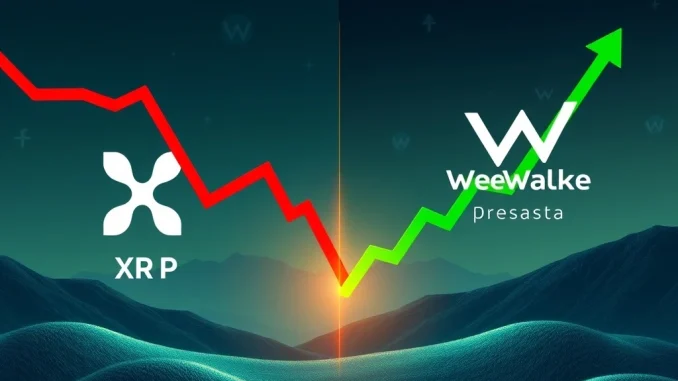

The cryptocurrency market is a dynamic arena where fortunes can shift in an instant. Today, we delve into a dramatic unfolding of events that saw XRP, a long-standing crypto giant, experience a significant downturn, while a promising newcomer, WeWake, celebrated an impressive presale success. This juxtaposition highlights the inherent crypto market volatility and the evolving landscape of investor sentiment.

XRP News Today: Unpacking the $175 Million Sell-Off

Recent XRP news today sent ripples of concern through its community. Ripple co-founder Chris Larsen executed a massive transfer of 50 million XRP, valued at approximately $175 million, just as the token was approaching a local peak near $3.60. This move, highlighted by blockchain investigator ZachXBT, saw a significant portion—$140 million—sent directly to centralized exchanges. This action immediately fueled speculation that the transfer was a strategic offload of assets at near-peak prices.

The timing of Larsen’s transaction coincided precisely with a sharp decline in XRP’s value, which plummeted below $3.10 within days. This rapid XRP price drop ignited a firestorm of criticism across social media, with many labeling the event a ‘dump’ and accusing Ripple of enabling insider sales during bullish periods. While some argued it could be a move towards decentralizing ownership or diversifying holdings, the immediate market reaction underscored the fragility of investor confidence.

The lingering concern is the sheer volume of XRP still held by Larsen’s wallet—over 2.81 billion tokens. This substantial holding raises questions about potential future sell pressure and its implications for XRP’s long-term stability and growth trajectory. The incident serves as a stark reminder of how large individual holdings can influence market dynamics, particularly for established cryptocurrencies like XRP that are already navigating complex regulatory environments.

WeWake Presale: A Beacon Amidst Turbulence

Amidst the turbulence surrounding XRP, a contrasting success story emerged from the realm of new crypto projects: the WeWake presale. WeWake, a Layer 2 blockchain platform, launched its Stage 1 presale at an attractive entry point of $0.0100. What truly sets WeWake apart is its innovative approach to user onboarding, offering walletless and gasless access through seamless integrations with Google and Telegram. This focus on user-friendliness directly addresses common barriers to crypto adoption for non-technical users.

Early buyers in the WeWake presale are looking at a potential 15x entry advantage, with the project targeting a $0.15 listing price in the public market. This significant upside potential, combined with a robust roadmap, has quickly drawn the attention of retail investors seeking alternatives to assets plagued by regulatory uncertainties.

What Makes WeWake Stand Out?

WeWake’s strategic vision is laid out in its ambitious roadmap:

- Q2 2026 Mainnet Launch: The core of the platform, leveraging advanced technologies.

- ERC-4337 Smart Wallets & ZK-Rollups: Enhancing security, usability, and scalability for DeFi, NFTs, and dApps.

- Gasless Model: Eliminating transaction fees through Paymaster systems, making dApps accessible to everyone.

- Zero-Knowledge Proofs: Boosting privacy and security for all user interactions.

- Utility-Driven Tokenomics: 32% of its 308 million total supply allocated to the presale, with incentives for staking, governance, and ecosystem growth.

- Future Integrations: NFT minting and Telegram Mini App integrations by Q3 2026, further expanding its utility and reach.

These features collectively position WeWake as a solution geared towards mass adoption, directly addressing the pain points often experienced by new users in the crypto space.

Navigating Crypto Market Volatility: A Tale of Two Tokens

The divergent paths of XRP and WeWake vividly illustrate the inherent crypto market volatility and the shifting landscape of investor preferences. While XRP, an established player, grapples with the fallout from insider transactions and ongoing regulatory scrutiny from the SEC, WeWake emerges as a fresh contender focusing on innovation, user experience, and scalability.

This scenario highlights a broader trend in the crypto world: investors are increasingly diversifying their portfolios. While institutional players might look towards established altcoins like Ethereum and Solana, retail investors are keenly eyeing new crypto projects that promise high growth potential and solve real-world problems. The fragility of market confidence, however, remains evident, particularly when high-profile insider transactions shake the foundation of trust.

The XRP price drop, triggered by a founder’s actions, serves as a powerful reminder of the importance of transparency and accountability in the crypto space. Conversely, the successful WeWake presale demonstrates that projects with strong utility, clear roadmaps, and a focus on user accessibility can thrive even in a challenging market environment.

What Does This Mean for Investors?

For investors, these events underscore several critical lessons:

- Due Diligence is Paramount: Always research a project’s fundamentals, team, tokenomics, and roadmap.

- Understand Market Risks: High-profile sell-offs can significantly impact even established assets.

- Diversify Wisely: Balance your portfolio between established, potentially more stable assets and promising new ventures.

- Stay Informed: Keep abreast of XRP news today, new project launches, and broader market trends.

In conclusion, the recent market movements, with XRP’s significant dip following a founder’s sell-off and WeWake’s impressive presale performance, encapsulate the dynamic and often unpredictable nature of the cryptocurrency market. While established assets face their unique challenges, the continuous emergence of innovative new crypto projects like WeWake offers exciting opportunities for those willing to navigate the inherent crypto market volatility. As the digital asset space matures, understanding these contrasting narratives becomes crucial for making informed investment decisions and capitalizing on the next wave of innovation.

Frequently Asked Questions (FAQs)

Q1: What caused the recent XRP price drop?

The recent XRP price drop was primarily triggered by Ripple co-founder Chris Larsen transferring 50 million XRP, valued at $175 million, to centralized exchanges just before the token reached a local peak. This large-scale transfer fueled speculation of a sell-off, leading to a sharp decline in its value.

Q2: What is the WeWake presale, and what makes it attractive?

The WeWake presale is for a new Layer 2 blockchain platform aiming to offer walletless and gasless onboarding via Google and Telegram integrations. It’s attractive due to its focus on user accessibility, a targeted 15x entry advantage for early buyers, a clear roadmap including mainnet launch with ERC-4337 smart wallets and zk-rollups, and a utility-driven tokenomics model.

Q3: How does WeWake address user barriers in crypto?

WeWake addresses common user barriers by offering walletless and gasless transactions. This means users don’t need to manage complex crypto wallets or pay gas fees for every transaction, making it significantly easier for non-technical users to access DeFi, NFTs, and dApps. It utilizes Paymaster systems and zero-knowledge proofs for enhanced usability and security.

Q4: What is the significance of the contrasting performance between XRP and WeWake?

The contrasting performance highlights the inherent crypto market volatility and a shift in investor sentiment. It shows that while established assets like XRP face challenges such as regulatory scrutiny and insider actions, new crypto projects with strong innovation, user-friendly features, and clear utility can attract significant interest and capital, even amidst broader market concerns.

Q5: Should investors be concerned about insider sell-offs in crypto projects?

Yes, insider sell-offs can be a significant concern for investors. Large transfers or sales by founders or major stakeholders can create significant sell pressure, leading to price drops and eroding investor confidence. It underscores the importance of transparency and understanding a project’s token distribution and vesting schedules.