Exciting news for crypto enthusiasts and investors in Australia and beyond! Zerocap, a leading digital asset investment firm down under, is making waves by launching groundbreaking crypto options-based structured products. What’s truly innovative? These products are directly linked to the widely respected CoinDesk 20 Index (CD20). This move signifies a significant step forward in offering sophisticated and diversified investment opportunities within the ever-evolving digital asset landscape. Let’s dive deeper into what this means for you and the future of crypto investments.

What is the CoinDesk 20 Index and Why Does it Matter?

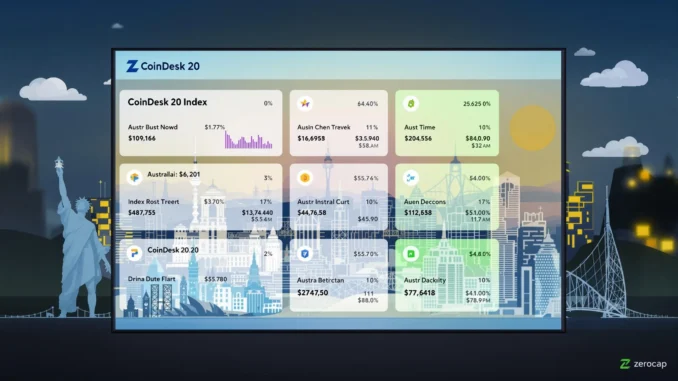

Before we delve into Zerocap’s exciting new offerings, let’s understand the backbone of these products: the CoinDesk 20 Index. Think of the CD20 as the crypto world’s equivalent of the S&P 500 or the FTSE 100, but specifically tailored for digital assets. It’s a benchmark index designed to measure the performance of the top 20 largest and most liquid cryptocurrencies. This isn’t just about Bitcoin and Ethereum; the CD20 casts a wider net, encompassing a diverse range of significant digital assets.

Key components of the CoinDesk 20 Index include:

- Market Leaders: It features established giants like Bitcoin (BTC) and Ethereum (ETH), the cornerstones of the cryptocurrency market.

- Emerging Altcoins: The index also includes prominent altcoins such as XRP, Solana (SOL), and Cardano (ADA), representing the broader spectrum of the crypto ecosystem.

- Diversification: By tracking 20 different assets, the CD20 offers a diversified view of the market, reducing reliance on the performance of any single cryptocurrency.

- Liquidity and Size: The index focuses on the largest and most liquid digital assets, ensuring tradability and representing established projects within the space.

Why does this matter? For investors, the CoinDesk 20 Index serves as a crucial gauge of the overall health and direction of the cryptocurrency market. It provides a standardized and transparent benchmark against which to measure performance and understand market trends. Products linked to the CD20, like Zerocap’s new offerings, allow investors to gain exposure to a broad basket of leading cryptocurrencies through a single, structured investment.

Unlocking Opportunities with Crypto Options

Now, let’s talk about the game-changer: crypto options. Options are derivative contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (the strike price) on or before a specific date (the expiration date). In the context of cryptocurrencies, crypto options offer sophisticated investors powerful tools for:

- Hedging Risk: Options can be used to protect against potential price declines in the cryptocurrency market. Imagine you hold a significant amount of Bitcoin; you can buy put options to limit your downside risk.

- Generating Yield: Strategies like covered calls allow investors to earn premiums on their existing crypto holdings, generating income in addition to potential price appreciation.

- Leveraged Exposure: Options can provide leveraged exposure to the cryptocurrency market, allowing investors to control a larger position with a smaller initial investment. However, leverage also amplifies potential losses, so it’s crucial to understand the risks.

- Portfolio Diversification: Introducing crypto options into a portfolio can enhance diversification and potentially improve risk-adjusted returns.

Zerocap’s new structured products are built upon these crypto options, specifically linked to the CoinDesk 20 Index. This means investors can now access sophisticated investment strategies based on the performance of a diversified basket of top cryptocurrencies, all within a structured product framework. This is particularly appealing for investors looking for more than just spot market exposure and seeking tools to manage risk and potentially enhance returns.

Zerocap: Pioneering Digital Asset Investments in Australia

Who is Zerocap, and why are they leading this charge in Australia? Zerocap is a prominent digital asset investment firm based in Australia, known for its focus on providing institutional-grade investment solutions within the cryptocurrency space. They are dedicated to bridging the gap between traditional finance and the world of digital assets, offering a range of services including:

- Structured Products: Like the new crypto options products linked to the CoinDesk 20 Index.

- Asset Management: Providing professional management of digital asset portfolios.

- Trading and Execution: Offering sophisticated trading services for institutional clients.

- Custody Solutions: Ensuring the secure storage of digital assets.

Zerocap’s partnership with CoinDesk Indices to launch these crypto options products underscores their commitment to innovation and providing investors with access to cutting-edge investment opportunities. Being based in Australia, Zerocap is well-positioned to serve both the Australian market and the broader global crypto investment community, particularly in the Asia-Pacific region. Their move is a strong indicator of the growing maturity of the Australian cryptocurrency market and its increasing integration with global financial trends.

Navigating Digital Assets: What are the Benefits of Structured Products?

Why choose structured products linked to digital assets, especially those based on crypto options and the CoinDesk 20 Index? Structured products offer a unique blend of benefits that can be particularly attractive in the volatile cryptocurrency market:

| Benefit | Description |

|---|---|

| Defined Risk and Return Profiles | Structured products can be designed with specific risk and return characteristics tailored to investor preferences. This can include capital protection features or enhanced yield potential compared to simply holding the underlying assets. |

| Access to Sophisticated Strategies | They provide access to complex investment strategies, like those using crypto options, that might be difficult or time-consuming for individual investors to implement on their own. |

| Diversification through the CoinDesk 20 Index | Products linked to the CoinDesk 20 Index inherently offer diversification across 20 leading digital assets, reducing concentration risk. |

| Professional Management | Structured products are typically managed by experienced financial professionals, offering expertise in product design, risk management, and market execution. |

| Simplified Access | They can simplify access to the cryptocurrency market, particularly for investors who are new to digital assets or prefer a more structured investment approach. |

However, it’s also crucial to remember that structured products are not without risks. Investors should carefully consider the terms and conditions, understand the underlying assets and strategies, and assess whether the product aligns with their investment goals and risk tolerance.

Conclusion: A Bold Step Forward for Crypto Investments

Zerocap’s launch of crypto options-based structured products linked to the CoinDesk 20 Index marks an exciting and innovative development in the cryptocurrency investment landscape. By combining the broad market representation of the CoinDesk 20 Index with the sophisticated capabilities of crypto options, Zerocap is empowering investors with new tools to navigate the dynamic world of digital assets. This move not only highlights the growing sophistication of the Australian crypto market but also signals a broader trend towards more mature and diverse investment offerings within the global cryptocurrency ecosystem. As Australia continues to embrace digital asset innovation, Zerocap is undoubtedly positioning itself at the forefront of this financial revolution, unlocking new opportunities for investors seeking to participate in the future of finance.