Warning: Attempt to read property "post_excerpt" on null in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 392

Warning: Trying to access array offset on false in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 394

Warning: Attempt to read property "post_title" on null in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 394

[ad_1]

The staking world has changed a lot, and liquid staking is emerging as the new game changer in the Proof of Stake (PoS) space. Among the top contenders in the market is the STAKING AI platform which stands out as the best crypto staking platform for staking digital assets with top-notch infrastructure, high rewards, and user-centric services. This article will cover 9 of the best liquid staking platforms in 2024, starting with STAKING AI.

STAKING AI: The Future of Liquid Staking

STAKING AI redefines staking by combining innovation with simplicity. As a regulated infrastructure operator, STAKING AI offers non-custodial delegation services for PoS public blockchains. Investors can earn interest on their crypto holdings while having the flexibility of liquid staking.

Why Choose STAKING AI?

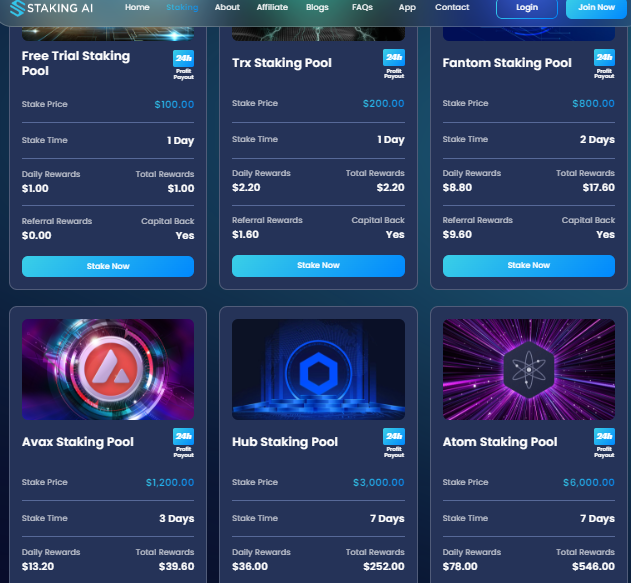

Free $100 Staking Bonus: You get a free $100 staking bonus for signing up, plus daily staking opportunities.

Referral Commissions: You earn up to 4% lifetime commissions by referring others to stake on the platform.

Flexible Staking Plans: There are various staking plans to suit different budgets and time frames, from daily, weekly, and long-term plans.

Top Tier Infrastructure: It has a global team that provides 24/7 node coverage for secure staking.

Ease of Use: It has simple registration, quick deposit options, and real-time rewards tracking for beginners and other users.

How to Get Started on STAKING AI

Sign Up: Register with email, username, and referral code if applicable.

Choose a Plan: Select from various staking pools like Ethereum, Polygon, or Solana depending on your investment goals.

Stake and Earn: Watch your rewards accumulate daily, and withdraw anytime.

STAKING AI is perfect for both novice and seasoned investors, offering a user-centric approach to staking while maintaining a strong emphasis on asset security.

Lido Finance

As a well-known name in the liquid staking space, Lido Finance supports major PoS networks like Ethereum, Solana, and Polygon. Users get derivative tokens like stETH for Ethereum that can be used in DeFi protocols for extra earnings.

Pros:

Multi-network support.

Integration with top DeFi platforms.

Cons:

High fees for small stakes.

Although Lido is a solid platform, it lacks the various staking plans and referral incentives of STAKING AI.

Rocket Pool

Rocket Pool is a decentralized Ethereum staking platform where users can stake as low as 0.01 ETH. It’s focused on decentralization and also gives node operators extra rewards.

Pros:

Low barrier to entry for Ethereum staking.

Community driven.

Cons:

Mainly staking for Ethereum.

STAKING AI supports multiple networks and has a $100 staking bonus making it a better option for diversified crypto portfolios.

Ankr Staking

Ankr Staking offers liquid staking solutions across multiple blockchains like Ethereum, Binance Smart Chain, and Polkadot. It gives derivative tokens that can be used in DeFi while earning staking rewards.

Pros:

Broad blockchain support.

DeFi integration for extra utility.

Cons:

Fees can eat into returns.

Unlike Ankr, STAKING AI has real-time rewards tracking and flexible plans for a better user experience.

StakeWise

StakeWise is focused on maximizing Ethereum staking rewards with low fees and liquid staking tokens. It also has pooled staking so small-scale investors can participate in Ethereum staking.

Pros:

Low fees.

User-friendly dashboard.

Cons:

Mainly for Ethereum staking.

STAKING AI has wider asset support and a professional team so it’s better than StakeWise.

P2P Validator

P2P Validator is known for its high-security standards and offers staking services for over 30 networks. It’s focused on reliability making it a popular choice among institutional investors.

Pros:

Broad network coverage.

Institutional grade security.

Cons:

Complex interface for beginners.

STAKING AI’s intuitive design and beginner-friendly features make it a more accessible choice for retail investors.

Binance Staking

As a major crypto exchange, Binance offers liquid staking through its Binance Earn program. Users can stake assets and get liquidity tokens that can be traded or used in DeFi.

Pros:

Trusted platform with a large user base.

High liquidity.

Cons:

Its centralized nature may not be suitable for decentralization advocates.

STAKING AI is decentralized and community-driven therefore it’s more aligned with the blockchain philosophy.

Coinbase Staking

Coinbase allows users to stake select cryptocurrencies directly from their accounts, with liquid staking available for Ethereum. It’s easy to use for beginners.

Pros:

Simple interface.

Custodial services.

Cons:

Only a few supported cryptocurrencies.

STAKING AI beats Coinbase with its multiple staking plans, higher rewards, and non-custodial model.

Frax Finance

Frax Finance offers liquid staking derivatives for Ethereum enabling users to access liquidity without sacrificing staking rewards. It also integrates with DeFi protocols.

Pros:

DeFi-friendly derivatives.

Competitive yields.

Cons:

Limited network support.

STAKING AI has more flexibility, professional support, and a lucrative referral program making it a better staking experience than Frax Finance.

Conclusion

In the liquid staking space, STAKING AI seems to be the clear winner. With high-quality infrastructure, multiple staking plans, and attractive rewards like a $100 staking bonus, it’s the platform for investors to maximize their crypto holdings. While other platforms like Lido, Rocket Pool, and Ankr are good, none of them have the innovation, accessibility, and user benefits that STAKING AI has. Start with STAKING AI today and unlock your digital assets.

[ad_2]

Source link