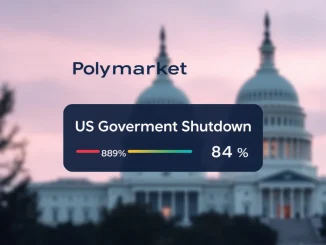

The specter of a US government shutdown once again looms large over the nation’s capital, sending ripples of concern through global financial circles, including the often-unpredictable cryptocurrency markets. Investors keenly watch these developments, understanding that political gridlock can swiftly translate into economic instability and heightened financial market volatility. This critical situation demands attention from anyone navigating today’s complex financial landscape.

Senate Bill Rejection Sets Stage for Crisis

On a critical vote, the U.S. Senate definitively rejected a Democratic-led bill. This bill aimed to prevent a looming US government shutdown. The news, initially reported by Walter Bloomberg, underscores deep divisions within Congress. The proposed legislation sought to extend government funding. It also included emergency aid for Ukraine and disaster relief efforts. However, Republican opposition centered on spending levels and border security policies. The Senate bill rejection now pushes Washington closer to a fiscal cliff. Without a new funding agreement, federal agencies face a cessation of operations. This scenario could begin as early as October 1st. The political stalemate thus intensifies.

Understanding a Government Shutdown and its Economic Instability

A US government shutdown is not merely a political talking point. It carries tangible, negative consequences. Essential services continue, but many federal operations halt. This includes significant parts of the government workforce. Hundreds of thousands of federal employees face furloughs. Others work without pay, awaiting retroactive compensation. Historically, shutdowns have impacted various sectors. They can delay economic data releases. This creates uncertainty for businesses and investors. Moreover, national parks may close. Visa and passport processing can slow down. Small business loans might face delays. Such disruptions can erode consumer and business confidence. This often contributes to broader economic instability. Past shutdowns have shown varying degrees of impact on GDP. Even short ones can cause measurable economic drag. This is due to lost productivity and reduced government spending.

Navigating Financial Market Volatility Amid Political Gridlock

The threat of a US government shutdown frequently triggers financial market volatility. Traditional markets, including stocks and bonds, react to the uncertainty. Investors typically seek safe-haven assets during such periods. However, the definition of a safe haven can shift. The dollar’s strength might waver. Treasury yields could fluctuate. Businesses anticipate potential impacts on contracts and regulations. This creates a cautious environment. Furthermore, rating agencies might issue warnings. Prolonged shutdowns could even affect the nation’s credit rating. Such developments naturally influence investor sentiment. They often lead to a flight to perceived safety or increased hedging activities. Market participants monitor legislative progress closely. They assess the likelihood and duration of any potential shutdown. This constant assessment fuels market movements.

The Crypto Market Impact: A Unique Response to Uncertainty

For the cryptocurrency sector, the prospect of a US government shutdown presents a complex scenario. Historically, Bitcoin and other digital assets have sometimes acted as uncorrelated assets. They occasionally serve as hedges against traditional financial system instability. A shutdown could potentially bolster this narrative. Investors might seek alternatives to traditional fiat currencies or government-backed securities. This could lead to increased demand for cryptocurrencies. Conversely, broad market panic could also drag down crypto assets. When traditional markets experience significant downturns, liquidity often tightens across all asset classes. This includes crypto.

- Increased Volatility: Expect heightened price swings in Bitcoin and altcoins.

- Safe Haven Debate: The “digital gold” narrative for Bitcoin may strengthen, attracting new capital.

- Regulatory Delays: A shutdown could halt or delay progress on crucial cryptocurrency regulations. This creates further uncertainty for businesses and innovators.

- Investor Sentiment Shift: A general flight from risk assets could initially impact crypto negatively. However, a prolonged crisis might highlight crypto’s decentralization benefits.

The crypto market impact is not uniform. It depends on the severity and duration of the shutdown. It also depends on how traditional markets react.

Examining Past Precedents and Future Outlook

Previous US government shutdown events offer some insights. For example, during the 2018-2019 shutdown, Bitcoin’s price saw some fluctuations. However, it largely followed its own market dynamics rather than directly correlating with government events. This suggests crypto markets can exhibit resilience. Nevertheless, the current economic climate differs. Inflation concerns and interest rate policies are key factors today. Therefore, past performance does not guarantee future results. The immediate future hinges on congressional negotiations. Lawmakers face a tight deadline to pass new funding legislation. The stakes are high for the U.S. economy and global financial markets. Averting a shutdown requires bipartisan compromise. Failure to do so risks significant economic disruption. This disruption would extend beyond federal employees. It would touch businesses and consumers nationwide. The Senate bill rejection underscores the urgency of this situation.

The Senate bill rejection is a critical development. It brings the United States perilously close to another US government shutdown. This situation poses a clear threat of economic instability and heightened financial market volatility. While the direct crypto market impact remains to be fully seen, the industry stands ready to react. Its unique position outside traditional finance offers both opportunities and challenges during such uncertain times. Staying informed on these political and economic shifts is crucial for investors. The coming days will reveal whether compromise or crisis prevails.

Frequently Asked Questions (FAQs)

Q1: What exactly is a US government shutdown?

A: A US government shutdown occurs when Congress fails to pass legislation funding government operations. Non-essential federal agencies and services cease to operate. Many federal employees are furloughed or work without pay. Essential services, like national security and air traffic control, typically continue.

Q2: How does a government shutdown cause economic instability?

A: Shutdowns create economic instability by reducing government spending and services. This can delay economic data, furlough workers, and halt federal contracts. Consumer and business confidence can decline, impacting GDP growth. The longer the shutdown, the more severe the economic consequences.

Q3: What is the typical financial market volatility during a shutdown?

A: During a shutdown, traditional financial markets often experience increased volatility. Stock prices may fluctuate due to uncertainty. Bond yields can shift as investors reassess risk. The dollar’s value might also react to the perceived stability of the U.S. economy.

Q4: How might a US government shutdown affect the crypto market?

A: The crypto market impact is complex. Some investors might view cryptocurrencies, especially Bitcoin, as a hedge against traditional financial instability, potentially increasing demand. However, broader market fear could also lead to a general sell-off across all asset classes, including crypto. Regulatory progress for crypto might also halt.

Q5: Has a government shutdown impacted crypto markets before?

A: Past shutdowns have shown varied effects on crypto markets. While some correlation can exist, crypto often operates on its own distinct drivers. The current economic climate, however, might lead to different outcomes compared to previous instances.

Q6: What are the next steps after the Senate bill rejection?

A: Following the Senate bill rejection, lawmakers must continue negotiations. They need to find a bipartisan agreement on government funding. The deadline is typically the end of the fiscal year, September 30th. Failure to act before then will trigger a shutdown.