The crypto world is buzzing following reports of a truly massive movement of stablecoins. A significant **USDT transfer** has caught the attention of market watchers, involving hundreds of millions of dollars shifting between major platforms. This kind of activity often signals potential moves by large market participants, commonly referred to as ‘whales’. Staying informed about these large transfers is crucial for understanding potential market dynamics.

Whale Alert Reports Huge USDT Transfer

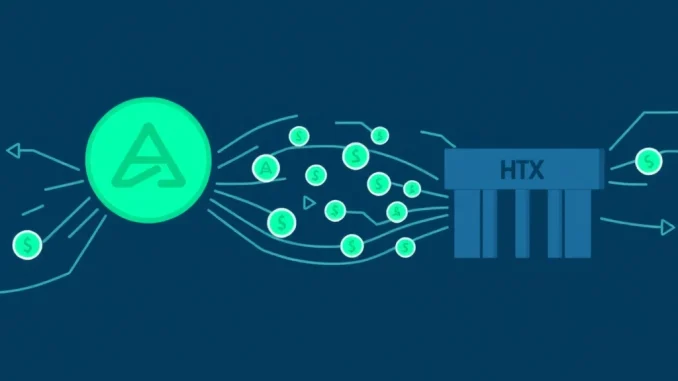

According to the popular blockchain tracking service, **Whale Alert**, a staggering **USDT transfer** totaling 700,000,000 USDT was executed recently. This immense sum, valued at approximately $701 million at the time of the transaction, originated from the decentralized finance (DeFi) protocol **Aave** and was sent to the centralized exchange **HTX**. Such a substantial movement between these two types of platforms is noteworthy and prompts questions about the motivations behind it.

What Does a Large Crypto Transfer from Aave to HTX Mean?

When a **Large crypto transfer** like this occurs, especially moving from a DeFi protocol like **Aave** to a centralized exchange like **HTX**, it can suggest several possibilities. **Aave** is primarily used for lending and borrowing digital assets, allowing users to earn interest on deposits or borrow by providing collateral. **HTX**, on the other hand, is a major venue for trading, swapping, and accessing various crypto services. Moving funds from a lending protocol to an exchange could indicate:

- **Preparation for Trading:** The owner might be moving the USDT to **HTX** to prepare for large-scale trading activities, potentially buying other cryptocurrencies or participating in arbitrage opportunities.

- **Seeking Liquidity:** While USDT is liquid, moving it to an exchange might be a step towards potentially converting it to fiat currency or preparing for an Over-the-Counter (OTC) transaction.

- **Adjusting Positions:** If the funds were previously deposited on **Aave** for yield or as collateral, withdrawing such a large amount could mean the user is closing or adjusting their borrowing or lending positions on the protocol.

- **Consolidation:** The transfer might simply be a consolidation of funds into a single, accessible location on an exchange.

Interpreting the exact reason for any single **Large crypto transfer** is speculative, as the intentions of the wallet owner are not publicly disclosed. However, tracking these moves, particularly by services like **Whale Alert**, provides valuable transparency into the flow of significant capital within the crypto ecosystem.

A Closer Look at Aave and HTX

Understanding the nature of the platforms involved helps provide context for this **USDT transfer**. **Aave** operates on various blockchains and is a leading name in decentralized finance. It allows users to interact directly with smart contracts to manage their digital assets without intermediaries. Funds held on **Aave** are typically in the user’s control via their private keys, though locked within the protocol’s smart contracts for lending/borrowing purposes.

**HTX**, formerly known as Huobi, is one of the world’s largest centralized cryptocurrency exchanges. Moving funds to **HTX** means placing them under the custody of the exchange’s wallet system. This is a common step for users who intend to actively trade assets against various pairs available on the exchange.

Here’s a simple comparison:

| Feature | Aave (DeFi Protocol) | HTX (Centralized Exchange) |

|---|---|---|

| Primary Function | Lending & Borrowing | Trading & Swapping |

| Asset Control | User’s Wallet (via smart contract) | Exchange’s Wallet (Custodial) |

| Transaction Visibility | On-chain (Public) | Internal (Private) |

The movement from a non-custodial, on-chain protocol like **Aave** to a custodial exchange like **HTX** highlights a strategic shift by the owner of these funds.

The Importance of Whale Alert

**Whale Alert** plays a vital role in the crypto space by monitoring and reporting **Large crypto transfer**s on various blockchains. Their automated system detects transactions exceeding a certain threshold and broadcasts them, often via social media. This service increases transparency by making significant on-chain movements visible to the public. Without **Whale Alert**’s reporting, this specific 700,000,000 **USDT transfer** might have gone unnoticed by many market participants.

Tracking these alerts allows analysts and enthusiasts to gain insights into potential activities of major players. While not every large transfer directly impacts the market price, aggregated data from services like **Whale Alert** can contribute to broader market sentiment analysis.

Understanding Large Crypto Transfer Activity

Large transfers, often associated with `crypto whale` activity, are a constant feature of the cryptocurrency market. These movements can sometimes precede significant trading volume or shifts in liquidity. However, it’s important to exercise caution when interpreting them. A **Large crypto transfer** to an exchange does not automatically mean the assets will be sold. They could be moved for staking, participation in exchange-specific events, or simply for easier management.

The sheer size of this particular 700M **USDT transfer** from **Aave** to **HTX** makes it stand out. It represents a substantial portion of circulating USDT and a significant amount of capital being moved from a decentralized lending environment to a centralized trading one.

Conclusion

The recent report by **Whale Alert** detailing the movement of 700,000,000 **USDT** from **Aave** to **HTX** is a significant event in the crypto landscape. This **Large crypto transfer**, valued at over $700 million, underscores the dynamic nature of how major participants manage their digital assets across different platforms. While the exact intentions behind this move remain private, it highlights the ongoing interplay between decentralized protocols and centralized exchanges. Keeping an eye on such large-scale movements, as reported by services like **Whale Alert**, offers a glimpse into the activities of the market’s biggest players, reminding us of the considerable capital flows that characterize the cryptocurrency market.