction costs and execution speed, particularly during periods of network congestion. Oracle reliability represents another crucial consideration for perpetual futures platforms, as price feed accuracy fundamentally determines trading integrity. Additionally, cross-platform arbitrage opportunities naturally influence volume distribution, as traders seek optimal execution across available venues. Understanding these technical dimensions provides deeper insight into the observed volume fluctuations.

Key technical considerations for PerpDEX evaluation include:

- Smart contract audit history – Comprehensive security reviews

- Oracle robustness – Price feed reliability and decentralization

- Transaction finality – Speed and certainty of trade execution

- Cross-chain compatibility – Support for multiple blockchain networks

- Liquidity pool design – Efficiency of market making mechanisms

Conclusion

The substantial decline in Lighter trading volume following its recent airdrop represents a significant development in the perpetual futures exchange sector. This event has enabled Hyperliquid to reclaim its position as market leader while highlighting the competitive dynamics shaping decentralized finance derivatives trading. The observed patterns align with historical post-airdrop volume behavior while providing specific insights into current market conditions. As the DeFi ecosystem continues maturing, such volume fluctuations offer valuable learning opportunities for traders, platform developers, and market analysts alike. Sustainable platform growth ultimately depends on fundamental utility rather than temporary incentive programs, a principle clearly demonstrated by recent trading volume dynamics across leading PerpDEX platforms.

FAQs

Q1: What caused Lighter trading volume to decline so dramatically?

The primary catalyst was the platform’s recent token airdrop. Many decentralized exchanges experience temporary volume surges around distribution events as participants claim and potentially trade newly received tokens. After this initial activity, volumes typically stabilize at more sustainable levels, though Lighter’s decline was particularly pronounced.

Q2: How does Hyperliquid compare to other PerpDEX platforms?

Hyperliquid has reclaimed its position as the leading perpetual futures exchange by trading volume following Lighter’s decline. The platform maintains consistent liquidity, established community support, and reliable infrastructure. Cryptorank.io also highlighted Variational as another significant platform with daily volumes around $1 billion.

Q3: What are perpetual futures exchanges (PerpDEX)?

Perpetual futures exchanges are decentralized platforms that allow traders to speculate on cryptocurrency price movements using perpetual contracts without expiration dates. These platforms utilize funding rate mechanisms to maintain contract prices close to underlying asset values and have become increasingly popular in decentralized finance.

Q4: Should traders be concerned about using platforms after airdrops?

Post-airdrop volume declines represent common market behavior rather than inherent platform problems. Traders should evaluate platforms based on fundamental factors including liquidity depth, security audits, user experience, and sustainable tokenomics rather than temporary volume fluctuations around specific events.

Q5: What metrics should traders monitor when evaluating PerpDEX platforms?

Key metrics include trading volume consistency, liquidity depth, funding rate stability, platform uptime, security audit history, smart contract efficiency, and oracle reliability. Comparative analysis across multiple platforms provides the most comprehensive evaluation framework for informed trading decisions.