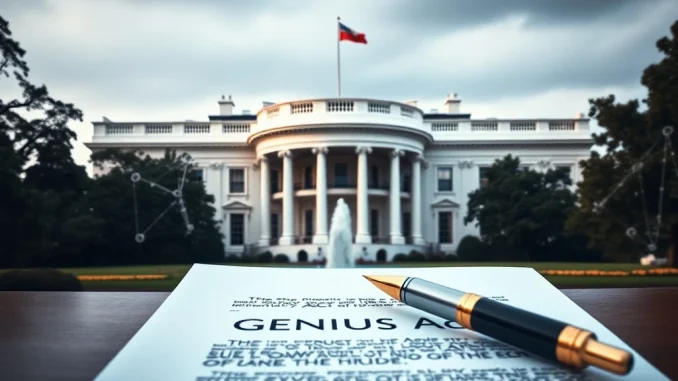

The cryptocurrency world is buzzing with anticipation! A landmark moment is on the horizon as the White House has officially confirmed that President Trump plans to sign significant crypto legislation this Friday. This isn’t just another news cycle; it’s a pivotal development that could reshape the regulatory landscape for digital assets in the United States.

The Countdown to Crucial Crypto Legislation

According to reports from JinSe Finance, a White House spokesperson has verified that President Trump is set to formalize new cryptocurrency laws. This includes the highly anticipated GENIUS Act, a bill specifically targeting stablecoin regulation. The signing ceremony is scheduled for Friday at 2:30 p.m. U.S. time, an event that Coin Pulse indicates will gather industry leaders and lawmakers. This confirmation signals a serious commitment from the administration to bring clarity and structure to the evolving digital asset space.

For years, the crypto industry has operated under a patchwork of regulations, often leading to uncertainty and hindering mainstream adoption. This impending signing suggests a move towards a more defined framework, which many believe is essential for the long-term growth and stability of the market. It’s a moment that could either pave the way for innovation or introduce new challenges, depending on the specifics of the signed bill.

Understanding the GENIUS Act and Its Impact on Stablecoin Regulation

At the heart of this legislative push is the GENIUS Act, a bill designed to provide a comprehensive framework for stablecoins. Stablecoins, digital currencies pegged to stable assets like the U.S. dollar, have seen exponential growth and are increasingly used for remittances, trading, and decentralized finance (DeFi). However, their rapid expansion has also raised concerns among regulators regarding consumer protection, financial stability, and illicit finance.

While the exact details of the GENIUS Act will become fully clear upon its signing, its very existence points to a recognition by policymakers of stablecoins’ importance and the need to integrate them safely into the broader financial system. Key areas that stablecoin regulation typically addresses include:

- Issuance Requirements: Rules for entities issuing stablecoins, including capital reserves and auditing.

- Consumer Protection: Safeguards for users, ensuring transparency and recourse in case of issues.

- Interoperability: How stablecoins interact with traditional financial systems.

- Anti-Money Laundering (AML) & Know Your Customer (KYC): Measures to prevent illicit activities.

The successful implementation of thoughtful stablecoin regulation could significantly boost confidence in the digital asset market, attracting more institutional investors and mainstream users. It could also set a precedent for how other forms of digital assets are regulated in the future.

What This Means for the Market: White House Crypto Policy Takes Shape

The White House’s decision to prioritize and sign this crypto legislation sends a strong signal to both domestic and international markets. It signifies a maturation of the cryptocurrency industry, moving from a niche technology to a recognized component of the global financial landscape. This formal endorsement from the highest office could:

- Reduce Regulatory Uncertainty: A clear legal framework can alleviate concerns for businesses and investors.

- Spur Innovation: Defined rules can provide a stable environment for companies to build and expand.

- Enhance Consumer Confidence: Regulations often come with protections that make users feel safer engaging with digital assets.

- Attract Institutional Capital: Large financial institutions often require regulatory clarity before committing significant investments.

This move is a testament to the growing influence of cryptocurrencies and blockchain technology on the global stage. It underscores that governments worldwide are increasingly grappling with how to integrate these innovations responsibly into existing legal and economic structures.

The Path Ahead for Trump’s Crypto Stance

President Trump’s administration has previously expressed varying views on cryptocurrencies. While some officials have voiced skepticism, others have acknowledged the potential of blockchain technology. This signing, however, marks a definitive step towards establishing a more concrete and perhaps more favorable regulatory environment under his watch. It reflects an evolving understanding within government of the need to adapt to technological advancements rather than resisting them.

This legislation could set a precedent for future regulatory actions, not just in the U.S. but globally. Other nations often look to the U.S. for guidance on emerging technologies and financial innovations. The signing of the GENIUS Act could thus catalyze similar legislative efforts worldwide, creating a more harmonized international regulatory landscape for digital assets.

As the Friday signing approaches, the crypto community will be watching closely. This event represents more than just a legislative formality; it’s a significant indicator of how governments are beginning to embrace, rather than merely observe, the digital asset revolution. It’s a step towards integrating these powerful technologies into the mainstream financial system, potentially unlocking new avenues for economic growth and innovation.

In conclusion, the confirmed signing of cryptocurrency legislation, including the GENIUS Act for stablecoin regulation, by President Trump this Friday marks a momentous occasion for the digital asset space. This decisive action from the White House aims to provide much-needed clarity and a formal framework for a rapidly evolving industry. It signals a new era of engagement between traditional governance and decentralized finance, promising both opportunities and challenges as the market adapts to these new foundational rules. The long-term implications of this move could be profound, shaping the trajectory of crypto adoption and innovation for years to come.

Frequently Asked Questions (FAQs)

Q1: What is the significance of the White House signing crypto legislation?

A1: The signing signifies a major step towards formalizing the regulatory framework for cryptocurrencies in the U.S. It provides clarity for businesses and investors, potentially boosting confidence and attracting more mainstream adoption to the digital asset market.

Q2: What is the GENIUS Act, and what does it aim to regulate?

A2: The GENIUS Act is a specific piece of legislation focused on stablecoin regulation. It aims to establish rules for stablecoin issuers, ensure consumer protection, and integrate stablecoins more securely into the financial system, addressing concerns like reserves and transparency.

Q3: When is the crypto legislation expected to be signed?

A3: The White House has confirmed that President Trump plans to sign the crypto legislation, including the GENIUS Act, during a ceremony on Friday at 2:30 p.m. U.S. time.

Q4: How might this new legislation impact the cryptocurrency market?

A4: This legislation is expected to reduce regulatory uncertainty, potentially spur innovation by providing a stable environment for crypto companies, enhance consumer confidence through clear protections, and attract more institutional capital into the market.

Q5: Is this the first time the U.S. government has addressed crypto regulation?

A5: While various U.S. government bodies (like the SEC, CFTC, Treasury) have issued guidance and taken enforcement actions regarding cryptocurrencies, this specific signing of comprehensive legislation by the White House marks a significant, consolidated effort to establish a broader regulatory framework.

Q6: Will this legislation affect all cryptocurrencies equally?

A6: The immediate focus of the GENIUS Act is on stablecoin regulation. However, the establishment of clear White House crypto policy sets a precedent that could influence future legislation and regulatory approaches for other types of cryptocurrencies and digital assets as well.