The cryptocurrency world is buzzing with unexpected news that could reshape the future of digital assets in the United States. In a surprising turn of events, a significant **US stablecoin bill** is now on the fast track, with a crucial vote scheduled for July 16. This development signals a major step towards clearer regulatory frameworks for stablecoins, an area that has long sought definitive guidance.

A Pivotal Moment for the US Stablecoin Bill: What Just Happened?

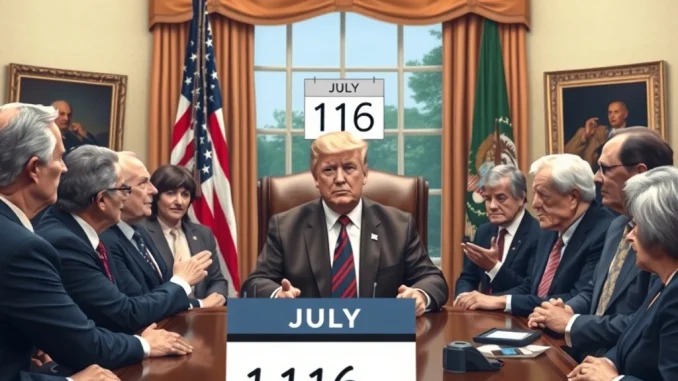

In an announcement that sent ripples across the crypto community, former President Donald Trump revealed on Truth Social that a pivotal meeting in the Oval Office has paved the way for the GENIUS Act, a bill specifically focused on stablecoin regulation. Trump stated that he convened with 11 of the 12 lawmakers essential for the bill’s passage, securing their agreement to advance with a vote on the morning of July 16. Adding to the momentum, House Speaker Mike Johnson participated by phone, indicating his readiness to expedite the vote. This rapid progression comes after the House previously failed to pass a procedural vote on the bill, making this renewed push particularly significant.

The swift movement suggests a newfound bipartisan consensus, or at least a strong enough political will, to address stablecoin regulation. This could be a game-changer for how digital assets are perceived and integrated into the traditional financial system.

Why is Stablecoin Regulation So Crucial Right Now?

The push for robust **stablecoin regulation** isn’t just about controlling a niche part of the crypto market; it’s about establishing foundational rules for digital currencies that aim to maintain a stable value. Stablecoins, like Tether (USDT) or USD Coin (USDC), are designed to peg their value to a stable asset, typically the U.S. dollar, making them vital for:

- Market Stability: They act as a bridge between volatile cryptocurrencies and traditional fiat, facilitating trading and reducing risk.

- Global Transactions: Offering faster, cheaper cross-border payments compared to traditional banking.

- Financial Innovation: Powering decentralized finance (DeFi) applications and broader blockchain ecosystems.

Without clear regulations, concerns persist regarding consumer protection, financial stability, and potential illicit use. A well-defined framework could unlock immense potential for innovation while mitigating risks, ensuring these digital assets operate transparently and securely within the financial system.

Decoding the GENIUS Act: A Glimpse into Future Crypto Legislation

While specific details of the GENIUS Act haven’t been widely publicized, its focus on stablecoin regulation suggests it will likely address key aspects that have been points of contention in the past. This could include:

- Reserve Requirements: Mandating that stablecoin issuers hold reserves equivalent to the value of stablecoins in circulation, and specifying what those reserves can be (e.g., cash, short-term U.S. Treasuries).

- Auditing and Transparency: Requiring regular, independent audits of reserves and public disclosure of financial health.

- Licensing and Oversight: Establishing which regulatory bodies (e.g., OCC, Fed, SEC) will oversee stablecoin issuers and what licenses are required.

- Consumer Protection: Measures to safeguard users’ funds, prevent fraud, and ensure clear disclosure of risks.

This move towards comprehensive **crypto legislation** is critical for attracting institutional investment and fostering mainstream adoption, as regulatory clarity provides much-needed certainty for businesses and investors alike.

The Countdown to the July 16 Vote: What’s at Stake?

The impending **July 16 vote** marks a pivotal moment for the U.S. crypto landscape. If passed, the GENIUS Act could:

- Boost Confidence: Provide a clear regulatory pathway for stablecoin issuers, potentially attracting more companies to operate within the U.S.

- Enhance U.S. Leadership: Position the U.S. as a leader in digital asset innovation and regulation, rather than lagging behind other nations.

- Impact Market Dynamics: Influence the types of stablecoins that thrive in the U.S. market and potentially affect their market capitalization and usage.

- Set a Precedent: Serve as a template for future crypto legislation, signaling a more proactive approach from U.S. lawmakers.

Conversely, a failure to pass the bill could perpetuate regulatory uncertainty, potentially driving innovation and investment overseas. The stakes are undeniably high for the entire digital asset ecosystem.

The Unexpected Catalyst: Trump’s Stablecoin Stance

One of the most intriguing aspects of this development is the direct involvement and vocal support from Donald Trump. Historically, political figures have been cautious or even skeptical about cryptocurrencies. However, Trump’s recent pivot, including his public embrace of digital assets and his expressed desire for the U.S. to be a leader in the crypto space, highlights a significant shift in political sentiment.

His active role in bringing lawmakers to the table and pushing for the **Trump stablecoin** bill underscores the growing recognition of crypto’s economic and political importance. This could signify a broader, bipartisan push for crypto-friendly policies, especially as the 2024 election approaches and the crypto voting bloc gains more prominence.

This surprising turn of events, with a former president actively championing crypto legislation, suggests that digital assets are no longer a fringe topic but a mainstream political concern. The momentum behind the GENIUS Act, fueled by this high-level political engagement, is undeniable.

Looking Ahead: The Future of Crypto Regulation in the U.S.

The impending July 16 vote is more than just a legislative formality; it’s a barometer for the U.S.’s readiness to embrace and regulate the digital economy. Should the GENIUS Act pass, it would provide a much-needed foundation for stablecoins, potentially opening doors for further innovation and investment in the blockchain space. It also sets a precedent for how future digital asset classes might be regulated, moving from a fragmented approach to a more comprehensive framework.

The collaborative effort between Trump and lawmakers, especially following a prior setback, highlights a growing understanding and urgency within political circles regarding digital assets. As the date approaches, the crypto community will be watching closely, hoping that this crucial step leads to a more predictable and prosperous regulatory environment for stablecoins and the broader cryptocurrency market.

Frequently Asked Questions (FAQs)

What is the GENIUS Act?

The GENIUS Act is a proposed U.S. stablecoin bill specifically designed to establish a regulatory framework for stablecoins. While its full details are pending, it’s expected to cover aspects like reserve requirements, auditing, licensing, and consumer protection for stablecoin issuers.

Why is July 16 a significant date for stablecoin regulation?

July 16 is the date set for a crucial vote on the GENIUS Act in the U.S. House of Representatives. This vote could determine the immediate future of stablecoin regulation in the country, providing much-needed clarity for the crypto industry.

How does Donald Trump’s involvement impact the stablecoin bill?

Donald Trump’s active engagement, including meeting with lawmakers and publicly advocating for the bill, has significantly accelerated its progress. His support brings high-level political momentum and potentially bipartisan backing, increasing the likelihood of the bill passing after a previous procedural failure.

What are stablecoins and why do they need regulation?

Stablecoins are cryptocurrencies designed to maintain a stable value, typically pegged to a fiat currency like the U.S. dollar. They need regulation to ensure consumer protection, maintain financial stability, prevent illicit activities, and foster trust and mainstream adoption by ensuring transparency in their reserves and operations.

What are the potential implications if the US stablecoin bill passes?

If the US stablecoin bill passes, it could provide regulatory clarity, boost investor confidence, attract more institutional investment, and solidify the U.S.’s position as a leader in digital asset innovation. It would also establish clear rules for stablecoin issuers, potentially leading to a more secure and transparent market.

Has a similar crypto legislation been attempted before in the U.S.?

Yes, there have been various attempts and proposals for crypto legislation, including previous efforts to regulate stablecoins. However, many have faced challenges in gaining sufficient bipartisan support or navigating the complex legislative process. The current push for the GENIUS Act represents a renewed and seemingly more successful effort.