The cryptocurrency world recently observed a significant event. Whale Alert, a prominent blockchain tracker, reported the minting of 401 million USDC. This substantial injection of stablecoin into the ecosystem marks a crucial development. Such large-scale USDC minted events often signal important shifts within the broader crypto market. Investors and analysts closely monitor these movements. They provide insights into liquidity and potential future trends.

Understanding the Massive USDC Minting Event

The recent USDC minted transaction involves a staggering 401 million units. This occurred at the USDC Treasury. Circle and Coinbase jointly govern USDC, a leading stablecoin. It pegs its value 1:1 to the U.S. dollar. This minting process creates new USDC tokens. These tokens are backed by an equivalent amount of fiat currency or highly liquid assets. The USDC Treasury holds these reserves. This ensures the stablecoin’s stability. Such large mints are not uncommon. However, their scale demands attention. They can influence various aspects of the digital asset landscape.

The Role of Stablecoins in the Crypto Market

Stablecoin minting plays a vital role in the crypto economy. Stablecoins like USDC bridge traditional finance and decentralized finance (DeFi). They offer price stability in volatile markets. Traders use them to lock in profits without converting to fiat. They also facilitate rapid transfers across exchanges. Furthermore, stablecoins are crucial for lending and borrowing protocols. These protocols form the backbone of the DeFi ecosystem. A large USDC minted sum increases the available liquidity. This can potentially fuel more trading and investment activities.

Whale Alert’s Insights into Crypto Treasury Movements

Whale Alert provides critical transparency in the crypto space. This automated system tracks and reports large cryptocurrency transactions. Its alerts cover significant movements of Bitcoin, Ethereum, and stablecoins. The report on the 401 million USDC minted transaction offers immediate insight. It confirms a major supply increase. Such reports help market participants understand institutional activity. They also reveal potential shifts in capital flow. Consequently, traders often react to these alerts. This highlights their importance for market analysis.

Potential Market Impact of Increased USDC Supply

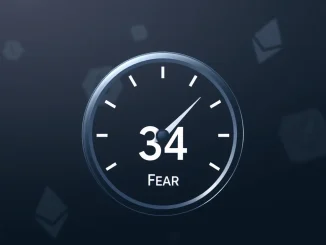

An increase in stablecoin minting, especially of this magnitude, can have several implications. First, it suggests an influx of new capital into the crypto market. Investors may be preparing to buy other cryptocurrencies. This new USDC could also be deployed into DeFi protocols. This would boost liquidity for lending, borrowing, and yield farming. Secondly, it can reduce slippage for large trades. More available USDC makes executing big orders smoother. However, increased supply might also signal a shift from volatile assets. Some investors may convert other cryptocurrencies into USDC. They seek stability during uncertain times. Therefore, the exact impact depends on subsequent capital deployment.

What 401 Million USDC Minted Means for Investors

For investors, the USDC minted event warrants careful observation. A significant increase in stablecoin supply often precedes buying pressure on other assets. This is because minted stablecoins are typically used to purchase volatile cryptocurrencies. This could lead to upward price movements. Conversely, some interpret large mints as a sign of impending volatility. Investors might be moving funds into stable assets. They could be preparing for potential downturns. It is crucial for investors to consider the broader market context. They should analyze on-chain data and news. This helps them make informed decisions.

The Mechanics of the USDC Treasury and Its Operations

The USDC Treasury functions as the central hub for USDC operations. When new USDC is minted, an equivalent amount of fiat currency enters the reserve. This process ensures the 1:1 peg. Conversely, when USDC is redeemed, tokens are burned. The corresponding fiat amount is then released. These operations are crucial for maintaining trust and stability. Independent auditors regularly verify the reserves. This adds another layer of security. The transparency of the USDC Treasury operations is a key feature. It differentiates USDC from other stablecoins. This robust framework supports its widespread adoption.

Broader Implications for the Decentralized Finance (DeFi) Ecosystem

The large USDC minted sum directly impacts the DeFi ecosystem. More USDC means more liquidity for decentralized exchanges (DEXs). It also benefits lending platforms and yield farming protocols. This increased liquidity can lead to lower transaction costs. It can also improve capital efficiency within DeFi. Developers and users often prefer USDC due to its regulatory compliance and transparency. Consequently, a higher supply of USDC strengthens the foundation of many DeFi applications. This fosters further innovation and growth in the sector.

The minting of 401 million USDC at the USDC Treasury is a notable event. It reflects ongoing activity within the digital asset space. This substantial stablecoin minting could signal various market dynamics. These include increased liquidity or shifts in investor sentiment. Whale Alert continues to provide valuable insights into these large movements. Monitoring such events remains crucial for anyone navigating the complex crypto market. As the ecosystem evolves, stablecoins will undoubtedly maintain their pivotal role.

Frequently Asked Questions (FAQs)

What is USDC?

USDC (USD Coin) is a stablecoin pegged to the U.S. dollar on a 1:1 basis. It is managed by Centre, a consortium founded by Circle and Coinbase. Each USDC token is backed by reserves of U.S. dollars and short-duration U.S. Treasuries, ensuring its stability.

Why is 401 million USDC minted significant?

The minting of 401 million USDC signifies a large injection of new capital or liquidity into the crypto ecosystem. This volume can indicate increased demand for stablecoins, potential buying interest in other cryptocurrencies, or a strategic move by institutional players.

Who is Whale Alert?

Whale Alert is a popular automated system that tracks and reports large cryptocurrency transactions across various blockchains. Its alerts provide real-time transparency into significant movements of digital assets, helping traders and analysts monitor market activity.

How does stablecoin minting impact the crypto market?

Large-scale stablecoin minting often indicates an increase in capital ready to be deployed into the crypto market. This can lead to increased liquidity for trading, lending, and other decentralized finance (DeFi) activities. It may also signal potential upward price pressure on other cryptocurrencies if the minted stablecoins are used for purchases.

Where are USDC reserves held?

USDC reserves are held in segregated accounts with regulated U.S. financial institutions. These reserves are regularly audited by independent accounting firms to ensure that every USDC in circulation is backed by an equivalent amount of U.S. dollar assets.

Is USDC a decentralized cryptocurrency?

While USDC operates on decentralized blockchains, its issuance and redemption are centrally managed by Centre (Circle and Coinbase). This makes it a centralized stablecoin, as opposed to algorithmic or decentralized stablecoins, which rely on smart contracts and crypto-collateral for stability.