A massive USDT transfer has just caught the attention of the crypto community, signaling significant movement of capital within the digital asset space. This large transaction, involving hundreds of millions, highlights the dynamic nature of cryptocurrency markets and the key players operating within them.

What Did Whale Alert Report?

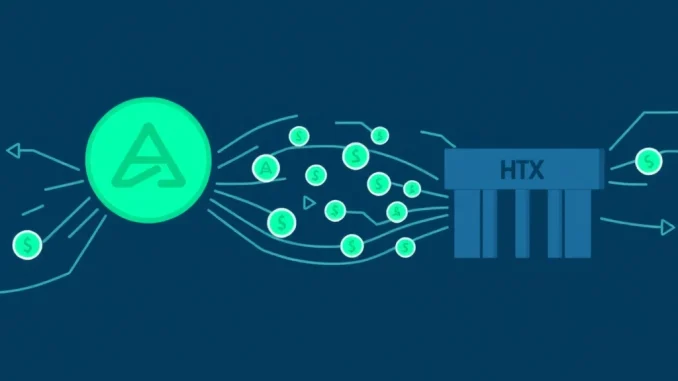

The popular blockchain tracking service, Whale Alert, recently flagged a substantial movement of Tether (USDT), the largest stablecoin by market capitalization. The report indicated that exactly 400,000,000 USDT was transferred from a wallet associated with Aave to a wallet linked to the HTX cryptocurrency exchange. At the time of the transaction, this amount was valued at approximately $400 million.

Such large transfers are often monitored closely by market participants as they can sometimes precede significant market activity or indicate strategic moves by large holders, often referred to as ‘whales’.

Aave to HTX: Who Are the Players?

Understanding the entities involved provides context for the transaction:

Aave: Aave is a leading decentralized finance (DeFi) protocol operating primarily on the Ethereum blockchain (though expanded to others). It allows users to lend and borrow cryptocurrencies without traditional intermediaries. Users deposit assets like USDT into lending pools to earn interest, or borrow assets against their collateral. A large withdrawal from Aave suggests a user is pulling their funds out of the DeFi lending platform.

HTX: Formerly known as Huobi, HTX is a major centralized cryptocurrency exchange. Exchanges provide platforms for users to buy, sell, and trade various cryptocurrencies. Depositing a large amount of USDT onto an exchange like HTX typically means the owner intends to trade it for other assets, use it for leverage, or perhaps prepare for withdrawal into fiat or other forms.

The movement from a DeFi protocol to a centralized exchange is a common pattern for users shifting strategies, potentially moving from earning yield in DeFi to trading or other activities on an exchange.

Why is a $400 Million Crypto Whale Transaction Significant?

A transaction of this magnitude is noteworthy for several reasons:

Scale: $400 million is a substantial amount of capital in any market, including crypto. Such a large movement by a single entity can impact liquidity and potentially influence short-term market dynamics, especially for USDT trading pairs.

Market Indicator: Large transfers, particularly those involving major platforms like Aave and HTX, can sometimes signal shifts in market sentiment or strategy among large holders. Is the whale preparing to sell other assets? Is this related to specific market conditions?

Liquidity: Moving 400M USDT onto an exchange significantly increases the available USDT liquidity on that platform, potentially impacting trading pairs involving USDT.

This crypto whale transaction is a data point that analysts will consider when evaluating market sentiment and potential future movements.

Potential Reasons Behind the USDT Transfer

While the exact motivation behind this specific USDT transfer is unknown, several possibilities exist:

Exiting DeFi Yield: The user might have withdrawn their USDT from Aave’s lending pool, perhaps because they found better opportunities elsewhere, needed the capital, or were reducing their DeFi exposure.

Preparing to Trade: Depositing a large sum of USDT onto an exchange like HTX often indicates an intention to trade that stablecoin for other cryptocurrencies or potentially fiat currency.

Institutional Movement: Large transfers can sometimes be linked to institutional players rebalancing portfolios, preparing for large purchases or sales, or managing treasury assets.

OTC Deals: The funds could be intended for a large Over-The-Counter (OTC) trade arranged directly with another party, using the exchange as an escrow or processing point.

Internal Transfers/Rebalancing: It’s possible this is an internal transfer by a large fund or entity managing assets across different platforms for various strategic reasons.

Without further information, these remain potential explanations for the movement from Aave to HTX.

What Comes Next for Aave, HTX, and USDT?

While one large transaction doesn’t dictate the market, observing subsequent actions can provide insights. Market participants might watch:

Trading Activity on HTX: Does a large purchase of Bitcoin, Ethereum, or other assets follow the deposit?

USDT Stability: Large movements of stablecoins are typically routine, but exceptionally large or frequent transfers can sometimes coincide with periods of market volatility.

Aave Protocol Activity: Is this part of a larger trend of withdrawals from Aave, or an isolated event?

This event serves as a reminder of the transparency provided by blockchain technology and the tools like Whale Alert that help track these significant capital movements.

Summary

A major crypto whale transaction involving a 400 million USDT transfer from the DeFi protocol Aave to the centralized exchange HTX has been reported by Whale Alert. This movement of substantial capital highlights the interplay between decentralized and centralized platforms and could signal strategic shifts by a large market participant. While the precise reason remains speculative, possibilities range from exiting DeFi yield to preparing for significant trading activity on the exchange. Tracking the follow-up actions related to this transfer will be key for those monitoring market dynamics.