Warning: Attempt to read property "post_excerpt" on null in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 392

Warning: Trying to access array offset on false in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 394

Warning: Attempt to read property "post_title" on null in /www/wwwroot/coinpulsehq.com/wp-content/themes/mh-magazine/includes/mh-custom-functions.php on line 394

[ad_1]

Recent industry insights suggest that the future of crypto is bullish. Continuous advancements in blockchain technology and favorable regulatory developments are contributing to this optimistic outlook.

Analysts are noting the significant potential for cryptocurrencies to transform economic and social structures globally.

Experts Stay Bullish on Crypto

Jeremy Allaire, CEO of Circle, expressed heightened optimism about the future of crypto. He attributed this confidence to the continuous advancement of open Internet protocols, which have historically transformed industries and economies.

He believes that crypto represents the next evolution in Internet infrastructure, addressing the critical need for a trust layer.

The emergence of Bitcoin marked the beginning of this transformation, introducing the potential for digital tokens, public blockchains, and smart contracts to revolutionize economic and social structures. He noted the rapid progress in blockchain technology, highlighting the development of third-generation public blockchains capable of supporting large-scale applications.

“Digital tokens, issued on public blockchains, intermediated by smart contracts could unleash a trusted environment on a global scale that would be the foundation of how nearly all of the building blocks of society and the economy could become Internet-native,” Allaire said.

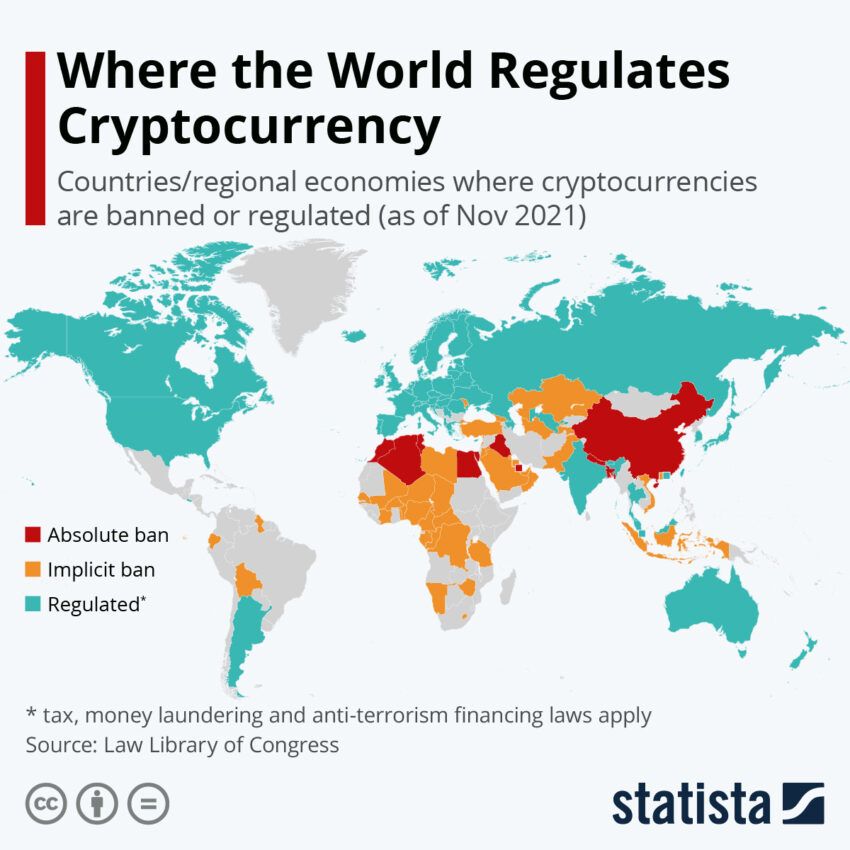

The global acceptance of digital assets further fuels Allaire’s bullish outlook. Indeed, governments worldwide are establishing regulatory frameworks for cryptocurrencies, and major financial institutions are integrating blockchain technology into their services.

QCP Capital analysts echoed Allaire’s optimism. They highlighted the recent rebound in Ethereum prices and the positive impact of regulatory developments. The SEC’s decision to close its investigation into Ethereum 2.0 and the potential launch of Ethereum exchange-traded funds (ETFs) have bolstered market sentiment.

Analysts noted increased activity in the options market, suggesting strong investor confidence in ETH’s future performance.

“The options market has also reflected this optimism, with the desk observing heavy buying activity of top-side calls across various tenors. Despite uncertainty around the reception of the Ethereum ETF, capturing 10% to 20% of Bitcoin ETF flows could propel ETH above $4,000,” analysts at QCP Capital wrote.

Read more: Ethereum (ETH) Price Prediction 2024 / 2025 / 2030

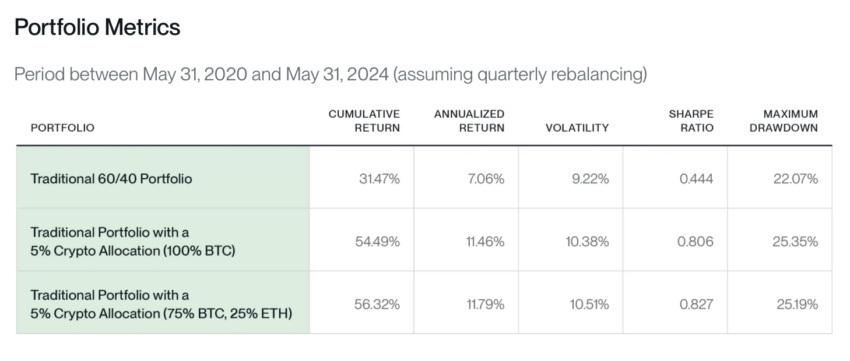

Matt Hougan, Bitwise’s Chief Investment Officer, also shared a positive outlook. He highlighted the potential benefits of adding Ethereum exposure to investment portfolios. Subsequently, he presented three compelling reasons for this strategy: diversification, distinct use cases, and historical performance.

Hougan acknowledged that some investors might prefer a Bitcoin-only approach, particularly those focused on concerns about fiat currency devaluation and inflation. Bitcoin’s established market position and regulatory clarity make it a strong choice for such strategies.

However, for other investors, the introduction of a spot Ethereum ETF will provide a chance to expand their investment in crypto.

“Today, the market cap for ETH, the crypto asset that powers the Ethereum blockchain, is about $420 billion. That’s about one-third the size of Bitcoin’s $1.3 trillion. The starting place should therefore be about 75% Bitcoin and 25% ETH,” Hougan explained.

These insights suggest a promising future for Bitcoin and Ethereum, driving the next wave of innovation and adoption in the financial system despite the recent price action.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link