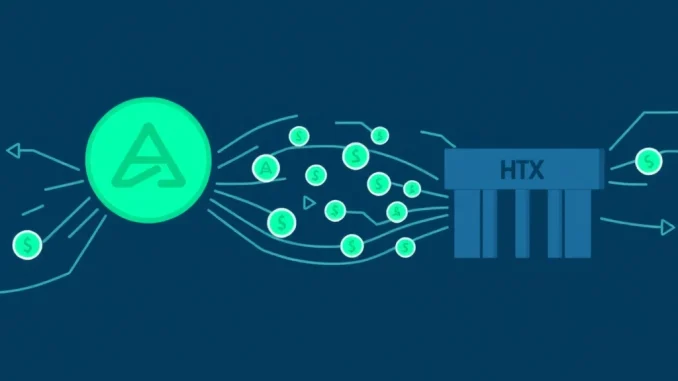

The crypto world is always buzzing with activity, and sometimes, massive movements of digital assets catch the eye of market observers. One such event recently occurred, sparking discussions across the community: a significant USDT transfer involving hundreds of millions of dollars. Whale Alert, a popular blockchain transaction tracker, reported a movement of 300,000,000 USDT. This colossal sum was transferred from Aave, a leading decentralized finance (DeFi) protocol, to HTX, a major centralized cryptocurrency exchange. Valued at approximately $300 million, this large crypto transfer immediately raised questions about the potential motivations behind such a move and its possible implications for the platforms involved and the broader market.

What Happened with the USDT Transfer?

At its core, the event is straightforward: 300 million units of Tether (USDT), the largest stablecoin by market capitalization, changed hands from one address associated with Aave to another associated with HTX. While the transaction itself is a simple blockchain record, the context—moving from a DeFi lending protocol to a centralized trading platform—is what makes it noteworthy. Whale Alert’s notification serves as a public announcement of this movement, highlighting the transparency inherent in public blockchains, even when the identity of the ultimate beneficiary remains private.

Here’s a breakdown of the key details:

- Asset Transferred: 300,000,000 USDT

- Source: Address identified with Aave

- Destination: Address identified with HTX

- Approximate Value: $300,000,000

- Reported By: Whale Alert

Understanding the entities involved is crucial to interpreting the significance of this USDT transfer.

Understanding the Players: Aave and HTX

Aave is a cornerstone of the decentralized finance ecosystem. It’s a non-custodial liquidity protocol where users can participate as depositors or borrowers. Depositors provide liquidity to earn passive income, while borrowers can borrow cryptocurrencies by providing collateral. Funds within Aave pools are typically used for lending or remain as available liquidity. A large withdrawal like 300 million USDT from an address associated with Aave suggests funds previously held within or managed by the protocol were moved out.

HTX, formerly known as Huobi Global, is one of the world’s largest centralized cryptocurrency exchanges. Exchanges like HTX facilitate trading, offer various financial services (like margin trading, futures, etc.), and act as gateways for users to convert between fiat currency and cryptocurrencies. Moving a large sum of USDT to an exchange often indicates an intention to trade, provide liquidity for trading pairs, or potentially withdraw to fiat or other assets.

The contrast between these two platforms—one decentralized and focused on lending/borrowing, the other centralized and focused on trading—is key to analyzing the transfer’s purpose.

Why Do Large Transfers Like This Matter?

Movements of vast amounts of cryptocurrency, especially stablecoins like USDT, are closely watched for several reasons:

- Market Impact: Large sums moved to exchanges can signal potential selling pressure or intent to engage in significant trading activity. Conversely, moves away from exchanges might indicate accumulation or movement to cold storage.

- Liquidity Shifts: A $300 million move significantly impacts the liquidity available on both the source (Aave) and destination (HTX) platforms for USDT.

- Whale Activity: Transactions of this size are typically executed by ‘crypto whales’ – individuals or entities holding significant amounts of cryptocurrency. Tracking crypto whale movements can sometimes offer insights into market sentiment or potential upcoming trends, though their motives are often opaque.

- Platform Health/Strategy: A large withdrawal from a DeFi protocol like Aave could be a strategic decision by a large liquidity provider, or it could simply be a whale rotating assets. A large deposit to an exchange like HTX could be for trading, providing market depth, or preparing for large withdrawals in other assets.

This specific large crypto transfer is notable due to the sheer volume and the transition from a DeFi environment to a CEX environment.

Decoding the Intent: Why Move $300M USDT from Aave to HTX?

Pinpointing the exact reason behind such a large crypto transfer is challenging without direct information from the parties involved. However, based on typical market behavior and the nature of Aave and HTX, several plausible scenarios emerge:

- Preparing for Trading: The most common reason for moving large stablecoin sums to an exchange is to prepare for buying other assets or engaging in significant trading strategies. The whale might anticipate market volatility or see trading opportunities on HTX.

- Arbitrage: Price differences for assets between Aave’s ecosystem (where synthetic assets or yield-bearing tokens might be involved) and HTX’s trading pairs could present arbitrage opportunities that require moving liquidity.

- Yield Farming/Staking Opportunities: While Aave offers yields, the whale might be moving funds to HTX to participate in specific staking programs, yield products, or promotions offered by the exchange that are not available on Aave.

- Collateral Management: If the funds were previously used as collateral or borrowed against on Aave, this move could be part of a larger strategy involving managing leveraged positions, potentially moving collateral to HTX for margin trading.

- Liquidity Provision on HTX: The whale might intend to provide significant liquidity for USDT trading pairs on HTX, earning fees from trading volume.

- Preparing for Fiat Off-Ramp: Although less direct, moving USDT to an exchange is a necessary step if the whale eventually plans to convert a portion of the funds into fiat currency, assuming HTX offers suitable fiat withdrawal options.

It’s important to remember that ‘Aave’ in the Whale Alert context might refer to an address known to interact heavily with the Aave protocol, not necessarily the protocol’s treasury itself. Similarly, the HTX address is likely a hot wallet or operational address for the exchange.

The Role of Whale Alert in Market Transparency

Whale Alert plays a vital role in providing transparency in the often-opaque crypto market. By tracking and reporting large transactions across various blockchains, it allows market participants and analysts to monitor significant movements that could potentially influence market dynamics. While these alerts don’t reveal the identity of the transacting parties or their intentions, they serve as valuable data points for understanding where large amounts of capital are flowing within the ecosystem. This particular alert about the USDT transfer from Aave to HTX is a prime example of how these tracking services highlight major shifts in liquidity.

Potential Implications and What to Watch For

While the exact outcome of this large crypto transfer is uncertain, here are some potential implications and things market watchers might look for:

- Increased USDT Liquidity on HTX: The deposit significantly boosts the available USDT liquidity on HTX, potentially leading to tighter spreads on USDT trading pairs.

- Potential Trading Volume: If the whale intends to trade, we might see increased volume in pairs involving USDT on HTX.

- Impact on Aave: While $300 million is a large sum, Aave manages billions in assets. The withdrawal’s impact on Aave’s overall liquidity pools might be minimal in percentage terms, but it signifies a large participant moving funds.

- Subsequent Transactions: Analysts will watch the HTX address to see if the funds are used for large purchases of other cryptocurrencies or if they are moved again.

This event underscores the interconnectedness of the DeFi and centralized exchange ecosystems and how large players navigate between them based on their strategies and market conditions.

Conclusion: Monitoring the Flow of Capital

The reported 300,000,000 USDT transfer from an address linked to Aave to HTX, highlighted by Whale Alert, is a classic example of a large crypto transfer that captures market attention. While the specific reasons remain speculative, the movement of such a substantial amount of capital from a DeFi lending platform to a centralized trading exchange suggests potential intentions related to trading, liquidity provision, or strategic asset management by a significant crypto whale. Events like this remind us of the dynamic nature of the cryptocurrency market and the value of on-chain transparency provided by services like Whale Alert in monitoring the flow of digital assets. Keeping an eye on subsequent movements from the destination address on HTX could offer further clues about the whale’s ultimate goals.